Should you Skip your SIPs when Markets are High?2 min read

There is a famous money making mantra in the markets ‘Buy Low, Sell high’. Does that mean you stop your SIP (Systematic Investment Plan) when markets are high and restart it when they come down? The answer lies in a famous quote by Sir John Templeton (founder of Templeton Growth Fund):

“I never ask if the market is going to go up or down next month, I know that there is nobody that can tell me that.”

Yes, the exact problem with the seemingly logical strategy of ‘Buy low, Sell high’ is identifying lows and highs in the market, or in other words timing the market. You can only call high/low for the historic performance based on what has happened, but not prospectively.

Should you time the market?

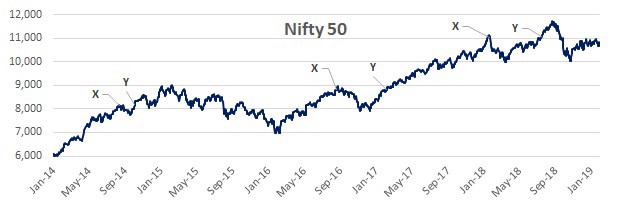

Now, let’s take an example and try to understand this. Take a look at the graph of Nifty 50 below for a particular 5 years. All the points marked ‘X’ on the graph can be considered as ‘highs’ as markets went down after that, but the markets came back after some time to similar levels marked as ‘Y’. The only difference has been the time taken between ‘X’ and ‘Y’. Now at point Y if you stopped your SIP thinking that the markets are at high levels, you would have definitely missed out on all the gains markets made post that.

Moreover, it is very difficult to identify when the markets are actually at a high. So, it is best to leave it to the experts to take a call on the market conditions? These experts are your fund managers. They are highly qualified and have a proven track record in managing funds during all market cycles.

Advantage SIP!

SIP does not seek to time the market i.e. trying to figure out when a high has been reached or vice versa. Rather it seeks to take advantage of these inherent fluctuations or volatility in the market through rupee cost averaging. So when markets are going up, you will buy at a higher price but the opportunity to gain is not lost. And when markets are going down, you are buying at a lower price than before.

Also, by trying to time the markets, you are defeating the entire purpose of an SIP, which is to induce investing discipline. Stopping an SIP is akin to stopping your investment habit. The lesser you invest the lesser will be your investment value and harder it will be to reach your financial goals.

To conclude, in the words of John Bogle (founder of one of the largest US fund houses - Vanguard):

“I don’t know anyone who’s ever got market timing right. In fact, I don’t know anyone who knows anyone who’s ever got it right.”

So, don’t stop your SIPs, continue your investments on Paytm Money to achieve your goals!