SME-IPOs first hit the markets in 2012 and since then have showcased a decent performance, bringing in a boost for small and medium-sized companies.

As the acronym suggests, Small and Medium Enterprise and SME-IPO is an Initial Public Offering (IPO) that is meant for the trading of shares in small and medium companies.

As the companies involved in this are small or medium-sized, the IPO that opens up is considerably small as compared to the IPOs that are listed on BSE & NSE’s main exchange platform.

More than 30 SMEs in India opened for the public in 2020. Tranvay Technologies, ICL Organic Dairy Products, Hindprakash Industries, Valencia Nutrients were the top performers last year.

Contents

Presence on BSE and NSE

Currently, there are two SME Exchanges in the country, the BSE SME platform (BSE) and EMERGE Platform (NSE). Both have their own eligibility criteria for SME listing in addition to the SEBI Guidelines provided for the Listing.

Both the BSE and the NSE launched the Exchange for listing and trading of small and medium-sized companies in the year 2012.

Currently, over 300 companies are listed on BSE and the NSE Emerge has over 180 companies listed on it.

Importance of SME-IPOs on a Global Level

On a global level, small and medium enterprises play an important role as they comprise a major chunk of the market. They, to a certain extent, define the social and economic development of a country.

In the case of India, we have several government-backed initiatives like Skill India, Make in India, Start-up India, Pradhan Mantri MUDRA Yojana, Public Procurement Policy which encourages the overall growth and development in this particular sector, and SME IPOs has enhanced the fundraising opportunity for these companies.

These initiatives have also acted as a game-changer for some companies on the agriculture and manufacturing front.

How is SME-IPO Different from the Regular IPO

1. The minimum investment in a normal IPO is Rs.12,000 to Rs.15,000 On the other hand for SME IPO it is Rs.1,20,000 to Rs.1,50,000. This is because only long term and capital intensive players are allowed for SME IPOs.

2. The minimum number of allottees for an IPO stands at 100, while for the SME IPO it is 50 allottees.

3. The application size of the SME IPO cannot be less than Rs. 100,000 which is comparatively higher than a regular IPO wherein the applications range from Rs. 10,000 to Rs.15,000.

4. A company going public through IPO has to report earnings on a quarterly basis, on the other hand, SME IPO has to report bi-annually.

Criteria for a Small Company to go Public

1. The company needs to have a proven track record of at least three years and should have an updated website.

2. There should not be any changes in the promoters of the company in the preceding year from the date of filing the application to BSE or NSE for listing under the SME segment.

3. Net Tangible Assets should be at least be Rs.3 crore as per the latest financial results. Also, the net worth should be similar, which is Rs.3 crore.

4. The company should have positive cash accruals from operations for at least two consecutive financial years preceding the application and its net-worth should be positive.

5. The post-issue pay-up capital of the company shall not be greater than Rs.25 crore.

7. No petition for winding up should be admitted by a court of competent jurisdiction against the applicant company.

Upcoming SME- IPO

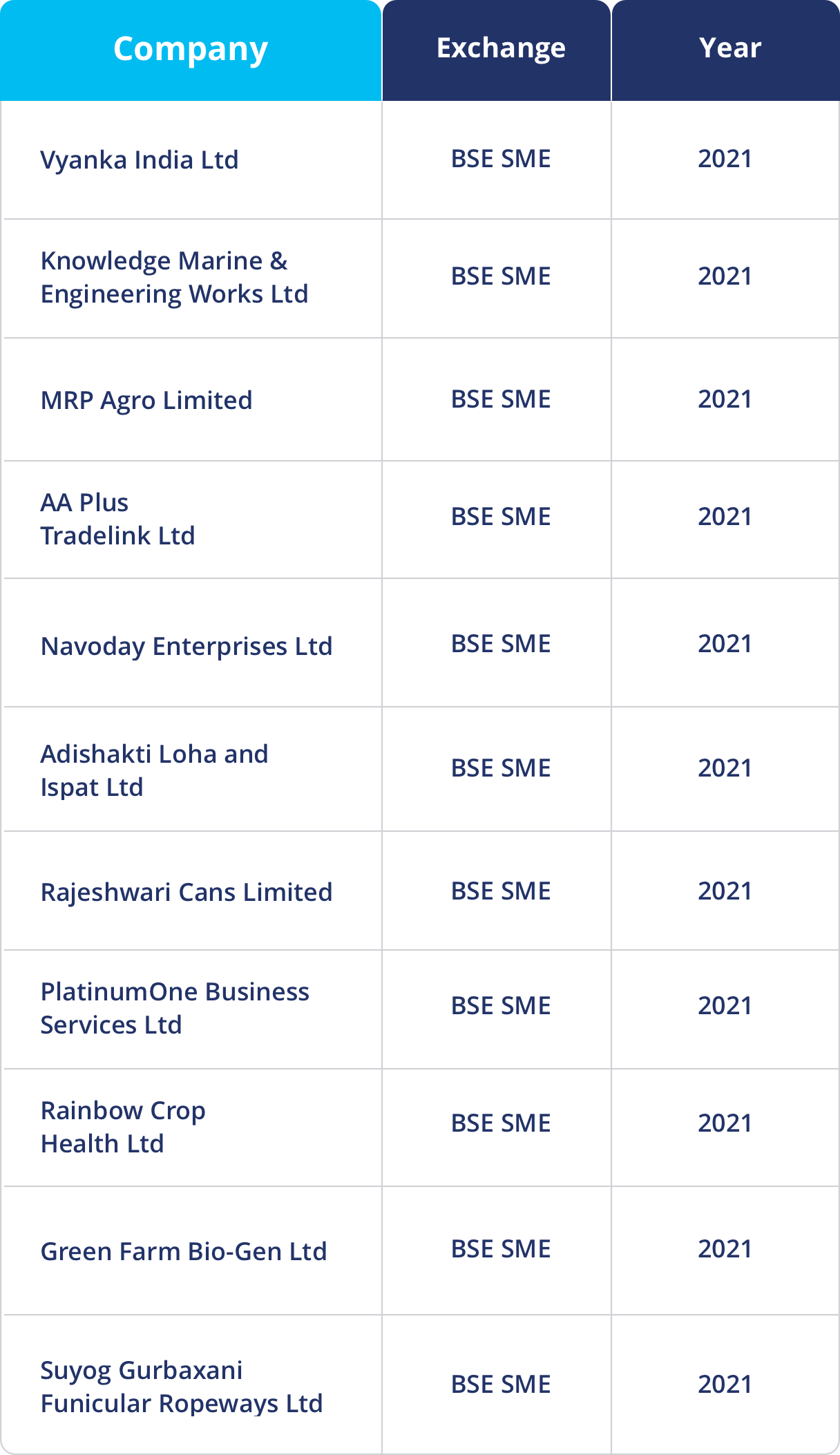

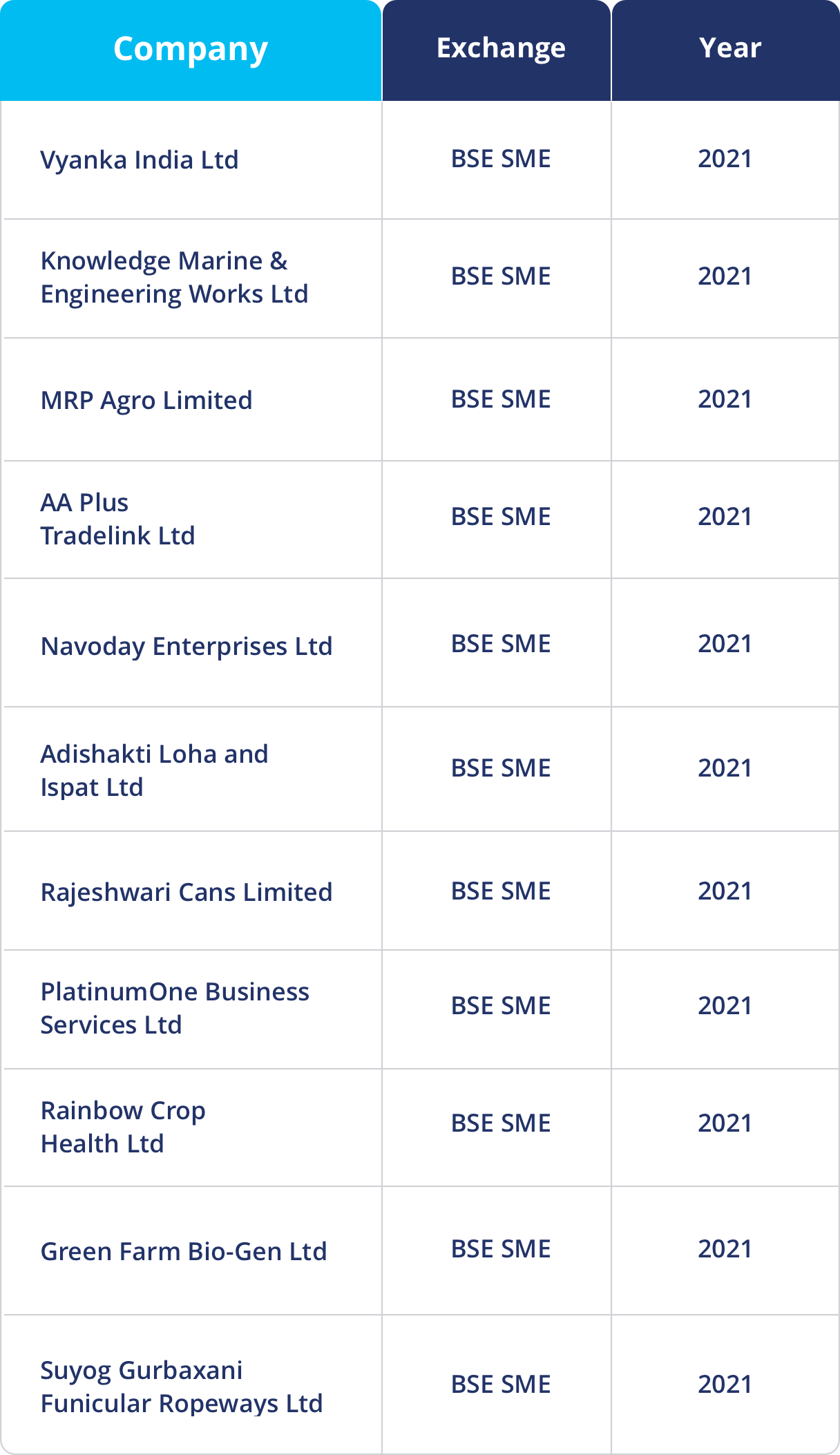

This certainly seems like a year of IPOs as around 35 small and medium companies are likely to open up their company for public in 2021.

According to media reports, around here there are a lot of SME-IPOs that can be expected in the year 2021.

Conclusion

Only long term and capital intensive players are allowed for SME IPOs. The main reason for this rule is that SMEs are upcoming businesses and volatile and impatient investors. There is little risk involved in the case of SME-IPO as there is always an uncertainty if the company will grow or lose out on more business.