Sona BLW Precision Forgings Limited IPO Details- Dates, Price & Overview4 min read

The season of IPOs has yet again kicked in and this time it’s Sona BLW Precision Forgings Limited, which is one of the leading automotive technology companies. The Rs.5,500 crore IPO will open on Monday, 14th June.

The issue comprises up to Rs. 300 crore worth of fresh equity and up to Rs 5,250 crore offer for sale by Singapore VII Topco III Pte, an affiliate of Blackstone.

The company has fixed the price band for its public offer at Rs. 285 to Rs 291 per unit.

The issue for subscription will open up on April Monday, 14th June and will go on till Wednesday, 16th June, 2021.

Know The Company

Sona BLW, a company based in Pune’s Bhosari MIDC is a technology and innovation-driven company. The company’s strong focus lies on research and development and it develops mechanical and electrical hardware systems, components as well as base and application software solutions, to meet the evolving demands of its customers.

It is one of India’s leading automotive technology companies, designing, manufacturing and supplying highly engineered, mission-critical automotive systems and components such as differential assemblies, differential gears, conventional and micro-hybrid starter motors, BSG systems, EV traction motors and motor control units to automotive OEMs. The same are supplied across US, Europe, India and China, for both electrified and non-electrified powertrain segments.

It has nine manufacturing and assembly facilities across India, China, Mexico and USA, out of which six are located in India.

According to the Ricardo Report, in the calendar year 2020, the company was among the top 10 players globally in the differential bevel gear market. And was also expected to be among the top 10 global starter motor suppliers based on our exposure to the PV segment in the calendar year 2020.

With its product offerings spanning across all types of conventional and electrified powertrains, the company is one of the few automotive technology manufacturers that is well-positioned to gain from high growth industry trends as well as various initiatives introduced by the GoI to facilitate the growth of the automotive industry in India, including the recently announced Rs. 570.42 billion production-linked incentive scheme, which is likely to increase exports resulting in increased demand for differential gears in India, according to the CRISIL Report.

IPO Details

The offer size is pegged at Rs.5500 crore, and it comprises fresh issue aggregating up to Rs.300 crore and an offer for the same of up to Rs.5250 crore.

Sona BLW Precision Forgings IPO price band has been fixed at Rs.285-291.

The face value of each share is Rs.10.

One can bid for a minimum order quantity of 51 shares.

IPO will open on June 14th and close on June 16th.

Source – BRLM. Dates are tentative

The company will utilise the funds for:

- Repayment or prepayment of company’s borrowings fully or partially and

- For general corporate purposes

In addition to the aforementioned objectives, the Company expects to receive the benefits of listing of the Equity Shares on the Stock Exchanges and enhancement of our it’s brand name and creation of a public market for our Equity Shares in India.

Company’s Strengths

- The company has an experienced and leading board of directors.

- It has a Strong Research & Development (R&D) team and at par capabilities or more with the other competitors.

- The company boasts a large product portfolio.

- It is one the of the leading manufacturers and suppliers to the global EV market.

- The company has a consistent performance track record.

Risks Involved

- Thecompany may not be successful in implementing its growth strategies, including its strategy to capture market opportunity in the growing EV market.

- The Company may not realize all of the revenue expected from its new and incremental business backlog and doesn’t have firm commitment agreements with customers.

- The Covid-19 pandemic and its ongoing impact.

- Huge reliance on successful R&D for technologically advanced systems and component.

- The company’s business is mainly dependent on the performance of the automotive sector globally, including

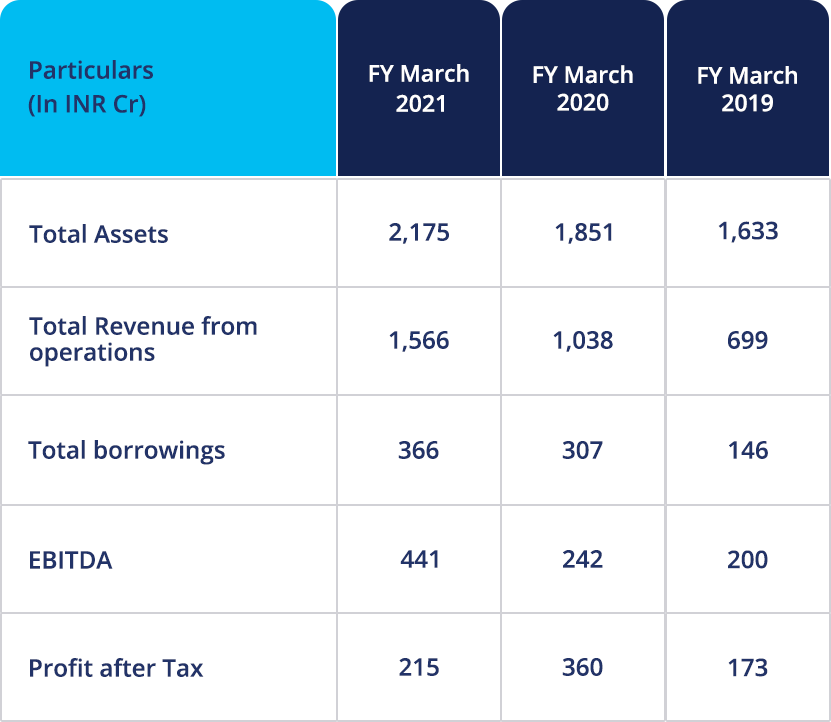

Financial Performance

Here’s a look at the company’s past financials.

Source: RHP

Conclusion

The company is a leader in the automobile sector with a decent financial portfolio that has been showcased over the past few years.

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.