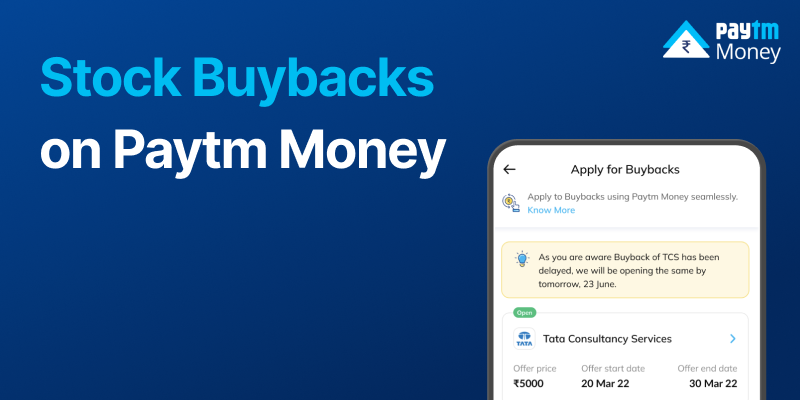

Stock Buyback on Paytm Money4 min read

What is a stock buyback?

A stock buyback is when a listed company buys its own shares back in the open market.

Why does a company announce buybacks?

A company can announce buybacks for a variety of reasons. As an investor, we should understand the underlying reasons for buybacks and accordingly take a call on participation.

Some of the potential reasons for announcing buybacks:

- Company has excess cash but limited growth opportunities to invest in

- Company feels the stock is undervalued and through buyback aimes in increasing value of available shares

- Company may want to increase proportion of shares owned as it is bullish on current operations

- Company may want to decrease potential of external controlling stake

What’s in it for you, an existing shareholder?

In a buyback, the company usually offers to buy back the stocks at a price above the current market price.

So you, the investor gets a premium over the stock’s current market price.

How do you know if you are eligible for Buyback?

For being eligible to participate in Share Buybacks, the investor needs to fulfill following conditions:

- Have shares in the portfolio by record date: Investors need to have the company shares in the portfolio on/before the record date announced by the company. Therefore, assuming the company has a T+2 settlement, the shares of the company should be purchased at least 2 trading dates before the record date.

- Have free holdings during order placement: Investors need to hold these shares and then apply them during the offer period, so that they are available for tendering during the offer period. If any shares are pledged, they’ll need to be unpledged before applying for buyback.

You can check your eligible quantity for a share buyback during the offer window on the Paytm Money app itself by entering the Buyback screen.

How do you find out upcoming Buybacks on Paytm Money?

You can track the share Buybacks which are open or upcoming on Paytm Money app in this manner

Step 1: Go to the accounts section, and select corporate actions “Buybacks, Delisting, OFS etc”

Step 2: From the list of corporate actions, select “Buyback”:

Step 3: You can see a list of Open, Upcoming as well as Closed buybacks here

How do you participate in Stock Buybacks?

Once you have checked your eligibility for any buyback and done your research and decided to apply for the same, you need to follow the steps as below:

- For applying to any Open Buyback, you can proceed to check additional information on the buyback, quantity you’re eligible to apply, etc as below:

- In the Apply screen, enter the quantity you want to apply up to the eligible quantity:

- Complete the eDIS TPIN + OTP process :

- Post successful TPIN + OTP authentication, confirm your order:

- Follow the status progress updates for your order as below:

- Additionally you will also be notified via mail regarding important updates for your buybacks.

How much quantity can you apply for in a Buyback?

Assuming you have holdings of the Buyback stock prior to the record date in your portfolio, here is a breakdown of the amount you are eligible to apply for:

- As can be seen in the above example screenshot, the user had 100 holdings in the portfolio (post settlement) of the stock as on the record date. Therefore the max cap the user can apply is upto 100 units.

- Now, as on the date of Buyback order, the user has, let’s say, 60 current holdings assuming the user has sold 40 units out of the 100 holdings held on the record date: 100 record holdings – 40 sold = 60 current holdings.

- And of these 60 holdings, let’s assume the user has pledged 20 holdings. Then the user can apply buyback for net available free holdings: 60 current holdings – 20 pledged = 40 available free holdings.

- Now, assuming the user has already applied for 10 units in this buyback, then the user can apply for the net 40 available free holdings – 10 already applied = 30 units eligible.

- Please note, the user could additionally buy the 40 units initially sold, get them in the portfolio post settlement before the Buyback offer period ends and apply for that quantity as well. Additionally, users can unpledge these 20 units before the Buyback offer period ends and apply for that as well.

Conclusion

Our product, Tech, Risk and Ops teams have worked day in and day out to help you with a seamless journey on Paytm Money. With the Buyback launch, you can easily track upcoming buybacks, apply for the same and track your Buyback orders.

Disclaimer – Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory.

Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. For complete Terms & Conditions and Disclaimers visit www.paytmmoney.com.