Stove Kraft IPO Details – Date, Price & Overview5 min read

Last year, capital markets witnessed some bumper IPOs. Around Rs. 24,973 crore were raised by 12 IPOs, it can be said with conviction that India has a huge appetite for IPOs.

So far January 2021 has been a busy season for IPOs as well, with three IPOs – Indian Railway Finance Corporation, Indigo Paints and Homefirst Finance already being launched. Stove Kraft, the kitchen solution, is next in line to go public this month.

Contents

Overview

Incorporated in 1999, Stove Kraft is a kitchen solutions company and an emerging home solutions brand. The company is ISO 9001:2008 certified leading brand for kitchen appliances in India and is one of the dominant players in pressure cookers and a market leader in the sale of freestanding hobs and cooktops.

The company is engaged in the manufacturing and retailing of a wide and diverse suite of kitchen solutions under their flagship brands, “Pigeon” and “Gilma”. Pigeon has been listed as one of the “India’s Most Admired Brands 2016” by White Page International. Both brands have enjoyed a market presence of over 15 years and have a high brand recall amongst customers for quality and value for money.

Moreover, the company also proposes to commence manufacturing of kitchen solutions under the BLACK + DECKER brand, which will cover the complete range of value, semi-premium, and premium kitchen solutions. Stove Kraft has also entered into an agreement with e-commerce platforms such as Flipkart for the sale of their products on these portals.

Export Business

Stove Kraft also indulges in the export of its products to 12 countries including UAE, Qatar, Bahrain, Kuwait, Iran, Tanzania, Uganda, Nepal, Philippines, Sri Lanka, UK, and the Netherlands.

Stove Kraft’s products also enjoy space in retail chains in the US. It also manufactures original equipment for retail chains in the US and Mexico under its brands.

Distribution Network

In 2020, Stove Kraft has persevered with increasing its distribution network to reap benefits from increased demand for certain products and to take precedence in new business opportunities.

As a result, their operations have now expanded to 27 states and 5 union territories as of September 30. The company’s distributors have increased from 429 in October 2019 to 651 in September 2020 which is an over 51% increase in a year.

The company’s retail outlets have increased more than 19% in a year i.e from 38,090 in October 2019, to 45,475 in September 2020.

IPO Listing Details

The Stove Kraft’s initial public offering of Rs 412.63 crore and will hit the markets on Monday, January 25th, and the issue will close on Thursday, January 28th. The company is issuing shares at a price band of Rs. 384 to Rs. 385 with a minimum lot size of 38 shares and in multiples thereafter.

Rajendra Gandhi and Sunita Rajendra Gandhi are the promoters of the company. Edelweiss Financial Services Limited and JM Financial Limited are acting as Book Running Lead Managers to the issue and the company’s shares are proposed to be listed on stock exchanges.

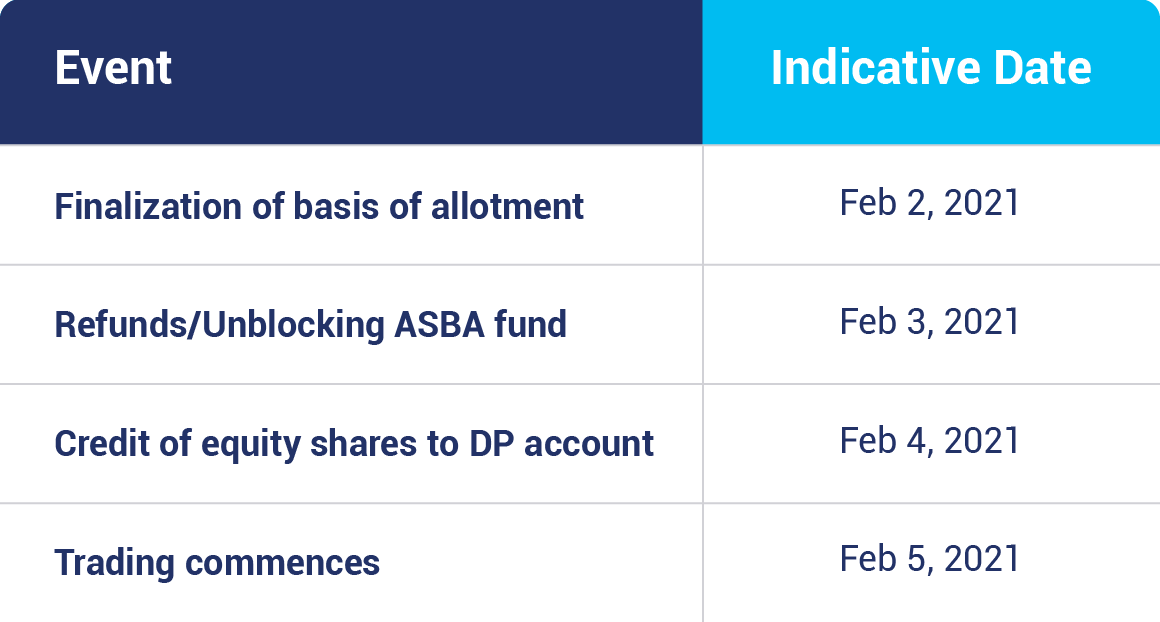

IPO Timeline

Objectives of the Issue

Stove Kraft proposes to utilise the net proceeds from the fresh issue towards repayment/prepayment, in full or part, of certain borrowings availed by them while also disbursing the proceeds towards general corporate purposes.

The Memorandum of Association also enables them to avail the net proceeds for existing and proposed business activities. Further, the company expects that the listing of the equity shares will enhance their visibility and brand image among existing and potential customers.

Strengths

- A well recognized, award-winning portfolio of kitchen solutions brands.

- The widespread, well-connected distribution network, multiple retail channels, and a dedicated after-sales network.

- Strong manufacturing capability with efficient backward integration.

- Consistent focus on quality and innovation.

- Strong track record and financial stability.

- Professional management with a successful track record and dynamic workforce.

Risks Involved

- The trademark for marquee brand ‘Pigeon’ is the subject matter of litigation and no assurance on landmark protection.

- Raw materials sourced from third parties with no long term contract or price guarantee relationships.

- They rely heavily on their brand portfolio. Hence, the inability to successfully maintain and promote a brand portfolio may adversely affect results.

- Their operations are significantly dependent on third parties for distribution and sales.

- Covid-19 outbreak and responses may affect potential business.

- Sales may be negatively impacted by increasing competition from companies and local firms.

How to Apply for IPO on Paytm Money

1) Log in to the Paytm Money app and complete your fully digital KYC for the stock, if not done already.

2) Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

3) You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

4) Next, you must add details for bidding such as quantity, amount, and so on. Maximum 3 bids are allowed.

5) After that, you have to enter your UPI ID so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

6) Once you accept the mandate, your application will be successfully submitted.

7) Once the allotment happens, you will be notified about your allotment status.

Conclusion

Stove Kraft is one of the leading kitchen solutions companies with a global presence. Its focus on its distribution network and the acumen to adapt to an ever-changing environment has displayed growth in recent years.