Suryoday Small Finance Bank IPO Details – Date, Price & Overview4 min read

Suryoday Small Finance Bank is all set to make its debut on the stock markets. The same will open its initial public offering of 1,90,93,070 equity shares on March 17 with a price band of Rs 303-305 per share.

The IPO opens on 17th March, Wednesday and will end on 19th March, Friday. The anchor book subscription (if any) will open for a day on March 16.

The small finance bank revealed the IPO in a virtual press conference, which includes a fresh issuance of 81,50,000 equity shares and an offer for sale of up to 1,09,43,070 equity scrips by existing shareholders. The IPO will raise Rs 582 crore at the top of the price band.

KFintech is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

The Mumbai-based lender has already raised Rs 150 crore in pre-IPO placement of shares to SBI Life Insurance Company and two mutual funds of Axis Asset Management Company at Rs 291.75 a share.

About the Lender

The Mumbai-based company started offering SFB services in 2017 and they serve customers in unbanked and underbanked segments. Before foraging into the SBF sector, the company operated as an NBFC.

As of December 31, 2020, their customer base was 1.44 million and their employee base comprised 4,770 employees and they operated 554 Banking Outlets including 153 Unbanked Rural Centres (“URCs”). Their delivery platform also includes partnering with business correspondents (“BCs”) for sourcing both asset and liability businesses and have expanded their network and presence through their reach to promote financial inclusion.

They have leveraged the use of technology across all aspects of their operations. In particular, they use digital technology for customer acquisition and also customer lifecycle management. Their employees use tablets to service customers in unbanked and underbanked segments which they believe has led to greater customer convenience and improved operational efficiency. The small finance bank also has a robust back-end operating system supported by their core banking and document management systems.

Its average collection efficiency was at 82% for the month of December while it was even lower in three key states — Maharashtra, Tamil Nadu, and Odisha. These three states together account for 77% of its lending businesses.

Suryoday’s gross loan portfolio was around Rs 3900 crore at the end of December 2020 with microloans share at 70%.

IPO Details

The initial public offer (IPO) of Suryoday Small Finance Bank consists of a fresh issue and Rs.582 crores. The IPO of up to 19.09 million shares comprises a fresh issue of 8.15 million shares and an offer for sale of up to 10.94 million. The company has fixed a price band at Rs 303-305 per share of the face value of Rs 10 each. The offer comprises a fresh issue of 81.50 lakh shares and an offer-for-sale (OFS) of up to 1.09 crore equity shares.

Axis Capital, ICICI Securities, IIFL Securities and SBI Capital Markets are the book lead running managers to the issue.

Proceeds from the issue will be used to augment tier-1 capital base to meet future capital requirements. As of March 2020, the bank’s CRAR (Capital to Risk Assets Ratio) was at 29.57% (Tier I capital of 28.61%), the highest among all small finance banks.

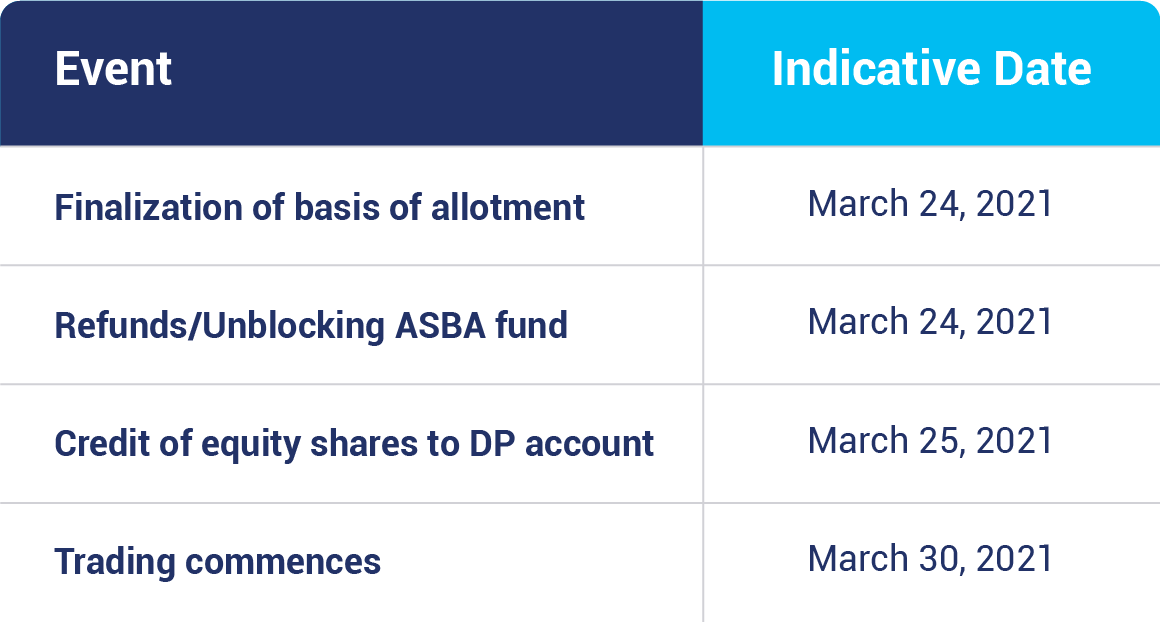

IPO Timeline

Strengths

1. The company/bank overall has a customer-centric approach with a focus on financial inclusion.

2. They have a diversified asset portfolio with a focus on retail operations.

3. The bank has an evolving granular deposit franchise.

4. The bank has been leveraging emerging technology to enhance the lender’s digital footprint.

Risks Involved

1. The economy is still in a recovery mode and there is still an impact of the outbreak of the COVID-19 on the banking and financial sector.

2. A large part of the business is significantly dependent on advances to inclusive finance (JLG) customers and any adverse developments in the microfinance sector could adversely affect business.

3. Indian banks are subject to strict regulatory requirements. Inability to comply with them will have an impact on operations.

4. Currently there is vulnerability to interest rate risk. Volatility in interest rates or inability to manage interest rate risk will adversely impact business and operations

5. Limited operating history as an SFB. Future performance cannot be evaluated basis past or current evolving and growing operations scale

6. Banks and directors are involved in certain legal proceedings and adverse developments in them can impact reputation, business and cash flow adversely.

Steps to Apply for IPOs on Paytm Money App

1. Log in to the Paytm Money app and complete your fully digital KYC

2. Once the KYC is done, click on the IPOs on the home screen

3. On the IPO home screen, you can apply for the open IPOs

4. To apply, enter the bidding details like quantity, price, and so on

5. Enter UPI id & accept the mandate of the same on UPI app to successfully submit IPO

application

6. Once the allotment happens, you would be notified about your allotment status.

Conclusion

Overall, the lender overall has a customer-centric approach with a focus on financial inclusion. The proceeds from this issue will be used to augment tier-1 capital base to meet future capital requirements.