Switch out from Dividend to Growth Plans of mutual funds6 min read

Many investors opt for dividend payout option of mutual funds, as these act as a regular income source and also provide some tax benefits (for investors in the higher tax brackets). But the abolition of dividend distribution tax (DDT) in Budget 2020 and making the dividends taxable in the hands of investor, makes this option less attractive. Through this article, we will explain the impact of these changes on your investments and suggest a better alternative for you.

But, first let’s see what the changes are in detail.

The Past

Before April 2018, there was no DDT on equity – oriented mutual funds. Short Term Capital Gains (STCG) was taxed at 15% and Long Term Capital Gains (LTCG) and dividends were tax free. Thus, investors favored investing in dividend plans of equity mutual funds to avail the benefit of tax free regular income while pocketing the extra gains accrued on capital invested.

Budget 2018 (from April 2018) introduced 10% DDT on equity – oriented mutual funds and 10% LTCG on capital gains over INR 1 Lakh in a year. DDT was paid by AMCs at source and remained tax free in the hands of the investors. As STCG was at 15% and there was still a tax arbitrage between dividend and growth plans in the short term, a lot of investors continued to favor dividend plans over growth plans.

In debt funds, DDT was at 25% while STCG was taxed as per investor’s tax slab. So most investors already preferred growth plans over dividend plans.

The Future

In Budget 2020 (changes are effective from April 1st, 2020), the Finance Minister abolished DDT and instead made dividends taxable in the hands of the investor at the applicable slab rate. This means that if you are in the higher tax slab (30%), you will have to pay 30% tax on the dividend income compared to the earlier 10% DDT. However, if you are in the lowest tax slab (5%), you will benefit and end up paying lower tax on the dividend income.

Also tax deducted at source (TDS) at 10% on dividends exceeding INR 5,000 has been introduced. This can be claimed back at the time of filing of income tax return (ITR) in case TDS cut is higher than your actual tax incidence. If not, the excess tax over and above TDS needs to be paid. Overall, introduction of TDS makes ITR filing cumbersome for the investors opting dividend option.

So clearly, if your tax slab rate is more than 10%, these changes will reduce your dividend income in hand and hence it is wise to switch from dividend to growth plan. Purely from the tax perspective, it may seem that investors in <10% tax slab will benefit by staying in dividend plan. But given the TDS deduction and hence claiming tax refund later, will make ITR filing cumbersome. Also, since LTCG is only charged on gains above INR 1 Lakh annually irrespective of tax slab, you may not have to pay any tax (0% tax) on your withdrawals under SWP vs slab rate in dividend plan. Thus, even if you belong to a lower tax bracket (<10%) it makes sense to switch your investments from dividend to growth plan.

If not dividend, then what?

For people looking for regular income, dividend plan is not the only option. Investors can opt for Growth plans and use Systematic Withdrawal Plan (SWP) for generating regular income. SWP, as the name suggests, is a feature offered by mutual funds to redeem a portion of investments at regular intervals (monthly, quarterly etc.). SWP ensures that you get the desired amount of income on the desired date. This is not the case with dividend pay outs by AMCs, where the quantum and timing of dividends are not certain.

If you are in a tax slab higher than 10%, SWP is more tax efficient vs. the Dividend option since under SWP you will most likely pay LTCG at 10% vs dividend that will be taxed at your slab rate of more than 10%. For getting the same amount in hand at a regular interval (monthly/quarterly), your investments will deliver almost twice as much returns in SWP compared to the dividend plan due to tax difference over a 10-year period.

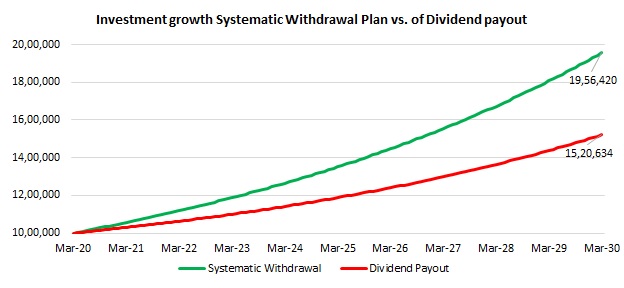

Let’s understand with a real example. You may choose to invest INR 10 lakhs in a Growth plan with SWP or Dividend plan for generating a monthly income of INR 5,000. Due to the tax difference explained earlier, your in-hand income in both cases will be INR 5,000 but the corpus that will be accumulated at the end of 10 years will be INR 19.6 lakhs in the SWP option vs INR 15.2 lakhs under the dividend option. Hence the returns on your invested amount of INR 10 lakhs is almost double in SWP plan vs dividend plan!!

Note: Investment growth is assumed to be 12% CAGR. The monthly post tax income in both cases is assumed to be INR 5,000. LTCG is at 10% and dividends are assumed to be taxed at 30%. Capital Gains tax implication at corpus withdrawal time has not been considered for the above graph. In case corpus is withdrawn at end of 10 year period also, Growth plan outperforms Dividend plan.

So just from the tax perspective, anyone in the >10% tax slab will stand to benefit from being invested in Growth plan and using SWP rather than opting for the Dividend Plan. Even if SWP is not offered by the scheme, you can simply withdraw the required amount every month as per your need.

Should You Switch?

If you’re currently invested in a dividend plan, it makes more sense to switch your investments to a growth plan and use SWP. But, as switch would be considered as a redemption and fresh investment, applicable exit load and capital gains tax would apply.

In the case of equity funds, if you switch within 1 year from the date of investment, the Short Term Capital Gains (STCG) will be taxed at 15% plus an applicable surcharge. However, if you switch after 1 year from the date of investment, then the Long Term Capital Gains (LTCG), exceeding the threshold of Rs 1lakh, will be taxed at 10% plus an applicable surcharge.

In the case of debt funds, if you switch within 3 years from the date of investment, then the STCG will be taxed as per your applicable slab rates. However, if you switch after 3 years from the date of investment, then the LTCG will be taxed at 20% after indexation benefit.

However, the effect of these two components may be negligible. As dividend plans have less NAV growth, capital gains may be very low. Coming to the exit load, from a long term investment perspective switching now is much more beneficial than waiting for your investments to come out of exit load period. So it is better to switch to a growth plan today!

Our Verdict

Much before this tax change was made, Paytm Money Advisory has been advising Growth plan since it is superior to the Dividend Plan. With this tax change, it becomes imperative for most investors in Dividend Plans to switch to Growth plans and use SWP for regular income.

Disclaimer: All the redemptions in SWP option are assumed to be from units that are long term in nature. It is assumed that you invest in equity – oriented funds for long term and keep redeeming amount required for monthly needs. Tax rates mentioned, unless specified, do not include surcharge and cess. Relevant surcharge and cess are as applicable. Before switching, please take into account the exit load and tax that is applicable on your investments.