Tax saving season is here! It is that time of the year when you may find yourself worrying and talking to your friends, colleagues and family to figure out the best investment option to save taxes. But don’t worry, we’re here to help. Through this article we would like to bring a fresh perspective to the way you view tax saving and help you figure out the best option available.

First, let’s get the basics out of the way before we get into the investment options, their benefits and finally, the ideal choice. Under section 80C, you can invest a maximum of Rs. 1,50,000 and save up to Rs.46,800 in taxes annually. Since the tax benefit at the time of investment is the same across all alternatives, what matters is the risk taken and the return expected from the chosen option.

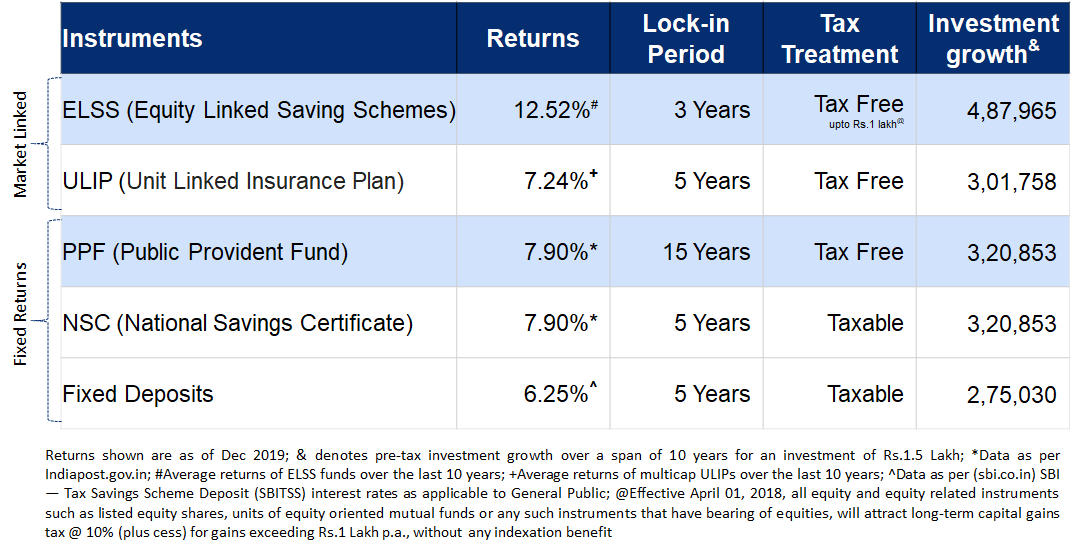

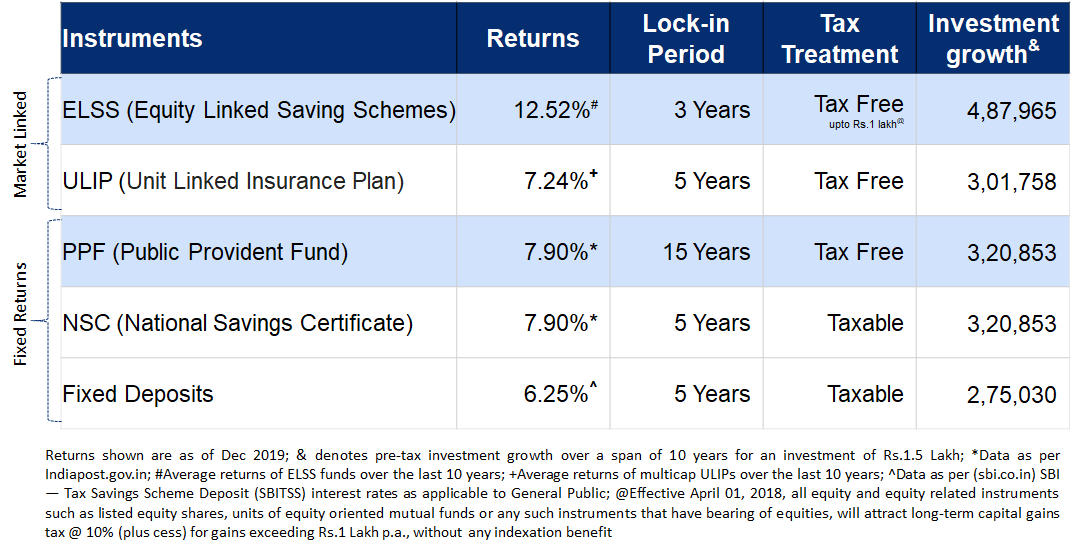

Tax saving investments can be broadly classified into:

- Market linked products i.e. equity oriented, like ELSS and ULIP, which offer higher but volatile returns. ELSS is an open ended multi cap fund with a 3 year lock-in period and thus, has the potential to generate long term wealth. ULIP in comparison invests partly in a life insurance and the rest into equity or debt like a mutual fund.

- Fixed return products i.e. debt oriented, which offer lower but guaranteed returns, like PPF, NSC and FD. PPF and NSC are small savings schemes run by the government which offer attractive interest rates, while FD is a term deposit offered by banks which you must be familiar with.

Here are the essentials to compare each of these tax saving instruments:

By now you must be thinking and wondering if, like others, we too will recommend ELSS funds like some silver bullet to take care of your tax saving. After all, the historical (10-year period) returns for ELSS do look fantastic, right?

But NO! We want to focus on the bigger picture here.

Please remember that tax saving is a necessary annual exercise. It enforces investment discipline and is best done when you have a fair clarity on what you plan to achieve (utility) through these investments. So planning for this utility beforehand is very important as it determines your risk and return expectations and thus your ideal tax saving option.

The utility is simply the wish you seek to fulfill from your tax-saving investments. For instance, your wish can be:

- Aspirational in nature, such as:

-

- A grand wedding for children

- A world tour with your family

- Buying a dream home (Or any other dream you wish to fulfill)

These wishes are long term in nature, where you intend to spend based on the value of your investments in the future. As they need a large sum of money for fulfillment, equity exposure is a must because of its long term wealth creation potential.

- Need based in nature, such as:

-

- Retirement planning

- Child’s education

- Repayment of your home/car loan

These too are long term goals, but being necessities, here you expect more certainty in your investment returns, growth and value. Given the stable nature of returns and less volatility, you should consider Fixed Return oriented products.

We would like to highlight that it is a common mistake to decide your wishes based on your age only. Your wish also has to be a function of your current investments, aspiration, needs and income.

For example, most young people are likely to have ASPIRATIONAL wishes given the fact they have a high risk taking ability. But even someone in their later stage of professional life can have an ASPIRATIONAL wish. This can happen if he/she has carefully saved enough money for their post-retirement life and still have surplus money to achieve their unfulfilled dreams or aspirations. If you can associate yourself with this scenario, consider investing in ELSS to enjoy the dual benefits of tax saving along with wealth creation.

Similarly, NEED-BASED wishes are typically associated with middle aged people or people nearing retirement. These people should consider investing in PPF. Even if you are a young professional with majority of your portfolio in volatile and risky assets, it is a good idea to invest in PPF so that a portion of your investments generates safe and stable returns.

Lastly, if you are parking a major or the entire portion of your monthly income in fixed deposits and your exposure to equity markets is limited or nil, then ELSS can be a good way to diversify your investments, save taxes and create wealth at the same time.

It is advisable to take the SIP route in case of ELSS as it will not just ensure disciplined investing but will also provide the benefit of rupee cost averaging. Investing through SIP also ensures that you don’t bring unnecessary stress to your cash flows at the end of the financial year.

So invest wisely this financial year!

Agree with us, but don’t know which scheme to choose — Check out “Invest to Save Tax” in the Investment Ideas section under the Invest tab. Download the app to get started. You also get the tax statement to submit as an investment proof.