In this blog, we will try to understand all things related to taxation when trading is declared as a business income. Trading income declared as business income can be classified into two categories:

- Speculative business income: Intraday equity trading income is considered as speculative.

- Non-speculative business income: By definition, income from trading F&O is considered as non-speculative business income. It is also best to consider income from shorter-term equity delivery-based trades as non-speculative business income if the frequency of such trades executed by you is high or if trading/investing is your main source of income.

When trading is declared as business income, the business income is added to the other income sources and taxes are levied accordingly. Let us consider person X with the following details.

Salary – INR 12,00,000

Short term capital gains from delivery-based equity – INR 2,00,000

Profits from F&O trading -INR 50,000 (Business Income)

Intraday equity trading – INR 50,000 (Business Income)

To find out the tax liability, we need to find out the total income which is found out by adding salary and business income.

Total income = 12,00,000 (Salary) + 50,000 (Profits from F&O Trading) + 50,000 (Intra-day equity trading) = INR 13,00,000

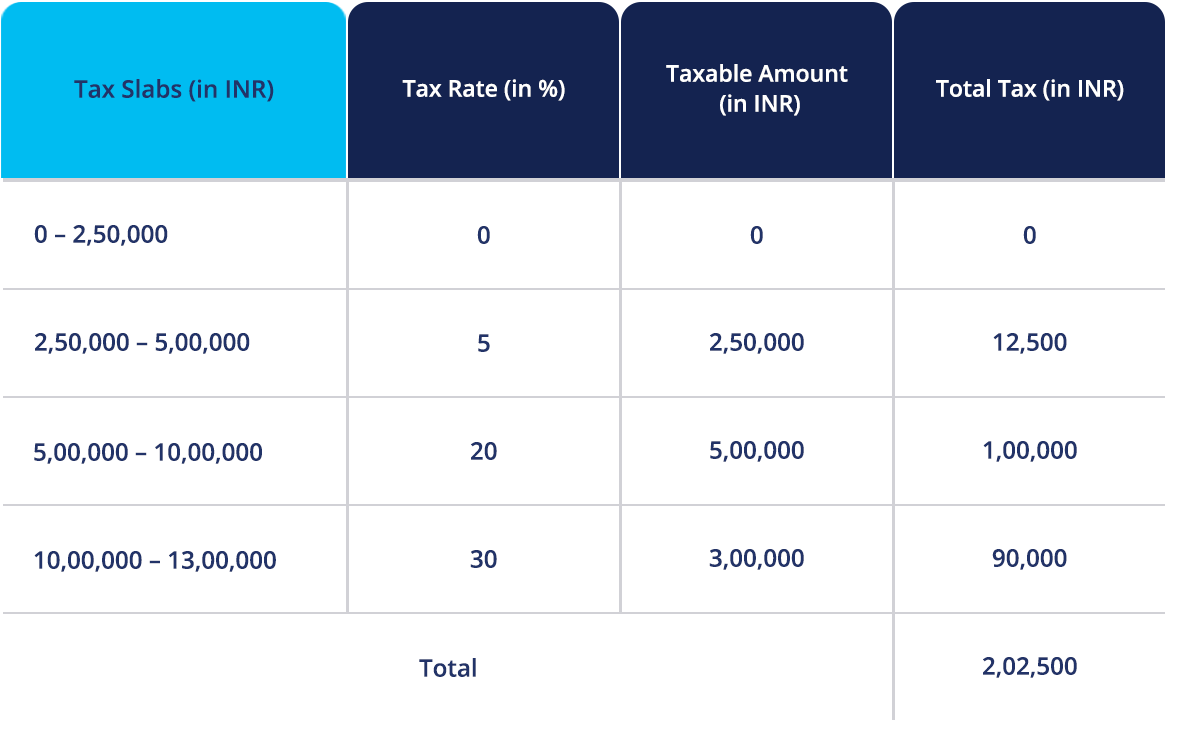

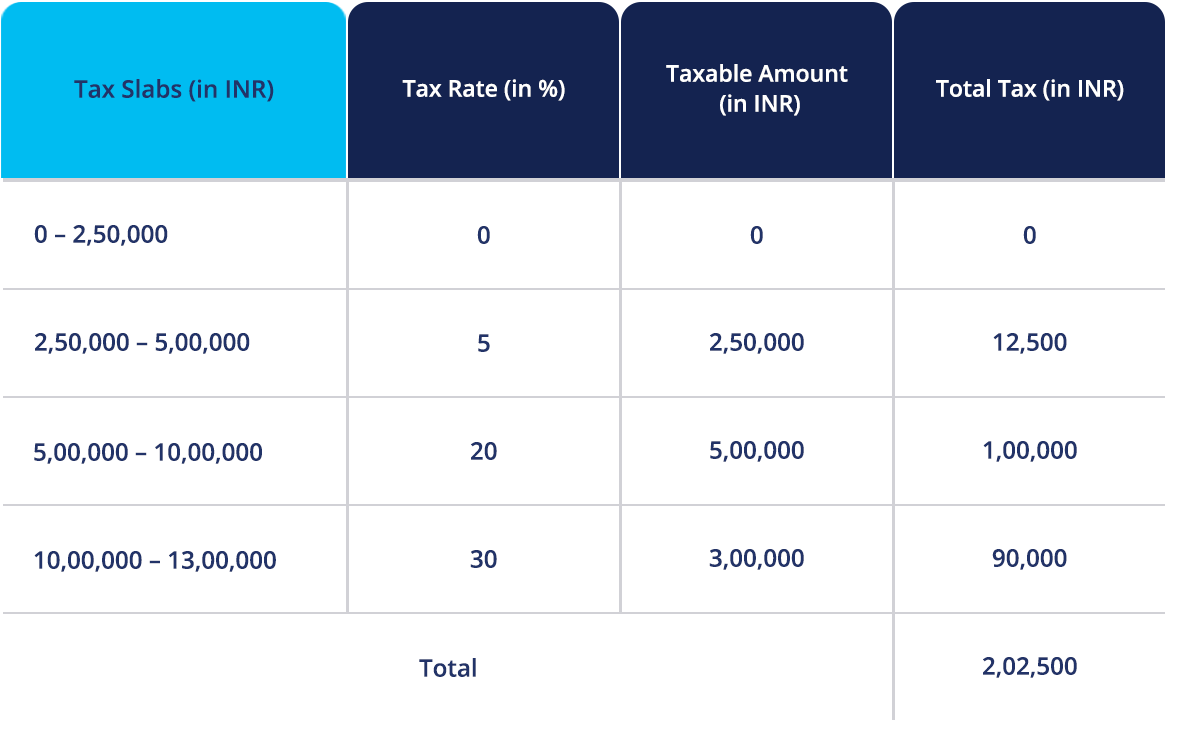

Mr. X now has to pay tax on INR 13,00,000 based on the tax slabs which are as follows.

Hence tax = 12,500 + 100,000 + 90,000 = INR 2,02,500/-

Now there is additional income tax on short term capital gains from delivery-based equity. This additional income has not been counted in business income. INR 2,00,000 will have a tax rate of 15%. So, the resulting tax liability is 30,000.

Total tax = 2,02,500 + 30,000 = 2,32,500

Now we will explore some factors that one has to be wary of when declaring trading as business income for taxation.

When can business losses be carried forward:

Speculative Loss (Equity intraday):

- Any speculative gains you make in a period can be used to offset the speculative loss. The period for which speculative losses can be carried forward is 4 years.

- Speculative Loss cannot be offset against non-speculative (F&O Trading) gains. If you make INR 50,000 loss in speculation and INR 50,000 gain in non-speculation, then you cannot offset one against another. You have to pay tax on non-speculation gain of INR 50,000. You can carry forward the speculative loss which can be offset against any future (upto 4 years) speculative gains.

- But let us say that you had a speculative gain of INR 2,00,000 and a non-speculative loss of INR 2,00,000, then you can offset one against another.

Non-speculative losses (F&O Trading):

- Any business income like rental income, bank interest income, capital gains for the same year can be used to set off non-speculative losses but you can’t set it off against salary income.

- Non-speculative losses can be carried forward to the next 8 years and can be set off only against any non-speculative gains made in that period.

Disclaimer – This content is purely for informational purpose and in no way advice or a recommendation. Investment in securities market are subject to market risks, read all the related documents carefully before investing.

Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019.