Time in the markets is more important than timing the markets!3 min read

You would have come across several fund managers or advisors talking about being invested in equity markets over the longer term, rather than giving active market entry (investment) or exit (redemption) calls. Even the legendary investor Warren Buffett said, “We continue to make more money snoring than when active.” But have you wondered why?

Timing the markets:

Ideally, as an equity investor, you would like to invest when the markets are at a low and redeem when the markets are at a high. But is it possible to time the markets consistently to generate superior returns? Let’s take an example of investing in the Nifty Midcap 150 index (benchmark for midcap funds) in three different scenarios.

1. Staying Invested

If you had invested in the Nifty Midcap 150 since inception (1st April, 2005), you would have made total returns of ~500% (or your investment becomes 6x)

2. Not invested when markets fall

If you had just avoided 1% of the worst days i.e. on which the index gave most negative returns, you would have made ~5000% returns (or your investment becomes 51x).

3. Not invested when markets rise

In the same way, if you are not invested in the markets for the top 1% of the days when they gave positive returns, you would have made only 13% returns in the last 14.5 years!

Hence, for any investor, the clear desire will be to avoid the bad days (scenario 2). But the endeavor to achieve this may actually lead you to miss the good days (scenario 3) since it is almost impossible for a retail investor to predict future returns. As the legendary value investor Benjamin Graham said, “In the financial markets, hindsight is forever 20/20, but foresight is legally blind.”

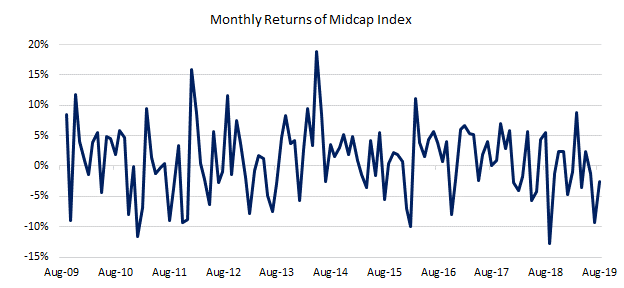

To be sure here, look at the volatility in monthly returns of the midcap index over a 10 year period as shown in the graph above. It is clear that it is easier for us to figure out these worst days in hindsight, but finding them out before hand is almost impossible!

So, what is the solution?

For a retail investor, the best course of action to generate wealth is to do nothing and stay invested in the markets for as long as possible or till your goal is achieved. That’s the scenario 1 above.

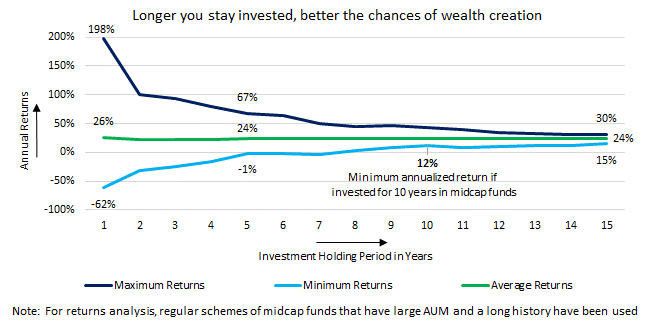

Let’s understand this better. Take a look at the historical performance of mid-cap mutual funds. The graph below shows maximum returns, minimum returns and average returns of mid cap funds for different holding periods.

It is evident from the graph, that if you stay invested in mid cap funds for a period of only 1 year, you run the risk to make minimum returns as low as -62%, although you can make maximum returns as high as 198% (a difference of 260%). However, if the investment period increases to 5 years, the minimum and maximum returns start coming closer to each other. In short, as the investment holding period increases, the difference between the maximum and minimum annualized returns narrows down drastically i.e. the chances of capital growth increase. So stay invested!!

Thus, the time for which you stay invested in the markets is more important than timing the markets!

As an investor you should take into account your investment objective, investment horizon and risk profile before making any investment decisions. Explore fund on Paytm Money app which are designed to take care of all these together.