Upcoming IPOs: Companies That Have Received SEBI’s Approval5 min read

It’s raining IPOs this monsoon! While July saw Zomato among others debuting with a lot of noise, August is all packed as well with some stellar IPO debuts! So, if you like staying updated on upcoming IPOs, here’s a list that you must go through!

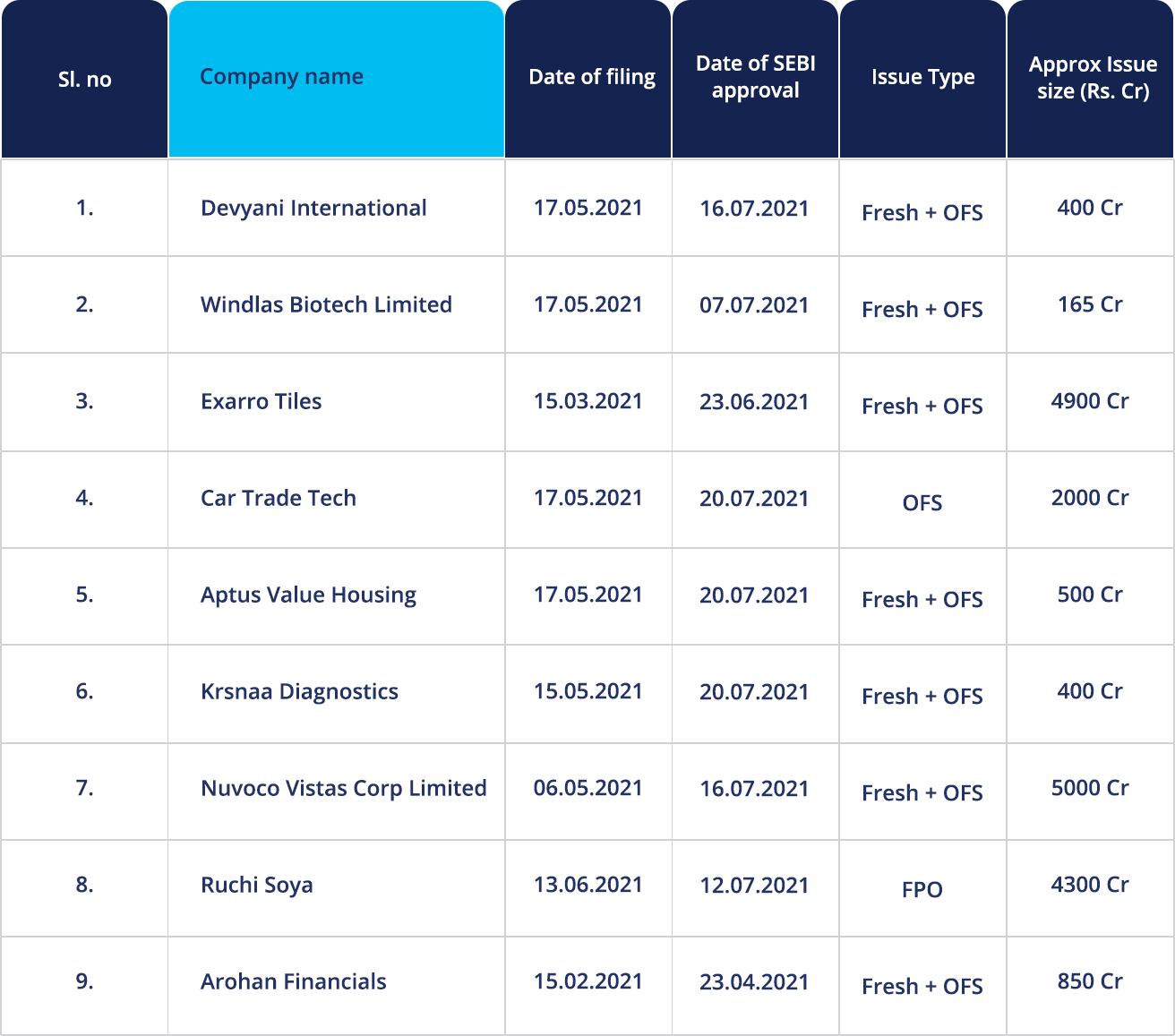

Let’s take a look at the companies that have filed their Draft Red Herring Prospectus (DRHP) and received approval from market regulator, SEBI:

About the companies:

Devyani International

Another big debutant is food and beverages major Devyani International – the largest franchisee of Pizza Hut, KFC and Costa Coffee in India and an arm of diversified conglomerate RJ Corp. Devyani International has engaged merchant bankers CLSA, Kotak Mahindra Capital and Edelweiss Securities, and the firm is also backed by American restaurant behemoth Yum! Foods.

Opens on: 4th August | Closes on: 6th August

Issue amount: Fresh issue of equity shares worth Rs 400 crore and an offer-of-sale (OFS) of up to 12.5 crore

Windlas Biotech Limited

Windlas Biotech is a pharmaceutical company, and in terms of revenue, it’s among the top five in the domestic pharmaceutical formulations contract development and manufacturing organisation (CDMO) industry. It has also two strategic operations – domestic trade generics and over-the-counter (OTC) brands, and exports.

As of December 2020, its manufacturing facilities had an aggregate installed operating capacity of 7,063.83 million tablets/ capsules, 54.46 million pouches/sachet and 61.08 million liquid bottles.

IPO Opens on: 4th August | Closes on: 6th August

Issue amount – Fresh issue of ₹165 crore and an offer for sale of up to 5.14 million shares

Krsnna Diagnostics

Pune-based firm runs diagnostic centres across the country covering all tests under radiology and pathology. The firm runs diagnostic centres across the country covering all tests under radiology and pathology. In November, Crisil revised its outlook on the long-term facilities of Krsnaa Diagnostics to ‘positive’ from ‘stable’ while reaffirming the rating at ‘BBB’.

Issue amount – equity shares worth Rs 400 crore and an offer for sale of up to 94,16,377 shares

Car Trade Tech

CarTrade Tech is one of India’s leading multi-channel auto marketplace, serving new and used automobile customers through several of its vertically integrated brands such as Carwale, CarTrade, Shriram Automall, BikeWale, CarTrade Exchange, Adroit Auto and Auto Biz. Besides being the most profitable amongst its peers, the CarTrade Tech saw its online and offline listings across platforms see a steady increase from 7.09 lakh in FY19 to 8.14 lakh in FY21. The company is profitable since FY19.

Issue amount: The issue is a complete offer for sale of 12,354,811 equity shares by investor and other selling shareholders

Aptus Value Housing

Chennai-based housing finance company Aptus Value Housing Finance (AVHFIL) has a significant footprint in South India. Since the inception of the company in 2010, it has had a clean asset quality with very low NPA. As of December 31, 2020, the company’s AUM stood at Rs 3,790.93 crore. The company has a workforce of 1,844 and a network of 181 branches catering to 56,430 active loan accounts across 75 districts in Tamil Nadu (including the Union Territory of Puducherry), Andhra Pradesh, Karnataka and Telangana.

Issue amount: Fresh issue of equity shares aggregating to 500 crore and an offer for sale of up to 64,590,695

Nuvoco

In terms of its manufacturing capacity, Nuvoco Vistas, a cement venture from Nirma Group, is the fifth largest cement company in India and the largest cement company in east India, as per the DRHP filings.

It also is one of the leading ready mix concrete manufacturers in India and has grown from being a cement focused entity to now a building materials company offering more than 50 products across cement, ready mix concrete and modern building materials sold under a well-established brand name.

The company has a pan India market share of 4.2%, whereas it is more dominant in the eastern region with a market share of close to 17%, in terms of capacity on a consolidated basis as of December 2020. In north India, it has 5% market share in terms of capacity

Issue amount: Fresh issue of Rs 1,500 crore and an offer for sale of Rs 3,500 crore.

Ruchi Soya Industries Limited

Baba Ramdev-owned Ruchi Soya Industries was acquired by Patanjali Ayurved through the insolvency court, and is now aiming to open subscription to its FPO for investors. The edibles oils-to-biscuits company’s shares which relisted on the bourses in January 2020 after the conclusion of the insolvency proceedings, surged as much as 8,000 per cent in six months driven by the low free-float and heavy investor interest. Those gains have since pared down to 6,276 per cent.

Issue amount: Apporx Rs 4,300 crore through sale of shares to bring down the holding of its promoter Patanjali Ayurved as mandated by Sebi’s minimum public shareholding norm.

Arohan Financial

The Kolkata-based company which commenced its operations in 2006, has served approximately 2.21 million borrowers across 17 states and stands as the largest NBFC-MFI in eastern India as per gross loan portfolio. It offers a broad range of products across credit and financial instruments. Between FY17-FY20, Arohan Financial Services, as per a CRISIL report, had the second highest gross loan portfolio growth at 68 per cent CAGR and stood amongst top five NBFC-MFI.

Issue amount: Fresh issuance of shares amounting to Rs 850 crore and Offer for Sale (OFS) of 27,055,893 equity shares

Exarro Tiles

Exxaro Tiles was incorporated in 2008, and the company is engaged in the manufacturing and marketing activities of vitrified tiles. The company manufactures Double Charge Vitrified Tiles (double layer pigment) and Glazed Vitrified Tiles made from ceramic materials i.e. clay, quartz, and feldspar. Its product portfolio consists of 1000+ different designs of tiles in 6 sizes. Topaz Series, Galaxy Series, and High Gloss Series are some of the well-established products of the company. It also exports tiles to different countries across the globe i.e. Poland, Bosnia, USA, and others.

Currently, Exxaro Tiles has 2 state-of-the-art manufacturing facilities in Padra and Talod with an installed production capacity of 1,32,00,000 sq mt per annum. It further has 6 display centers in 6 cities and 2 marketing offices in Delhi and Morbi.

Issue amount: Fresh issue of up to 1.12 crore equity shares and an offer for sale of up to 22.38 lakh equity shares

Sources: BRLM, RHP, MoneyControl, Business insider, Livemint, Economic Times

Disclaimer: This content is purely for informational purpose and in no way an advice or recommendation. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.