As Donald Trump & Joe Biden lock horns, all the bulls & bears across continents are cautiously awaiting the results of US elections because even though the US accounts for just around 5% of the world’s population, it manages to generate 20% of the world income, and US trade policies impact many countries including India.

As of 2 November 2020, polls are in favor of Biden winning the elections, BBC Poll of Polls declares potential victory for Joe Biden. Calls for 52% Biden and 43% for Trump.

The US President and his policies have implications on the Indian economy directly especially on our bilateral trade, H1B visas & Indian markets. Reports said that in the financial year of 2019-20, the total estimated value of the bilateral trade between India and the US stood at $89 bn.

Let’s look at What if… Trump Wins

If Donald Trump, the current US President, and a Republican functionary, is re-elected, he is likely to continue his stance on China which may directly & positively affect India as the manufacturing hub is likely to be shifted to India. So far, Donald Trump has imposed sanctions on Chinese imports worth $370 bn, and he is likely to continue it.

Apart from that, Trump has good relations with Indian Prime Minister, Narendra Modi and if Donald Trump continues his stay in the White House for the next four years then this relationship will further strengthen and help India economically i.e these personal relations would affect future trade agreements signed by India-US.

What if… Biden Wins

Joe Biden is contesting the presidency as a representative of the Democratic Party against the current US President Donald Trump. Biden has hinted at putting an end to the ongoing tariff war with China.

Last month, in a virtual campaign event to commemorate Independence Day, Joe Biden reportedly said that he would advocate “standing with India and confronting the threats it faces in its region and along its borders; expanding greater two-way trade that opens markets and grows the middle class in both our countries; taking on big global challenges together like climate change and global health security and strengthening our democracies where diversity is our mutual strength. And where we have an honest conversation about all issues as close friends do”.

In case Joe Biden wins the elections, investors may have to wait and watch the decision or steps taken by the US and Indian government.

What if…No one emerges as a clear winner

Indian stock markets are likely to take it adversely if the outcome is not in the favour of either of the candidates because all the future decisions will be on hold and may delay the trade activity as well.

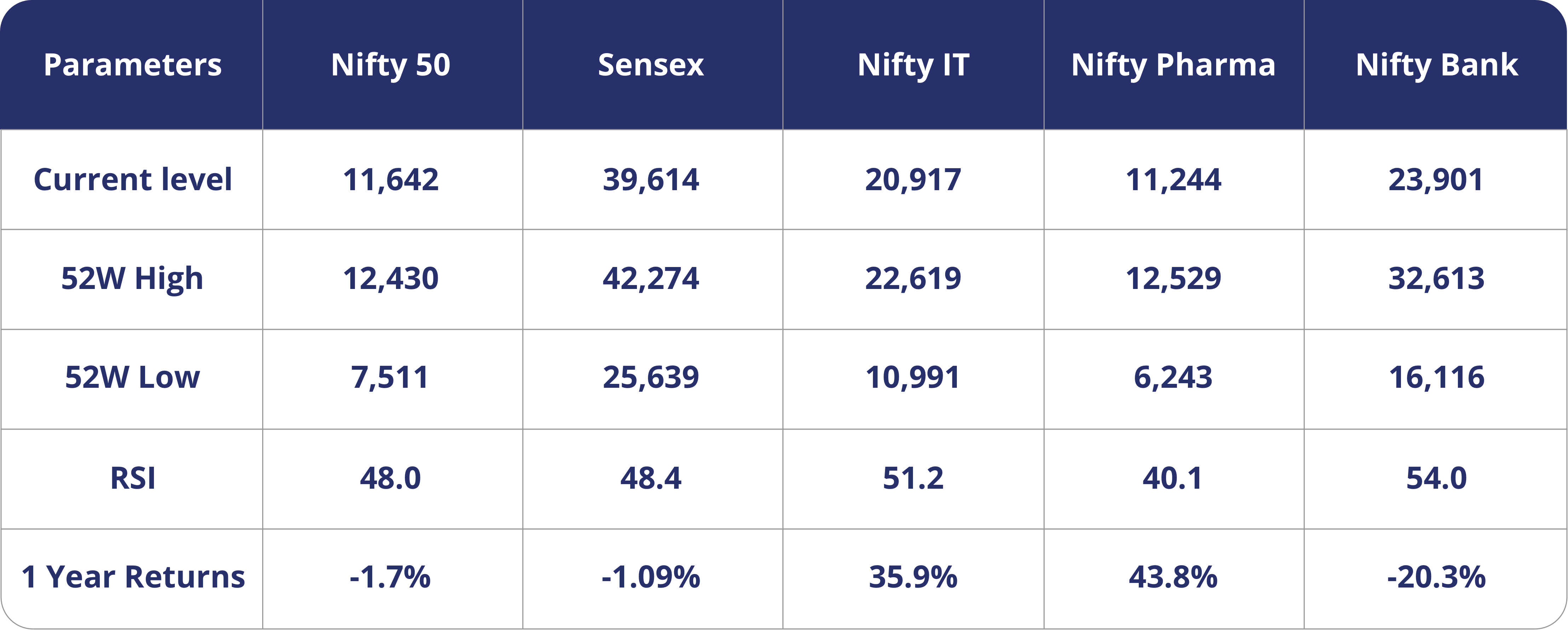

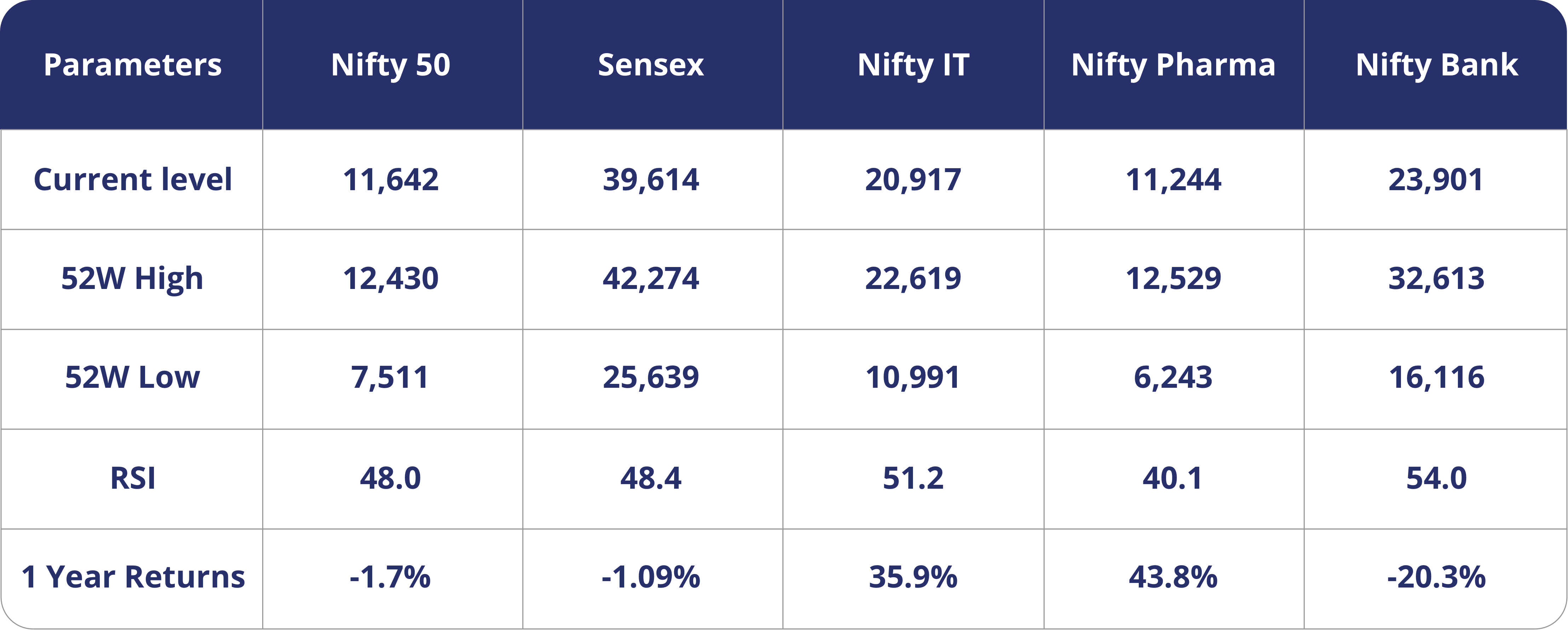

How Nifty has reacted lately?

In the run-up to US Election results, trade in the Indian markets suddenly caught a cold and the last week of October saw a subdued market movement amid uncertainty over US election outcome and stimulus and on the possible second wave of Covid-19.

Impact on Indian Markets

Whether the White House residents change or remain the same, the US Federal Reserve’s low-interest-rate policy is likely to continue in the near term.

If Biden claims the throne, then analysts expect someone with a dovish stance to replace Jerome Powell, Chairman of the US Federal Reserve. On the contrary, if Trump manages to keep the Presidency, then analysts believe that an unorthodox Chairman will replace Powell who may even consider having negative interest rates.

Falling interest rates will make India an attractive option as it would result in the continued inflow of cheap capital into Indian stock as well as debt markets.

However, as discussed earlier, if there isn’t a clear winner then the markets are likely to see some downside on uncertainty over the US elections outcome and stimulus decisions. Investors do not welcome any kind of uncertainty, and markets don’t react positively when uncertainty hovers.

If we look at Indian stock markets, Information Technology (IT) and the pharmaceutical sector generates sizable revenue from the US.

Software exporting companies and Indian drugmakers are the top-performing components (see the chart below) of the Indian equity market amid the pandemic and the outcome of the US Presidential elections will have a direct impact on these sectors as the stance of both the candidates on taxation, trade, and immigration policies differs. Trump has been vocal about protecting the jobs of US citizens, while Biden has a moderate stance on this subject, as per reports.

Looking at Pharma companies, the Donald Trump-led government has outlined plans to pump money into producing more medications at home. However, Trump may soften his stance over this to improve India-US relations.

Fundamental & Technical Dose

Data as of 30.10.2020