Vedanta Delisting6 min read

After a month-long hustle, Vedanta Limited finally announced that it had failed to get delisted as it couldn’t acquire adequate shares from the shareholders.

Well, this is not the first time that a company has wanted to get delisted. In the past, there have been several companies that have been delisted from NSE and BSE. For instance, In December 2014, Essar Oil had undergone a successful voluntary delisting and became one of the largest privately-owned business organizations in India.

Once delisting happens, you would no longer be able to buy/sell shares of the company from/to the stock market. Thus, delisting is a major decision that causes significant changes in the ownership of the company.

Surely, now you would be interested to know why Vedanta wanted to go for delisting and what led to the Delisting’s failure!!

Vedanta Ltd… hai kaun?

Vedanta Limited, a subsidiary of Vedanta Resources Limited, is a diversified conglomerate that deals in natural resources like zinc-lead-silver, iron ore, steel, copper, aluminium, power, oil, and gas. It handles the entire value chain starting from the exploration of primary metals (zinc, aluminium, copper) to their refining and final conversion into value-added products like sheets, rods, and bars.

The company enjoys market leadership across its core business segments. Being the country’s largest and globally the second largest zinc-lead miner (Source- Vedanta’s official website), it holds a major stake of 64.9% in Hindustan Zinc Limited (HZL) (govt company). Also, it is one of the Top 10 silver producers globally with an annual capacity of 21 moz (600 tonnes).

Additionally, the company is also involved in extracting oil & gas and generating power. In fact, it owns 3 operating blocks in India that produce oil & gas. Besides, the company also aims to replenish its reserves of mines and oilfields by setting up new facilities and acquiring existing ones.

Delisting matlab…?

Simply put, delisting is when a company chooses not to offer its shares to the public anymore for trading purposes. It wants to stay private. Such a decision can be at the company’s discretion, which is called voluntary delisting.

The other scenario can be involuntary delisting wherein the company is forcefully delisted by the NSE/BSE for varied reasons like bankruptcies, mergers/takeovers, the performance of the stock, and failure to maintain the minimum requirements prescribed by the exchange, among others. In this case, the company, its whole-time directors, promoters & subsidiaries are barred from participating in the stock market for 10 years.

Vedanta Ltd. Kyu Delist Hona Chahtii Thi?

Going private has its own advantages like better focus of management on optimizing returns, faster decision-making, dynamic capital allocation, and letting companies buy off shares at cheaper valuations from the market (when there has been undervaluation for extended time periods), among others. As for Vedanta Ltd, its management had decided to go for delisting on a voluntary basis. There were several reasons for this.

One of the reasons pointed out by Moody’s, the rating agency, was its complex group structure and negative ratings outlook. A move to privatize would have improved the credit profile of Vedanta Resources Limited’s (its parent company) and would have provided its parent company better access to Vedanta Ltd’s cash surpluses, thereby enabling the former to manage assets and liabilities (repayment of group debt of over $10 billion) more efficiently across its various subsidiaries.

The possible delisting would have also given direct access to cash on Hindustan Zinc Ltd (HZL) books and would have stopped a possible dividend leakage. Besides, such a merger of Vedanta with its parent company would have led to tax benefits.

Kaise Hua Delisting Process?

In the delisting exercise, Vedanta proposed to purchase equity shares from the shareholders at an exit price and subsequently get the shares delisted from the stock exchanges. The exit price was to be determined by a reverse book building process.

Initially, a floor price (or a minimum price that has to be offered to the public) of Rs 87.25 was determined according to the Delisting Regulations. Then, in the reverse book building process, public shareholders placed their bids during the bidding period.

The final exit offer price was the one at which the promoter would be ready to accept a minimum of 134.1 crore equity shares, that is equal to 90% of the paid up equity share capital of the Company, , excluding the shares that are held by a custodian and against which ADRs (American Depository Receipts) have been issued.

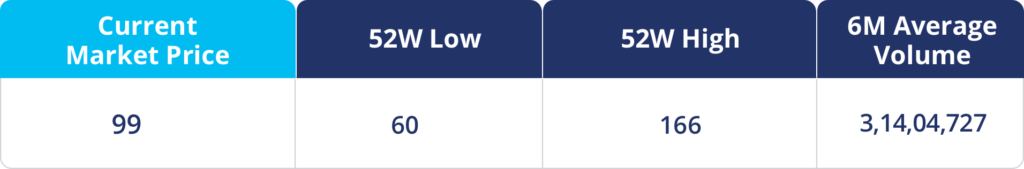

How was its stock price ka utaar-chadaav?

Being a cyclical stock, on the whole, an investor may expect a lot of volatility in Vedanta’s stock prices. Additionally, the overall success of its core business i.e. mining is hinged upon regulatory constraints and approvals from various social groups like environmentalists. So, if you have already invested in its stock, be prepared to face turbulence in your returns.

Vedanta’s stock started off on a high note of Rs 160.45 in the month of January 2020, only to touch the bottom of Rs 62.65 soon after 3 months due to falling demand owing to covid. Then, the stock prices picked up again and it was a bumpy ride till 25 September, right before the start of the delisting process. Since then the stock has been on its southward journey that continued till 12 October when the stock ended at Rs 96.95.

Why couldn’t Vedanta delist from the exchange?

In the end, Vedanta was not able to get delisted because it could garner offers for only around 125.47 crore shares as against the limit of 134 crore shares that was necessary for the delisting process to become successful.

Now, what happens to the shares of investors?

Vedanta says that its shares would continue to remain listed on the exchanges. Due to the failure of the delisting process, Vedanta would not acquire any shares from shareholders. This may come out as a negative point for Vedanta as the promoter did not make a counteroffer. The shares of Vedanta Limited are listed on the BSE Limited and the National Stock Exchange in India and its American Depository Receipts are listed on the New York Stock Exchange.

Right now, the stock holds several positives for the existing investors. Global recovery in commodity prices and an expected hike in oil & gas production coupled with capacity expansion benefits may improve Vedanta’s future earnings. At the same time, a failed attempt at delisting might again encourage the company to go for the second round of buybacks, even at a better price than what was offered before.

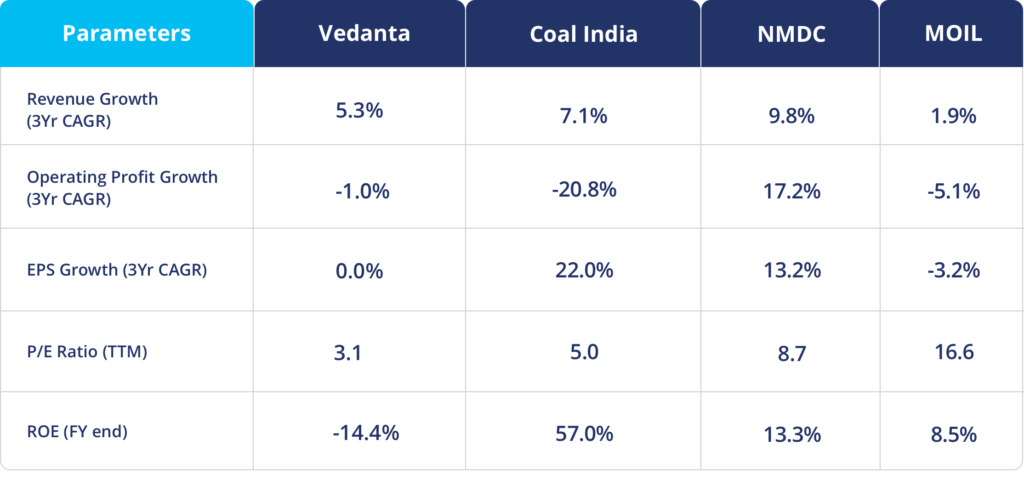

However, those who are interested to take sector-specific risk might even consider investing in other stocks that are out of troubled waters, just to keep firm-related risks at bay.

Ultimately, how the tables turn for Vedanta is yet to be determined. What do you think about it?

Fundamental Analysis

Vedanta Ltd. has a Market Cap of INR 38,138 crore and is a large cap stock

Technical Analysis