Vijaya Diagnostic: Dates, Details and Overview3 min read

Hyderabad-based Vijaya Diagnostic Centre’s Rs.1,895 Initial Public Offering will open for subscription on Wednesday, September 1.

The price band for the same has been fixed at Rs. 522-531 per share with a face value of Rs. 1 each. The IPO will open for subscription on September 1 and will close on September 3, Friday. The promoter of the company S. Surendranath Reddy will offload 5,098,296 equity shares in the OFS. Existing investors including Karakoram (29,487,290 equity shares), and Kedaara Capital AIF 1 (1,102,478 equity shares) will also participate in the share selling process.

ICICI Securities, Edelweiss Financial Services and Kotak Mahindra Capital Company have been appointed as book running lead managers (BRLMs) of the issue. KFin Technologies is the registrar of the issue.

Know the Company:

Vijaya Diagnostic Centre Limited is the largest integrated diagnostic chain in southern India, by operating revenue, and also one of the fastest-growing diagnostic chain by revenue for fiscal year 2020.

The company offers a one-stop solution for pathology and radiology testing services to its customers through its extensive operational network, which consists of 81 diagnostic centres and 11 reference laboratories across 13 cities and towns in the states of Telangana and Andhra Pradesh and in the National Capital Region and Kolkata as on June 30, 2021. For the three months ended June 30, 2021 and the fiscal year 2021, it derived 95.91% and 96.20% of its revenue from operations from the core geographies, Hyderabad and rest of Telangana and Andhra Pradesh, respectively.

The company offers a comprehensive range of approximately 740 routine and 870 specialized pathology tests and approximately 220 basic and 320 advanced radiology tests that cover a range of specialties and disciplines, as of June 30, 2021.

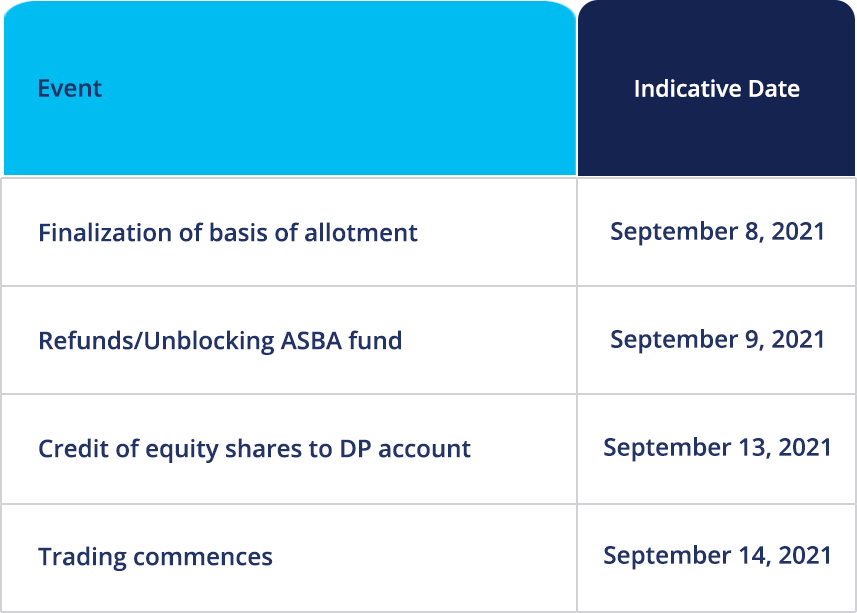

IPO Timeline:

Objective of the Offer:

With the amount raised, the company plans to carry out the Offer for Sale of up to 35,688,064 Equity Shares by the Selling Shareholders.

It has plans to achieve the benefits of listing the Equity Shares on the Stock Exchanges. In addition, the Company expects listing would enhance its visibility and its brand image among its existing and potential customers and create a public market for its Equity Shares in India.

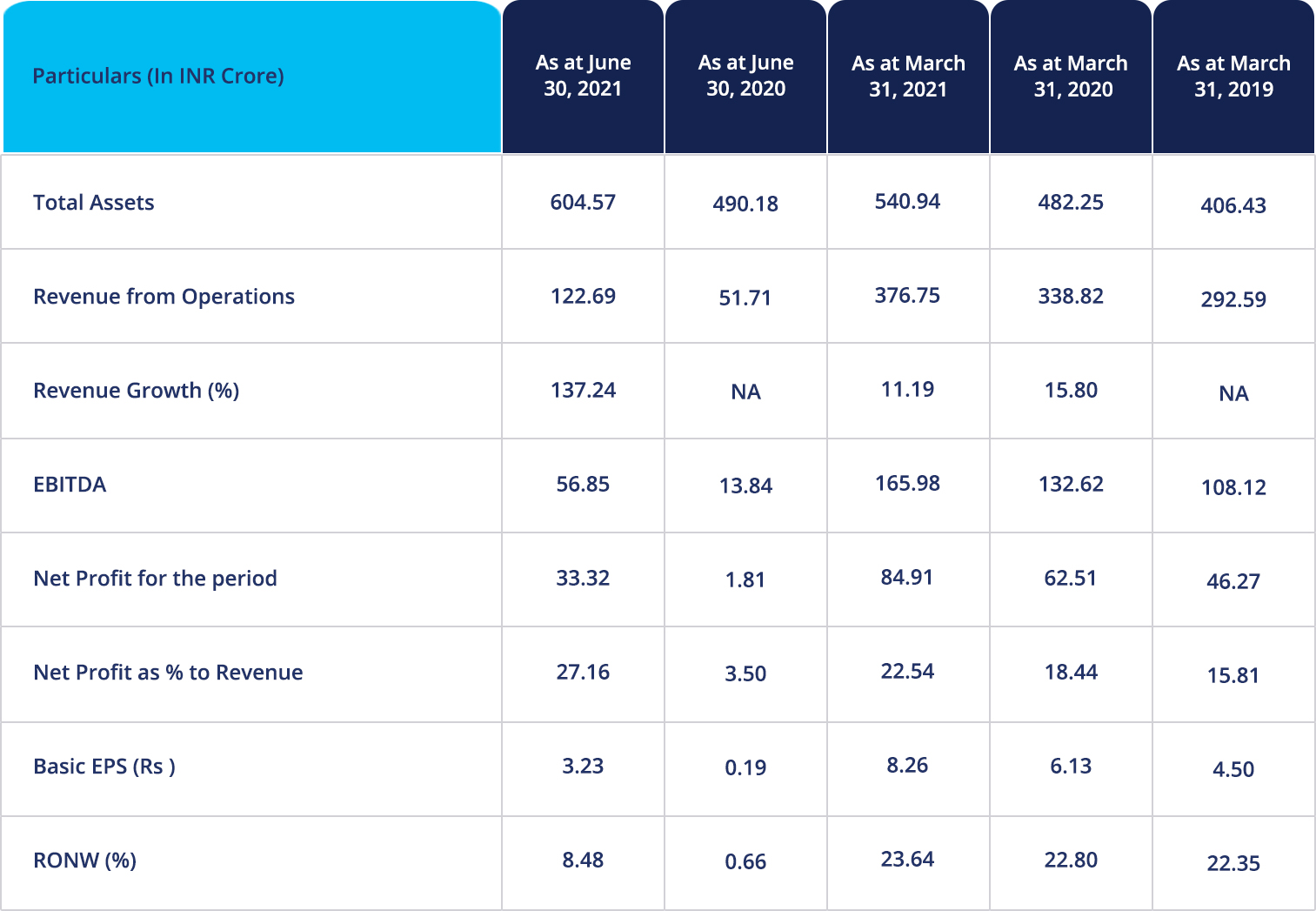

Important Financial Data:

Strengths of the Company:

- The company is one of the fastest growing diagnostic chain with dominant position in south India, well positioned to leverage the high growth in Indian diagnostics industry.

- The Integrated diagnostics provider that offers one-stop solution at affordable price with focus on superior quality standards;

- The company has a high brand recall driving high individual consumer business share and customer stickiness.

- Strong technical capabilities, quality infrastructure and state of the art medical technology with strong IT infrastructure.

- Dedicated management team with significant industry experience.

Risks Involved:

- The company’s inability to maintain and grow its brand name and brand image;

Adverse effect by global health epidemics, including the recent COVID-19 outbreak, and the continuing effect of the same.

- Any interruptions at its flagship centre and other diagnostic centres may affect the ability to process diagnostic tests, which in turn may adversely affect to business.

- Dependence on third parties to provides the testing equipments and reagents or recall of existing testing equipment and reagents.

- Failure or malfunction of its equipment could adversely affect the ability to conduct its operations.

- Non-compliance with and changes in any of the applicable laws, rules or regulations, including pricing, safety, health and environmental laws, may adversely affect its business, results of operations and financial condition and cash flows.

Source – RHP, BRLM

Disclaimer – This content is purely for informational purposes and is in no way advice or recommendation.

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers