Windlas Biotech IPO Details – Dates, Price & Overview2 min read

The Rs. 402-worth-IPO of Windlas Biotech Ltd. is all set to join a list of companies that will be going public this week. The Post Issue Implied Market Cap is at Rs.1,003 Cr at upper band and the total shares on offer is upto 8,825,102. The IPO will be open on 4th August and close on 6th August. The The price band of each share is fixed at Rs. 448 – Rs. 460. And the face value of each share is Rs. 5.

Know the Company:

Windlas Biotech Ltd is amongst the top five players in the domestic pharmaceutical formulations Contract Development and Manufacturing Organization (“CDMO”) industry in India in terms of revenue. With over two decades of experience in manufacturing both solid and liquid pharmaceutical dosage forms and significant experience in providing specialized capabilities, including, high potency, controlled substances and low-solubility.

The company was founded in 2001 and provides pharmaceutical development services, large-scale manufacturing services to its customers in India and overseas.

The company’s top customers include leading pharma companies like Cadila Healthcare Ltd, Pfizer Ltd, Sanofi India Ltd, Emcure Pharmaceuticals Ltd, Eris Lifesciences Ltd, Systopic Laboratories Private Limited, etc.

IPO Timeline

Objective of the IPO

With the accumulated funds, the company intends to purchase equipment required for capacity expansion of our existing facility at Dehradun Plant IV.

- They plan to finance incremental working capital requirements of the company

- The Repayment/prepayment of company’s borrowings

- The funds will also be utilised towards the general corporate purposes

Company Promoters

Ashok Kumar Windlass, Hitesh Windlass, Manoj Kumar Windlass, and AKW WBL Family Pvt Trust are the company promoters.

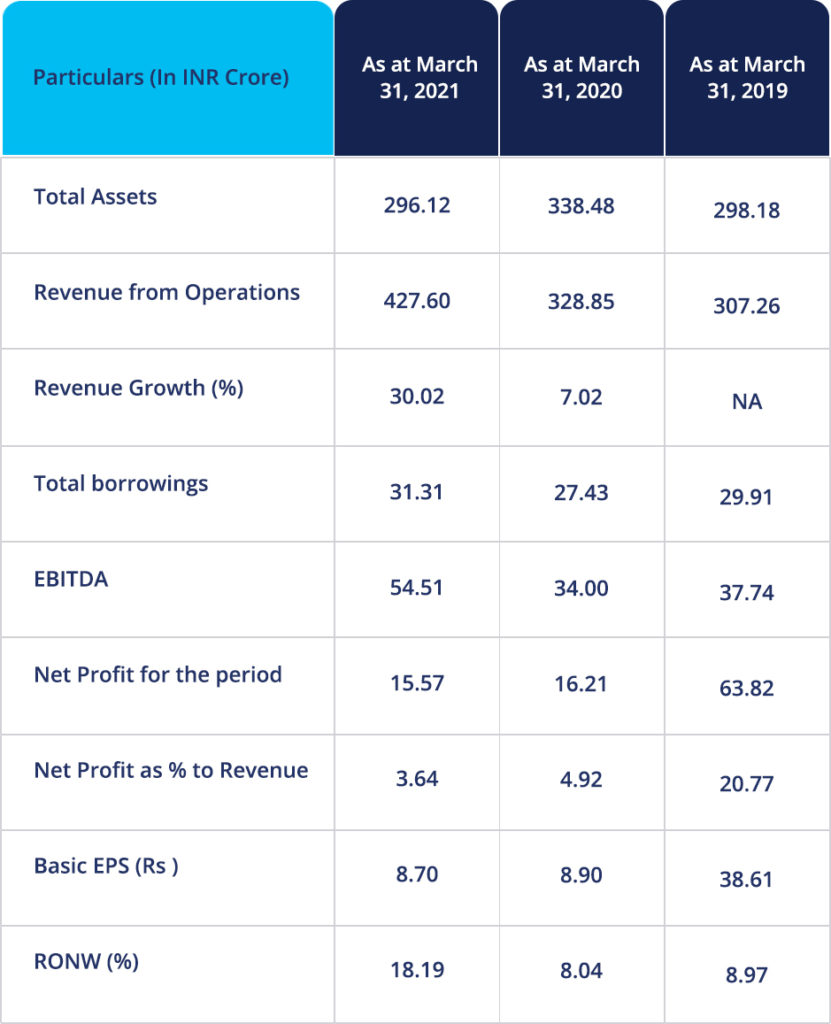

Financials of the Company

Strengths of the Company

- Windlas Biotech is a leading market player in the domestic pharmaceutical formulation CDMO segment.

- It has a strong focus on the chronic therapeutic category.

- The company boasts state-of-the-art manufacturing facilities in Dehradun, Uttarakhand.

- It has a professional and experienced Promoters and a senior management team.

- The company has an innovative product portfolio of complex generic products.

- There is a robust financial performance track record.

Risks Involved

- 85% of the company’s total revenue comes from CDMO customers.

- The company is entering into the new business of manufacturing injectables.

- There are outstanding litigation proceedings against the Company and Directors.

- The company has not declared dividends in the current financial year or the last three financial years.

Sources – RHP, BLRM

This content is purely for informational purpose and in no way an advice or recommendation. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Paytm Money Ltd SEBI Reg No. Broking – INZ000240532. NSE (90165), BSE(6707) Regd Office: 136, 1st Floor, Devika Tower, Nehru Place, Delhi – 110019. visit www.paytmmoney.com for complete disclaimers.