Ye Diwali- Car Ya ‘Be’Car5 min read

The festive season in India, a 45-day period, starting from Navratri till Diwali, holds immense significance from a social and business standpoint. Indians consider it auspicious to buy anything new at this time of the year. Even the car and two-wheeler showrooms around the country are all adorned with ribbons, balloons, and lights, in anticipation of a good sales pickup.

But this year the market sentiment looks rather dim than pompous. The automobile industry has already faced the brunt of pandemic-imposed lockdown with facilities being closed and zero sales for a few months.

Most of us would believe that post-lockdown, automakers would want to push sales even at a lower price thereby increasing the probability of aggressive discounts being offered. However, given the 11 straight months of year-on-year decline in auto sales, the auto dealers are more cautious than optimistic.

Now, the industry has pinned its hope of recouping the losses in these two months of the festive season. Let’s see what lies ahead for us, as a consumer- a lot of attractive discounts across automobile products or a not-so-attractive bargain!

Is race mein aur kaun kaun hai?

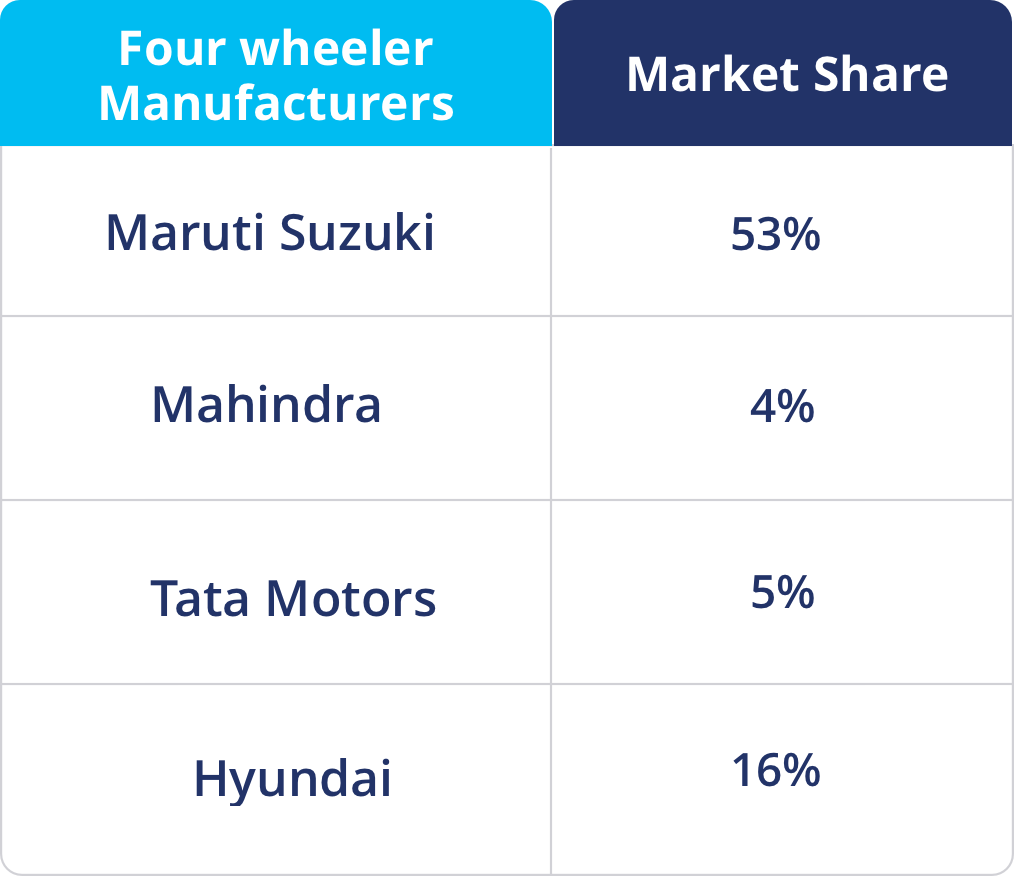

Competitors in the four-wheeler industry & their respective market share in India, as of February 2020

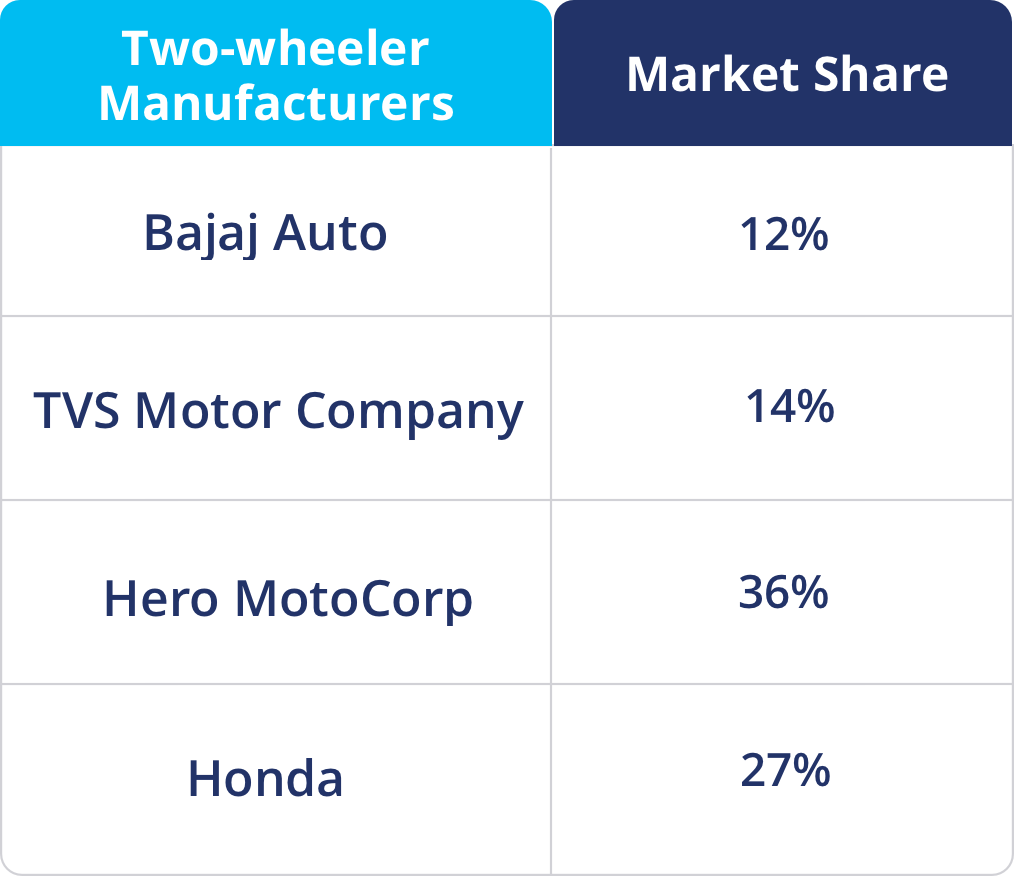

Competitors in the two-wheeler industry & their respective market share in India, as of June 2020

My discount… theek theek lgao…Bhai?

The prices of cars are not just determined by the manufacturer alone as it has other costs attached to it like taxes, insurance, new technologies like BS-VI, and so on.

The only thing that automakers can offer to make the deal more attractive is discounts. Earlier automobile manufacturers would push sales at lower prices during the festive season, but this year the companies have reportedly just pushed in marginal discounts on selective vehicles.

This year, discounts are not as aggressive as everyone has faced the brunt of lockdown and automakers want to make most of this festive buying spree and recoup the losses. Also, auto manufacturers have pinned their hopes on a revival in economic activity which may lead to an increase in demand.

As per some media reports, two-wheeler dealers have introduced some discount offers on premium scooters. However, dealers are hopeful about entry-level bikes and aren’t offering any discounts on the same. Optimism is on the back of better than expected rabi season, a good Kharif sowing, and a relatively lower impact of COVID-19 in rural areas, which is the main market for these bikes.

Passenger car manufacturers have reportedly increased discounts on their entry-level cars in October in the hope to boost retail sales.

This time very low sales…madam!!

During the lockdown in the Apr-Jun quarter, domestic passenger vehicle sales fell 78.4% as compared to last year. However, as the lockdown was eased and manufacturing facilities opened, domestic passenger vehicle sales rose 17% in the second quarter of the current financial year, compared to the corresponding period a year ago, as per the Society of Indian Automobile Manufacturers (SIAM) report. The industry body gives out a monthly sales figure for auto manufactures. These sales are from manufacturers to dealers and not direct consumer sales.

The latest data gives analysts hope that the upcoming festive season will lead to a recovery in the country’s automobile sector.

Now let us look at the dealer level data given out by the Federation of Automobile Dealers Association (FADA) which shows the direct to consumer sales data. As per FADA’s reports, in April, May & June, automobile sales at the dealer level have reflected a de-growth. But, the vehicle registrations in September grew by 11.45% as compared to the previous month but were down 10.2% compared to Sep last year. The passenger vehicle segment for the first time grew by 9.81% YoY since unlocking began.

FADA’s reports showed that currently the two-wheeler inventory is at 45-50 days and passenger vehicle inventory is at 35-40 days. The association is of the view that any further dampener in vehicle sales during the upcoming festivals will have a catastrophic impact on dealers’ financial health.

Auto Stocks…Rally Ya No Rally?

Every year investors are bullish on automobile stocks ahead of the festive season. Over the last five years, Nifty Auto has experienced a rally prior to the festive season which continued during and even after the season.

However, this excludes last year’s performance, where investors were not bullish on auto sales during the festive season on the back of a tight credit environment and higher insurance cost leading to an increase in the cost of ownership which held back consumers.

The Nifty Auto index is marginally up over last month, as investors are cautiously optimistic that the festive season may boost automobile sales and revive the industry-wide situation of a slump in sales. Therefore, as of now, market participants are in a wait and watch mode for auto stocks.

What next – Car Ya HaHa-Car?

The month of October & November brings with itself the much-awaited festival season of Navratri, Durga Puja & Diwali.

With no more lockdown as announced by the Central Government, a high growth period is anticipated during these two months for Automobile Sales in India.

In addition to that, the government is considering waiving off interest on interest during moratorium up to Rs 2 crores, which will help in improving customer sentiment and boost the demand for vehicles.

With Banks and NBFCs also gearing up with various festival offers to woo retail customers, Auto Sales is expected to witness a renewed growth and may close at par with last year.

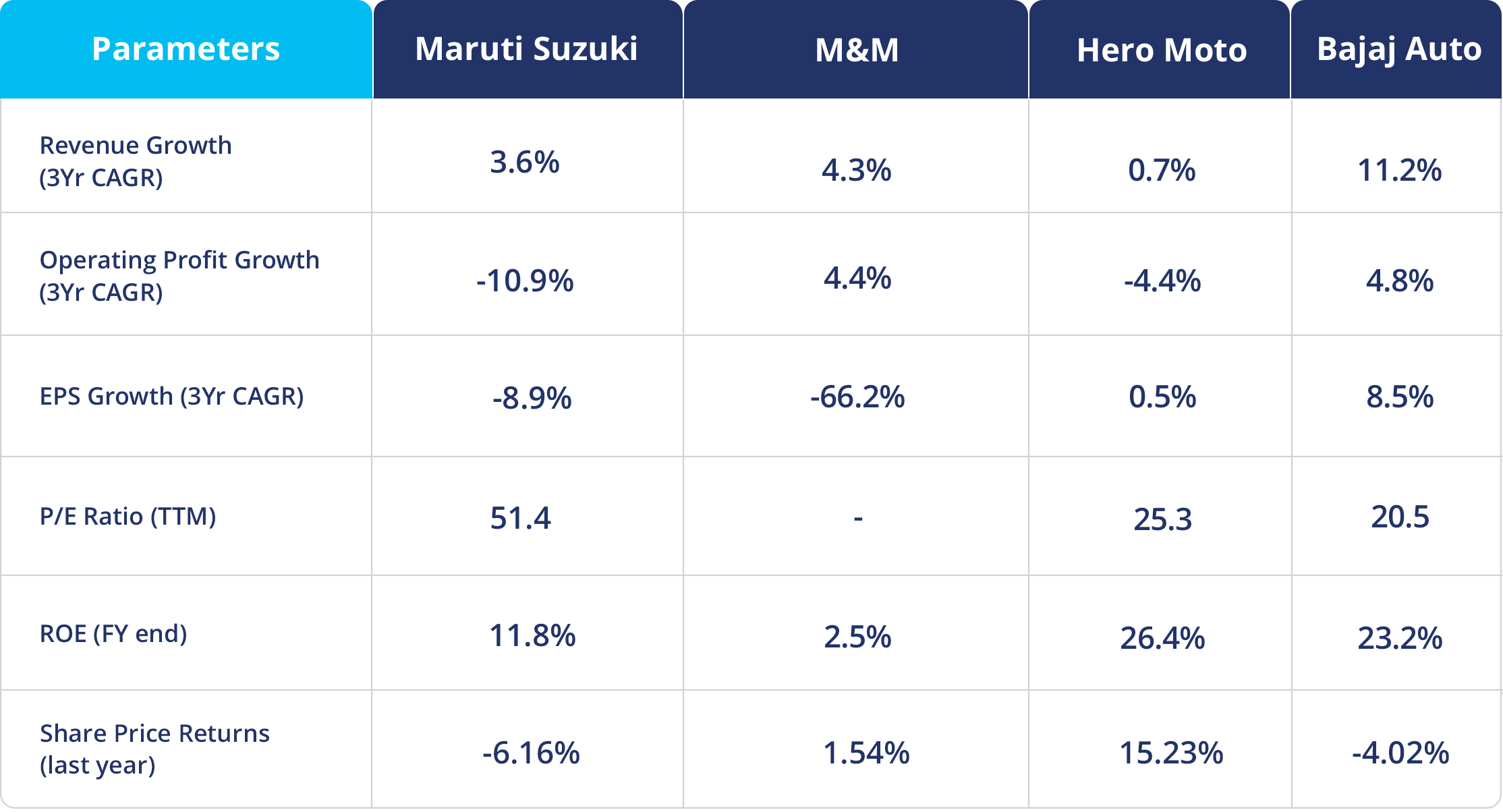

Fundamental dose

*Data as of Thursday, 22 Oct