Update on Impact of Yes Bank exposure on mutual fund schemes1 min read

Continuing from our last post, the government’s imposition of moratorium on Yes Bank Ltd. (YBL) on 5th March, 2020 had resulted in a significant drop in NAVs of the mutual funds having exposure to YBL bonds on that day. Further ICRA downgraded the credit ratings on YBL bonds to ‘D’ (i.e. below investment grade) on 6th March as restricted payments during the moratorium period severely constrains the ability of the bank to service its liabilities in a timely manner. Also, RBI on 6th March, 2020 announced ‘Draft Yes Bank Ltd. Reconstruction Scheme, 2020’ which proposes full and permanent write down of AT1 capital issued by YBL under Basel III framework.

As a result of the downgrade, most AMCs have created a segregated portfolio for their exposure to YBL securities in order to safeguard the interests of existing investors. Given all the developments, the exposures have also been marked down to zero. Investors should note that they will not be able to redeem the segregated portfolios of these mutual fund schemes immediately and redemption done will be processed at the NAV of the main portfolio.

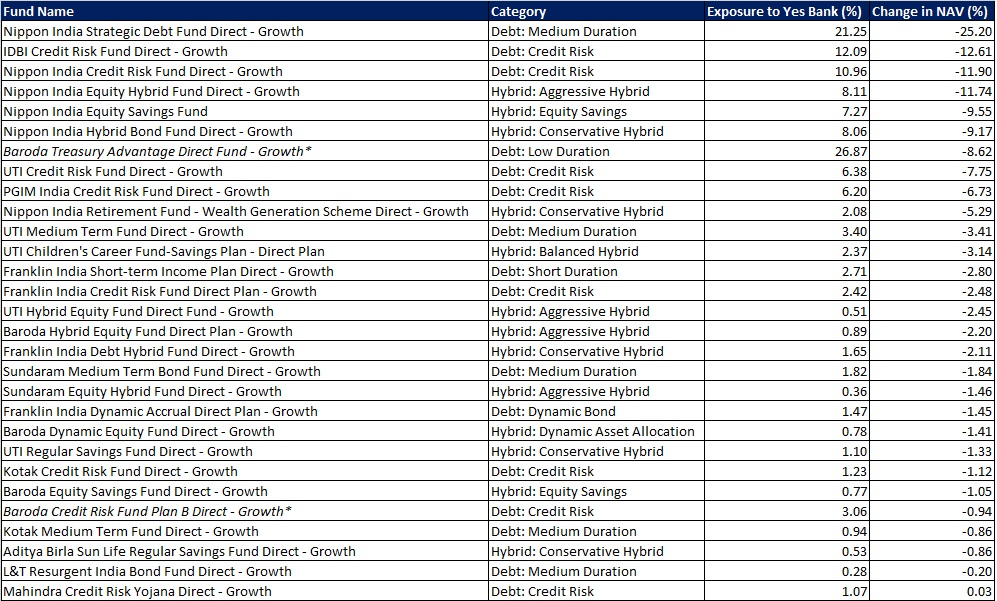

The following table shows the overall impact of YBL bonds downgrade on the debt and hybrid schemes of mutual funds over two days i.e. 5th and 6th March:

Investors should note that the situation with respect to Yes Bank and its impact is still evolving.