Back in 2010s, home delivery of food only meant calling up the restaurant and ordering,

Little did we know this would be tossed away in full swing.

It used to start with, “Hello? Haan Bhaiya, likh lo – ek Paneer Butter Masala, doo Garlic Naan, aur ek pulav. But it always ended with a mixed and confused order even in the third try.

But finally the Zomato revolution was an easier way to ditch the hostel mess ka Aloo Kanda.

A Look At Zomato

Indian food delivery service start-up Zomato has recently filed a Draft Red Herring Prospectus or DRHP.

The proposed IPO offer comprises a fresh issue of Rs. 7,500 crores and an Offer For Sale of Rs. 750 crores. The company needs to continue to invest in three core areas for the growth of its business which include customer & user acquisition, delivery infrastructure, and technology infrastructure.

The Company has made these investments in the past, and it expects these to continue to be critical for the growth of its business in the future.

It proposes to utilise the net proceeds towards funding organic and inorganic growth initiatives & general corporate purposes.

Let’s Look At The Company’s Business Model

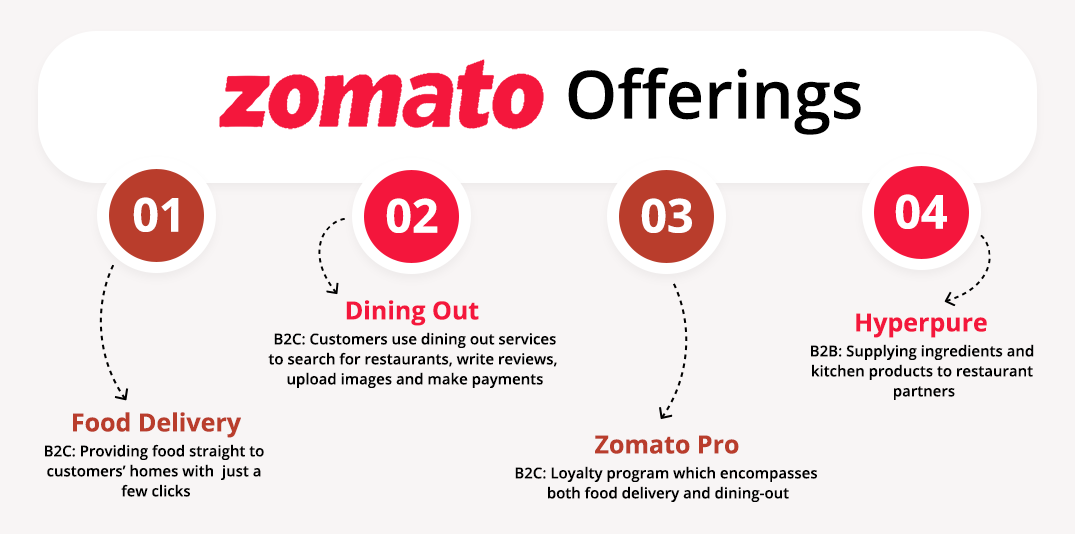

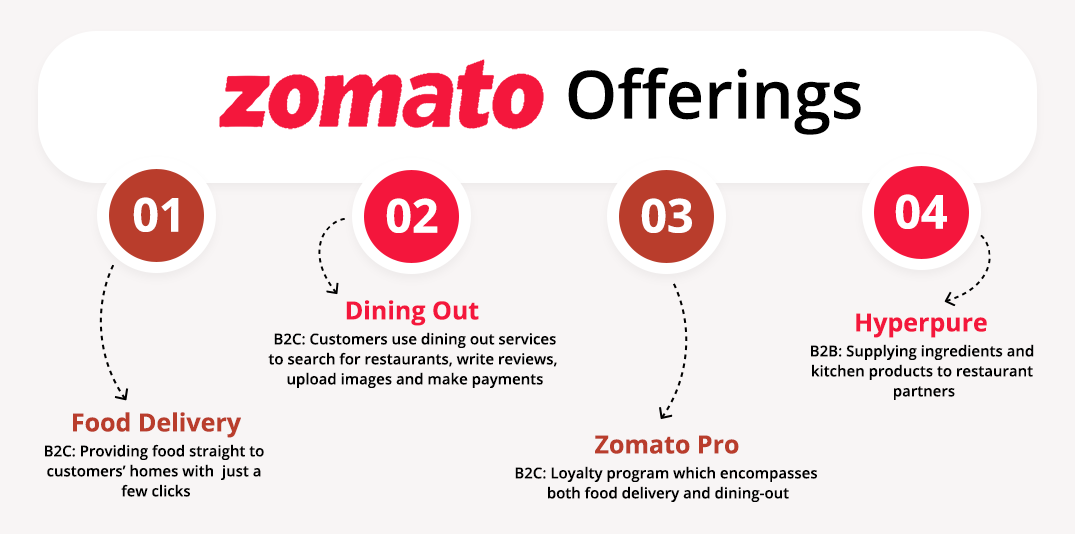

Zomato is primarily a food delivery service and an important chain between restaurants and customers. The platform offers users a wide bouquet of services, starting from ordering food online for home delivery, restaurant search & discovery, advance table-booking, access to user-generated reviews, and other content such as the menu, pictures, and so on.

Zomato has also introduced a subscription program, called Zomato Pro, where a user can access exclusive deals and discounts by paying an up-front membership fee.

Zomato gets an upfront platform fee for listing restaurants and commissions thereafter for orders. The platform is also used as an advertising platform by restaurants to reach out and engage with prospective customers. The platform also provides business support services including analytics and dashboards, table reservations, and payment processing.

By offering different services, Zomato has the ability to monetize its platform in several ways and create revenue streams from different participants on the platform — restaurants, customers, and delivery partners.

However, Zomato currently does not derive any platform charges from its delivery partners.

Another interesting addition to Zomato’s revenue stream is “Hyperpure” which is its farm-to-fork supplies offering for restaurants in India.

The company sources fresh, hygienic, quality ingredients and supplies directly from farmers, mills, producers and processors to supply to restaurant partners. In the month of December 2020, Zomato supplied to over 6,000 restaurant partners.

Some Business Metrics Of The Indian Food Delivery Shark

According to RedSeer, Zomato is India’s one of the leading food services platforms in terms of the value of food sold, as of December 31, 2020.

During Fiscal 2020, 41.5 million average MAU visited Zomato’s platform in India. As of December 31, 2020, the Company is present in 526 cities in India, with over 350,000 Active Restaurant Listings.

Its mobile application is the most downloaded food and drinks application in India in each of the last three years since 2018 on iOS App Store and Google Play combined, as per App Annie’s estimates.

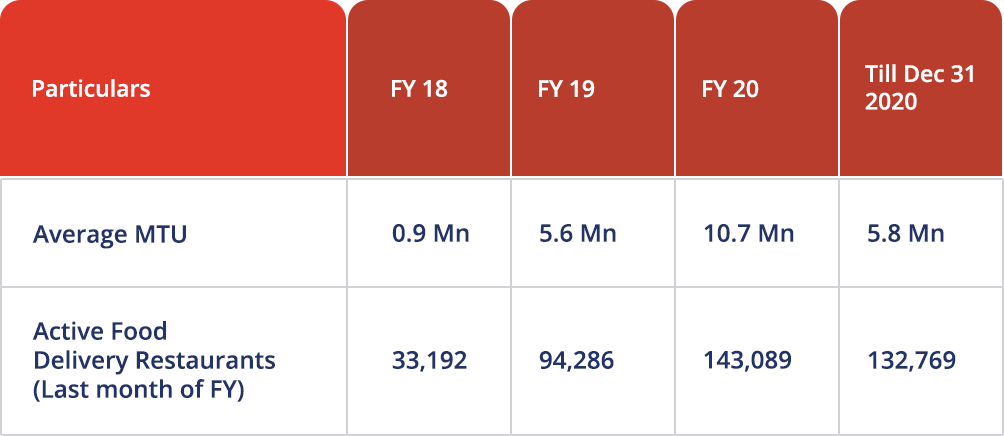

Source – DRHP

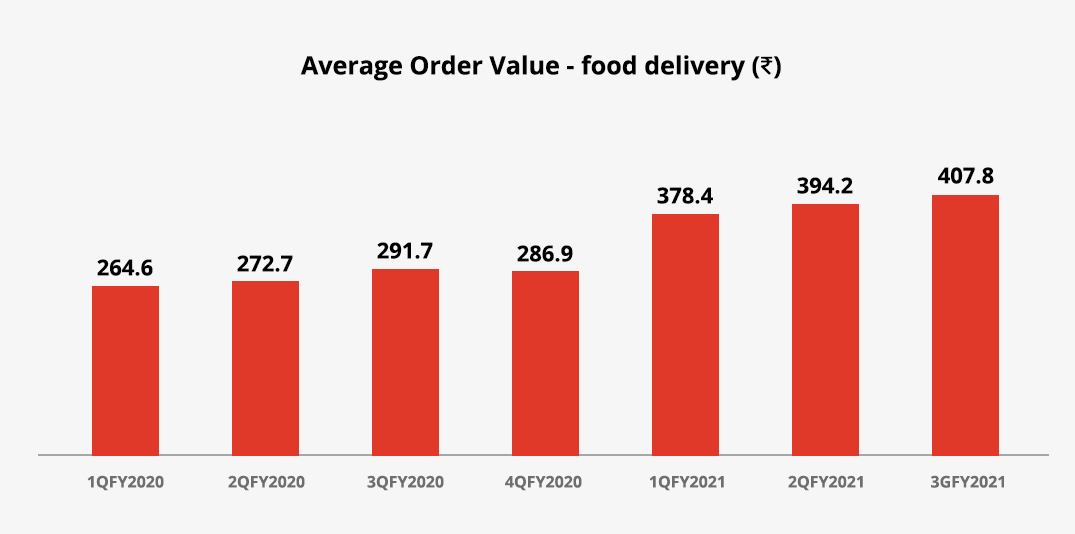

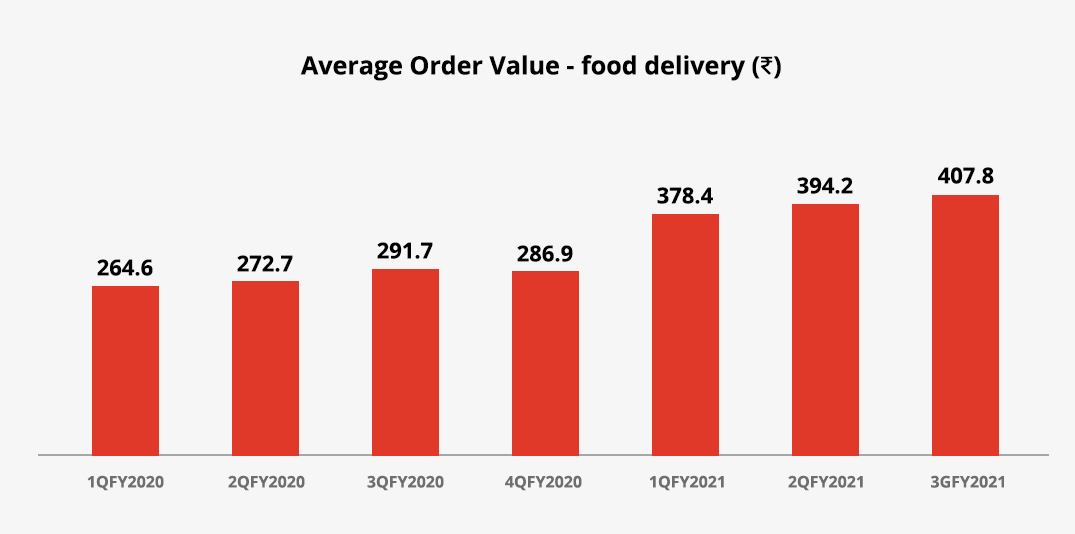

AOV (Average Order Value) is a function of the price of food at restaurants and the number of people the food is being ordered for. Everything else being equal, the AOVs are higher for orders from premium restaurants. Zomato’s AOV has increased steadily over the last seven quarters.

Source – DRHP

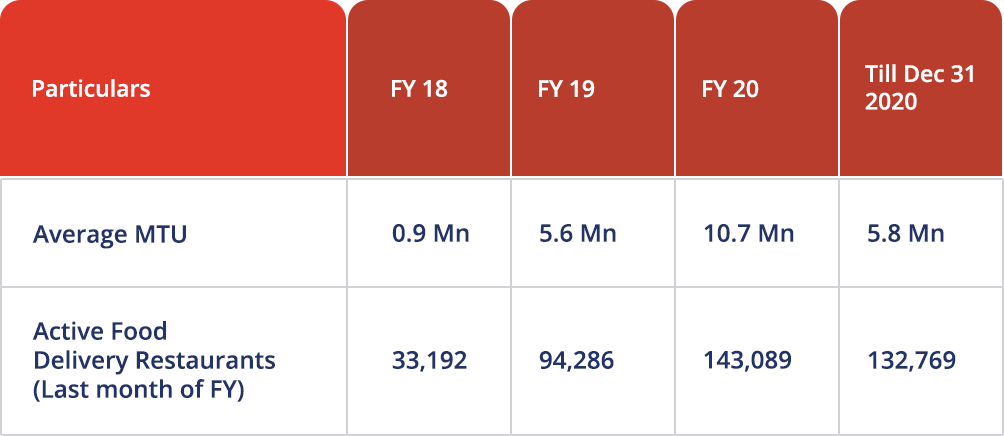

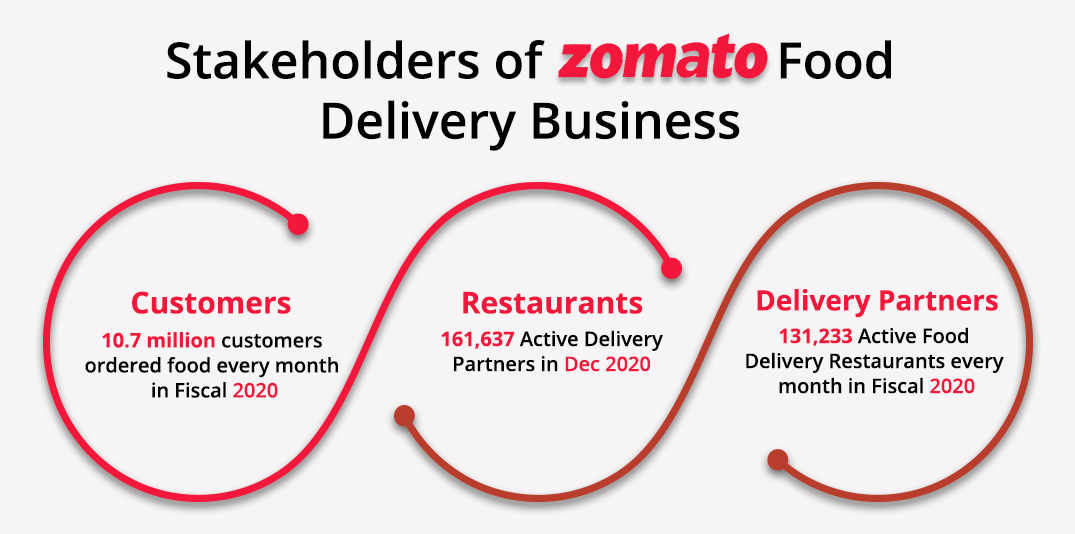

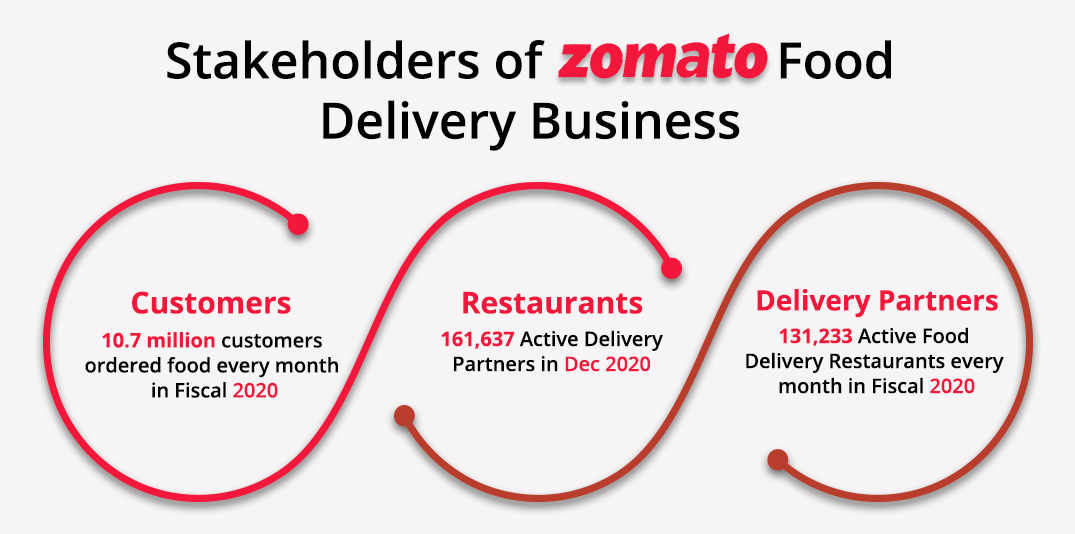

Let’s take a look at the key stakeholders and their traction of the food delivery business.

Source- DRHP

Zomato has even mentioned in the DRHP that its orders have grown from 30.6 million for Fiscal 2018 to 403.1 million for Fiscal 2020. The company’s GOV (Gross Order Value) has increased from Rs. 1,334.14 crore in Fiscal 2018 to Rs. 11,221 crore in Fiscal 2020.

Zomato Opportunity in The Indian Food Delivery Sea

As per Ambit Capital’s report, Restaurant food (or food services) accounts for only 10% of India’s spend on food.

This has massive growth tailwinds due to urbanization, convenience, and an increase in choices.

The post-pandemic era could further increase the rate of formalization due to a focus on hygiene.

India merely has a handful of national brands with ubiquitous presence compared to over

175 in the USA. This helps in two ways – it is easier to hold on to high margins in a fragmented space and the creation of in-house brands via cloud kitchen is possible.

The high AOV (average order value) orders are led by stay-at-home trends due to the pandemic. There are also luxury restaurants that have flocked to delivery platforms to stay afloat. It is unclear whether these trends would sustain post-Covid.

The high-volume businesses like meals at the office too are a challenging market owing to the presence of large informal players (whose accuracy is higher than formal players) and existing kitchen infrastructure. This coupled with the fact that customers are price sensitive implies that this segment is a tough nut to crack.

What About Other Sharks in this Space?

A lot of other players had mushroomed in the past such as the likes of Tiny Owl, Tasty Khanna and Foodpanda. But look around today, the market is dominated by the duopoly – Zomato and it’s biggest competitor, Swiggy.

The industry is highly competitive where Swiggy is also a major player and it can pent up the discount game to pursue revenue growth.

Other Challenges

Apart from that another challenge is that Zomato achieved over 400 mln orders in FY20 and quarterly run-rate of over 70 mln orders in 3QFY21. The change has been a massive uptick in contribution margin in the pandemic period as it virtually eliminated discounts and delivery fee became the norm.

The company has not given the split of the orders between geographies or cohorts. However, as per Ambit Capital’s report it is very likely that sustenance of delivery fees may be difficult in the last 200-300 cities once we are past the pandemic.

Scroll for the Food Delivery Shark’s Financial Data

Source – DRHP

In its DRHP the company said that, “We expect our costs to increase over time and our losses will continue given significant investments expected towards growing our business.”

The company will continue to expend substantial financial and other resources on, among others, advertising and sales promotion costs to attract customers and restaurant partners to the platform, developing the platform, expanding into new markets in India, and expanding delivery partner network.

And these efforts may be more costly than expected and may not result in increased revenue or growth in its business.

With Zomato entering Indian Stock Markets, will India witness a start-up boom similar to the dot com boom in the US markets? Only time will tell!

Disclaimer – This content is purely for informational purpose and in no way advice or a recommendation.