All About ‘Margin Against Stocks’ Feature On Paytm Money5 min read

Margin Pledge is a feature through which you can pledge your stocks to the broker in return for a collateral margin. This collateral is received after deducting certain percentage of value called ‘haircut’. You can trade in stocks, ETFs, futures and options using this collateral margin. Now, get additional funds by pledging your existing stocks and make the most out of your trades!

Check out “What is a Margin Pledge?”.

What’s unique about Margin pledge on Paytm Money?

- Very simple process for pledging and unpledging stocks. You can complete the entire process in few clicks.

- Get collateral with-in 90-120 mins during trading hours.

- Minimal charges of Rs. 15 per stock (excluding GST) for pledge or un-pledge.

- Stocks remain in your demat and you can track them in your portfolio.

- You can sell the pledged stocks from your portfolio directly, if needed. No need to worry about market volatility.

- Real-time collateral calculation based on the stock price movement.

Access ‘Margin against Stocks’ feature

How to Pledge Stocks at Paytm Money

In order to pledge your stocks, all you have to do is follow these steps.

Step 1: Select the desired stocks from the list displayed and the quantity of stocks you want to pledge.

Step 2: Click on the pledge option after which you will be sent an OTP for CDSL authorization.

Step 3: Once OTP has been entered, the process is complete.

Step 4: Your Margin will be increased in under 10 mins & you can see the same on the Collateral Fund Field on the Funds Page.

How to Un-Pledge Stocks at Paytm Money

In order to un-pledge your stocks,

Step 1: Click on the un-pledge option on your screen.

Step 2: Select the stocks from your pledged stocks list which you wish to un-pledge.

Step 3: Send in a request to un-pledge your stocks.

Step 4: We will check the status of the Funds available in your account and send you a confirmation whether the request is approved or rejected.

As you can see in the above given picture, the application also provides a brief explanation as to how pledging works. After pledging your stocks you receive an OTP which needs to be entered on the CDSL website for authorization. In less than 10 mins you should receive your margin on your pledged shares.

In case you get logged out or your device shuts down in the midst of the pledge request, you can go to the CDSL website and enter the OTP there in order to continue the pledge.

You need to ensure that mobile/e-mail ID are updated in your DEMAT account details. If at any time you feel like not going through with the pledge, you can simply refrain from entering the OTP, post which your request will automatically expire.

Once you enter the margin pledge tab, you will be able to see your DEMAT holdings in front of you as shown above. These holdings are filtered to display only those stocks from your DEMAT which are eligible for pledging.

On further clicking on the respective stock, additional details such as the haircut on that stock and the collateral amount you would receive will also be displayed.

Below will be displayed your total value of eligible stocks and the total margin you can receive for them. You can pledge or unpledged stocks according to your needs.

Now, when you have selected the stocks you want to pledge you will be diverted to this below displayed screen which will display all the pledge request made by you and which ones were successful and which were not.

It will also display the list of your pledged stocks and the stocks for which the request is still being processed.

How to Unpledge Stocks at Paytm Money:

If at any point of time, you feel like un-pledging your stocks, you can go to the un-pledge tab which will display all your pledged stocks along with their respective quantities and values. It will also display your debit and help you understand whether your pledged stock is eligible for un-pledge or not.

Where Can I see the list of stocks whether allowed for Margin pledge and corresponding haircuts?

Where Can I see the Value of the Stocks / Collateral already Pledged:

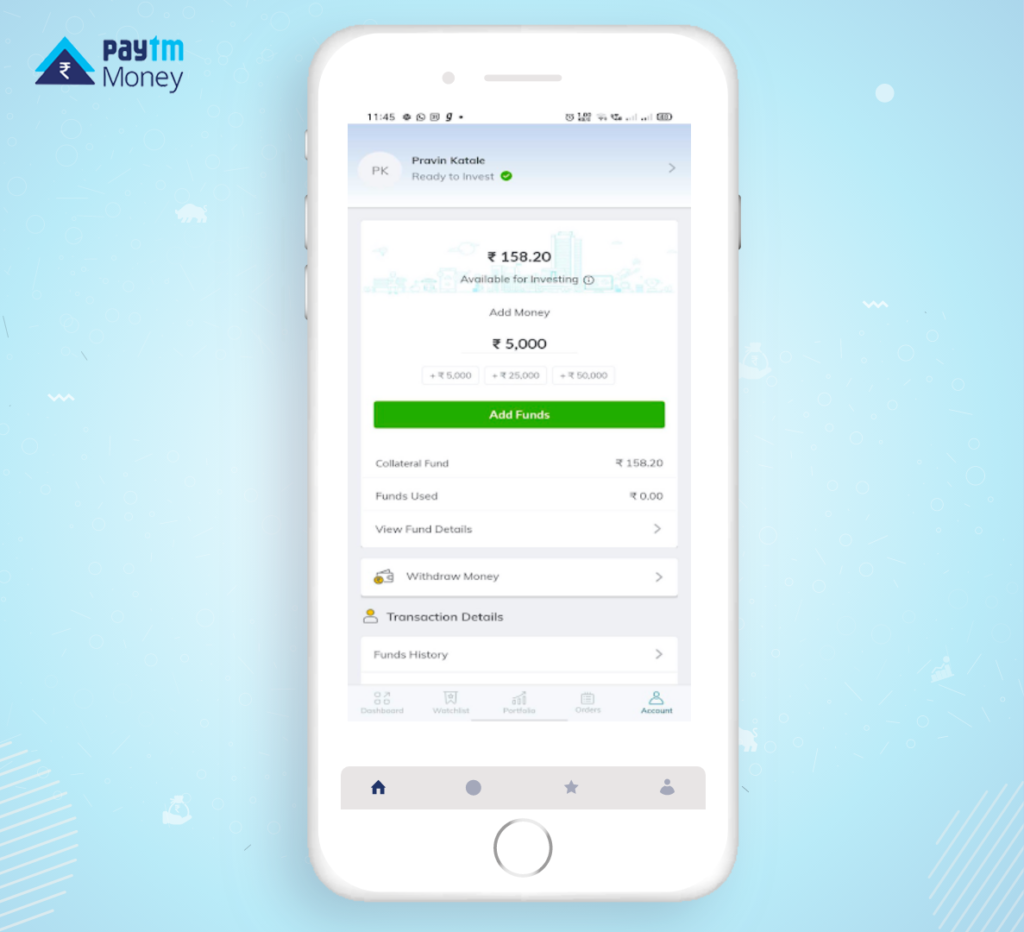

Here you can view your collateral funds. Collateral funds can be used for making any further trading transactions in the future as per your requirement. As it can be seen in the image, the user currently has Rs. 158.20 available for investing. They are also shown the funds they have used and their entire transaction history. Please note for Carry forward Option selling and Future trade, 50% margin needs to be funded by cash. If users consume more than 50% amount from collateral funds then outstanding balance will be charged 1.5% per month interest. Our Risk team will square-off the position whenever total margin falls below the required margin for the position.

Conclusion

Our product and tech teams have worked day in and day out to help you with a seamless journey on Paytm Money. With the margin feature now you can pledge in four steps and also un-pledge with ease on your Paytm Money app and the website.

Investment in securities market are subject to market risks, read all the related documents carefully before investing. For T&C and Disclaimers refer here.