What does Side-pocketing by AMCs in Mutual Funds mean?3 min read

The Background Story

Debt mutual funds are considered ‘safer’ and ‘less risky’ compared to equity mutual funds. It is a fact that equity funds have long term wealth creation potential but are volatile over the short term. On the other hand, debt funds have lesser volatility and many of them give you consistent and stable returns over different time horizons.

However, as discussed in our previous article, debt funds always carry some amount of risk. But credit risk (risk of not getting back the money which has been lent out) started getting more attention over the past year and a half due to various events and has been continuing since.

What is Side-Pocketing?

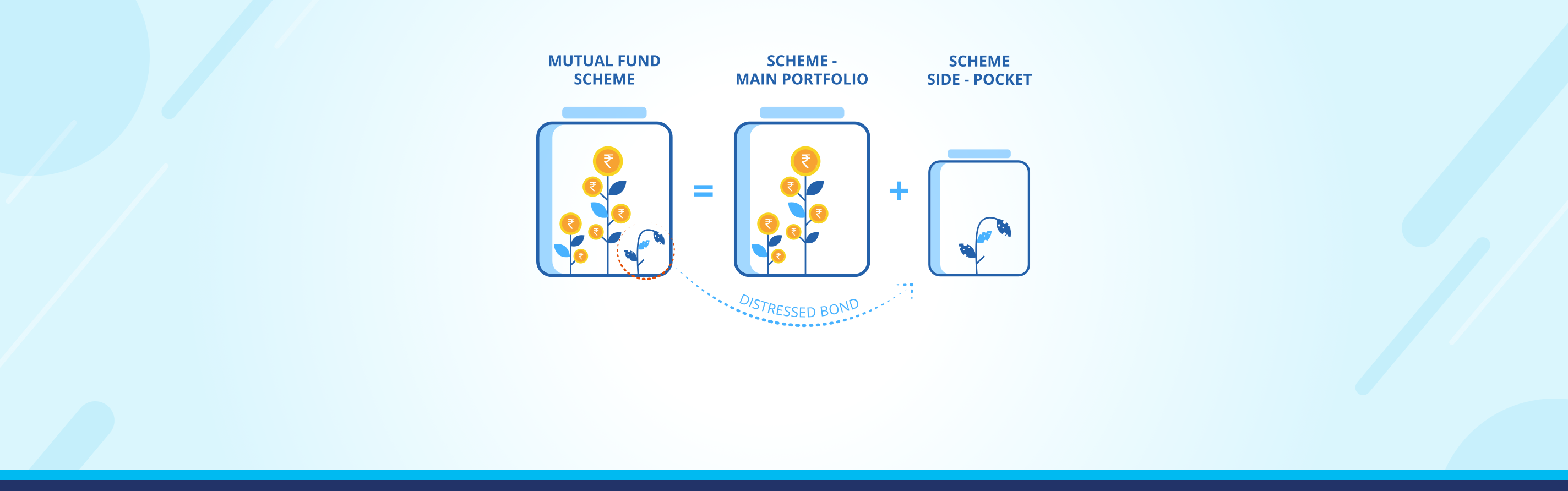

“Side Pocketing” is a mechanism to separate distressed, illiquid and hard-to-value assets from other more liquid assets in a portfolio. This prevents distressed assets from adversely affecting the returns of the rest of the portfolio. It has been introduced by the regulator (SEBI) to safeguard the interests of small/ retail investors in debt mutual funds.

How does this work?

Side-pocketing involves separation of the mutual fund portfolio into main portfolio and segregated portfolio in case of a credit event (for example, a bond in the mutual fund portfolio is downgraded to below investment grade by any of the rating agencies like CRISIL, ICRA, etc. leading to a drop in the NAV)

To understand this with an example, consider a mutual fund where an investor holds 100 units at NAV of INR 20 (portfolio value INR 2,000).

- One bond in the mutual fund portfolio, which was earlier contributing INR 3 to the NAV, is downgraded and now contributes INR 2 to the NAV. Hence the investor’s portfolio value has dropped from INR 2,000 to INR 1,900

- The AMC now separates the downgraded bond into the segregated portfolio and the rest remains in the main portfolio

- Consequently, the investor will get 100 units each in both portfolios. Main portfolio will have NAV of INR 17 and segregated/ side pocketed portfolio has NAV of INR 2

- Hence investor portfolio value does not change: Main portfolio = INR 1,700 and segregated/ side pocketed portfolio = INR 200

- All buying and selling is allowed only in the main portfolio

- Investors cannot freely redeem the segregated portfolio with the AMC and will get back the money sitting here only when AMC is able to recover the money from the bond issuing company

Does it help you?

Remember that it is not just you, the retail investor, who is investing in debt mutual funds. Many debt mutual fund categories see a lot of investment from institutional investors (Investment of Crores of Rupees!!).

Over the past year, credit events have led to some debt mutual funds witnessing a sharp single day fall in NAV. This leads to large redemption in these funds led by institutional investors. The fund manager is forced to sell good quality investments in the portfolio to meet the redemption. Retail investors in these funds are then left with a portfolio that has a higher concentration of the downgraded/ lower quality bond.

With side-pocketing in place, all investors on the day of the credit event will be treated the same as no investment/ redemption will be allowed until side-pocketing is completed.

Are there any risks involved?

Investors must remember that they cannot freely redeem the units of side-pocketed portfolio with the AMC. As and when the affected company pays back the money, all investors holding the side pocketed portfolio will get their money back. Also, there is no guarantee with regard to the amount of money that may be recovered. SEBI has also suggested an indicative list of safeguards that may be implemented by the AMC so that the provision of side-pocketing is not misused.

In case of a credit event, focus of side-pocketing is to stabilize the NAV of the main portfolio (having good investments) and prevent large redemption in the fund.

Has any AMC implemented this?

At present, SEBI has not mandated AMCs to implement side-pocketing but has left it to the discretion of the AMCs. Many of the AMCs have now enabled the provision of side-pocketing in their debt and hybrid mutual fund schemes. They can now implement side-pocketing in case of any credit events in these funds.