Tax-Efficient Regular Income: Arbitrage Funds3 min read

Savings bank account may be the first thing that comes to your mind when you think of parking short term surplus cash. It is largely risk free and generates a steady and assured interest income. You might be surprised to know that certain mutual fund categories can act as an alternative to the traditional savings bank account — they have low risk and can potentially earn you a higher income. One such option is ‘Arbitrage Funds’.

What are Arbitrage Funds?

SEBI classifies Arbitrage Funds in the Hybrid Category (invests in both equity and debt) of mutual funds. Instead of investing in only equities (stocks), which is volatile and risky, these funds follow an arbitrage/hedging strategy which reduces the risk considerably, thus providing stable returns.

Arbitrage funds invest in stocks and to reduce the volatility, they also invest in futures of the same stock. Simply put, this strategy involves locking in a risk-free profit by buying a stock in the cash segment and selling the same stock in the futures segment. By making sure that the portfolio is fully hedged at all times, irrespective of whether the stock goes up or down, a small profit is locked in.

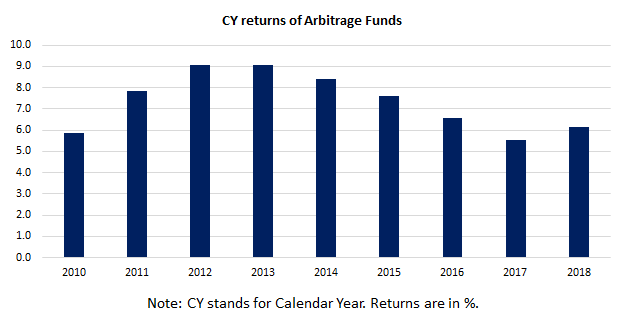

To ensure that you get to benefit from this locked-in profit, make sure that you stay invested for at least 3 months. This helps in smoothing out daily volatility and gives you stable return. The below graph shows that returns from arbitrage funds are largely steady on an annualized basis.

What are the risks here?

Mostly, the risk in Arbitrage funds comes from their investments in debt securities - around 15–20% of their portfolios are in short term debt securities. Hence credit risk of this part of the portfolio is something that needs to be watched closely. Stick to funds which invest only in highest credit quality debt securities to minimize credit risk.

Who should invest in Arbitrage Funds?

Over the last few months, yields of debt securities have continuously fallen due to consecutive rate cuts by RBI. This has led to lower expected returns from shorter duration oriented Debt Mutual Funds over the next 6–12 months. Keeping this in mind, it makes a good case for investment in Arbitrage Funds now.

Arbitrage Funds have returns comparable to shorter duration oriented Debt Mutual Funds, but have added advantage of equity like taxation, be it growth or dividend option. Dividend payout option has better tax adjusted returns compared to the growth option in the short term (less than one year of investment). Additionally, the dividend option can act as a regular source of income for the investors.

So, low risk taking investors who are looking to invest for short term (at least 3 months) or looking for a tax-efficient regular income source can invest in these schemes.

How to choose one - Paytm Money Investment Ideas!

There are a lot of arbitrage schemes in the market, and one may be confused which fund to invest in. To make it simple for you, Paytm Money has come up with a filtered list of arbitrage funds based on relevant quantitative and qualitative parameters.

Take a look at this new investment idea and start investing for “Tax-Efficient Regular Income“.