Mutual Fund Schemes that Outperformed Others in July 20203 min read

Contents

Equity market snapshot

Indian equities continued their good performance in the month of July. The month saw Nifty 50 posting a 7.5% gain while the Sensex posted a 7.7% gain. Markets rallied on the back of encouraging domestic data such as GST collections, manufacturing activity index, purchasing managers’ index etc. all of which pointed to some revival of the domestic economy. Better than expected quarterly earnings by some major corporates as well as hopes of a vaccine for covid-19 also helped the market up move. The last week of the month saw the market shedding some of its gains as US-China tensions re-surfaced, rise in covid-19 cases domestically and the RBI estimating that there would be a sharp increase in the Banking system NPAs.

Debt market snapshot

The month of July was mixed for debt markets. Markets were hoping for some RBI action to support the increased government borrowing program. A rate cut by RBI in August was also expected. The chances of such a rate cut got diminished given that retail inflation for June came in at 6.09%, which is on the higher side of the RBI inflation targeting ceiling. Furthermore there was not much clarity regarding absorption of the additional government borrowing. The 10 year G-sec yield fell by 4 bps (100 bps = 1%) to 5.84%.

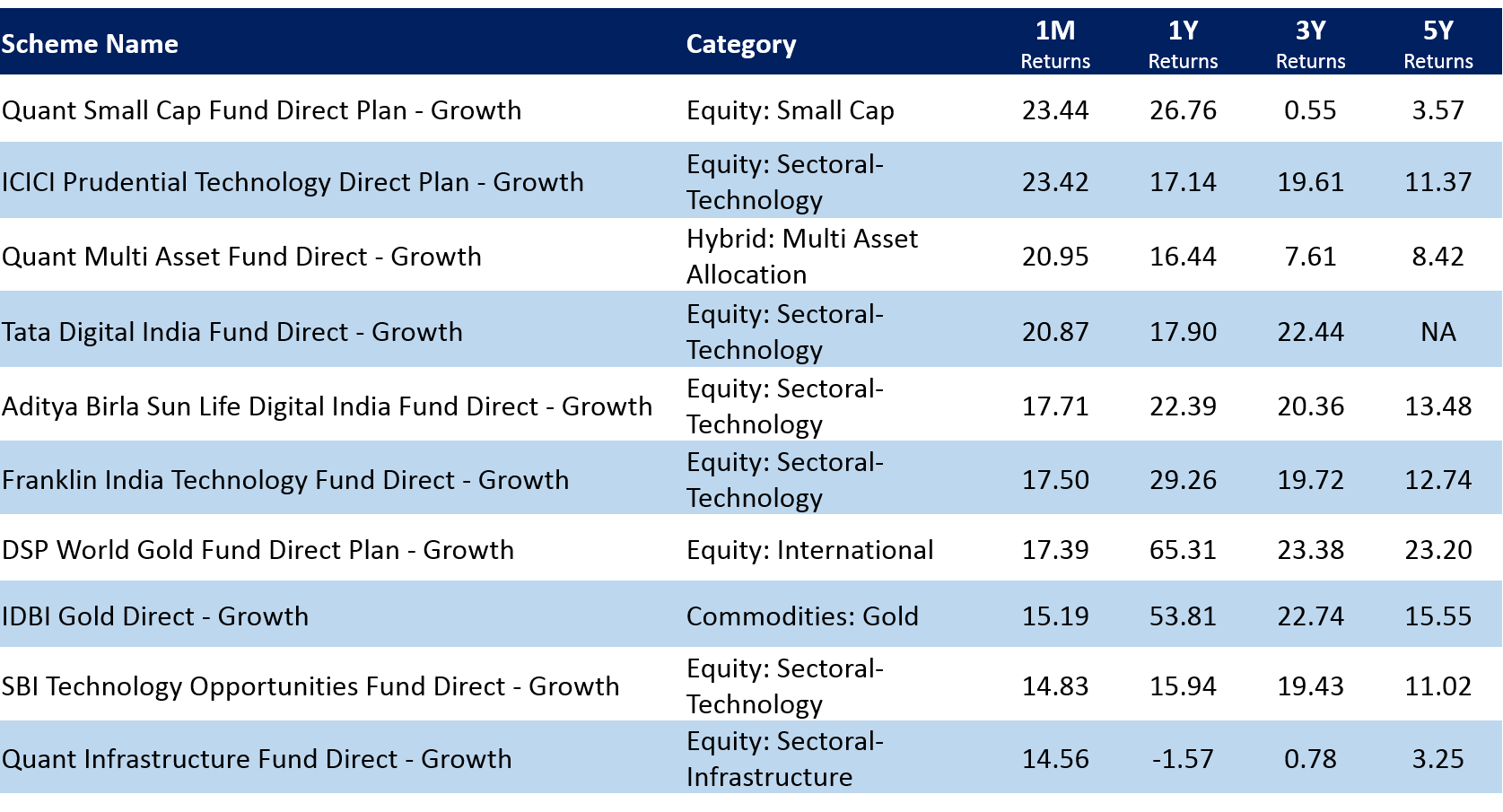

Monthly outperformers

Technology and IT related sectoral & thematic funds were among the top performers in the month of July. Robust quarterly results by some of the IT behemoths caused the shares of these companies to rally. As discussed previously, investors should understand the nuances of such sectoral and thematic funds before investing in them.

Let’s take a look at the best performing mutual funds across categories in July, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

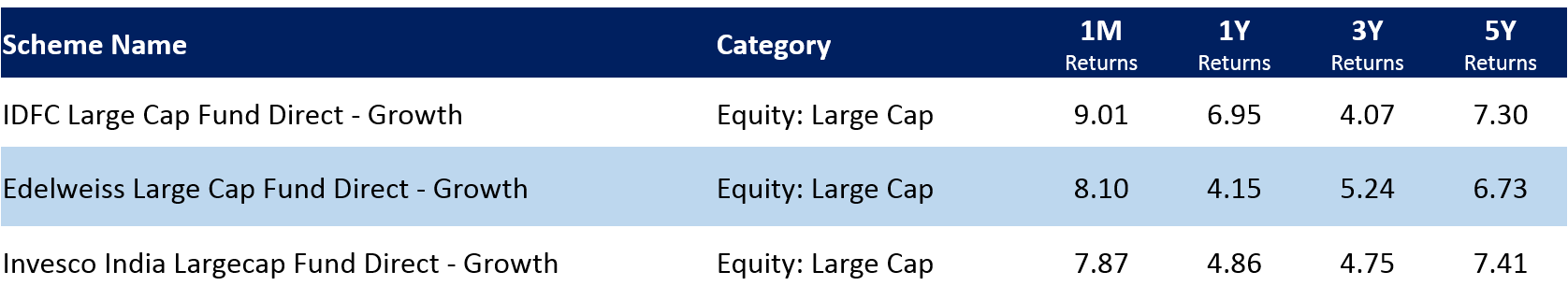

Best performing large cap funds in July, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

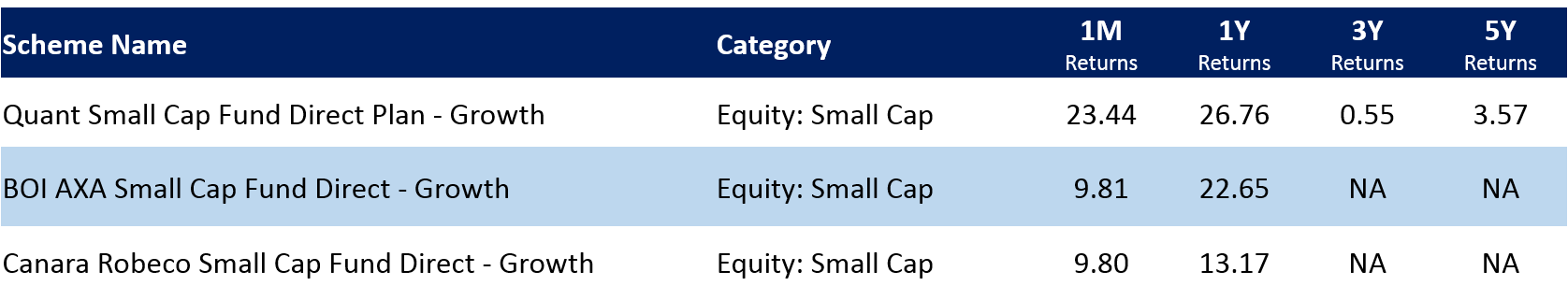

Best performing small cap funds in July, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

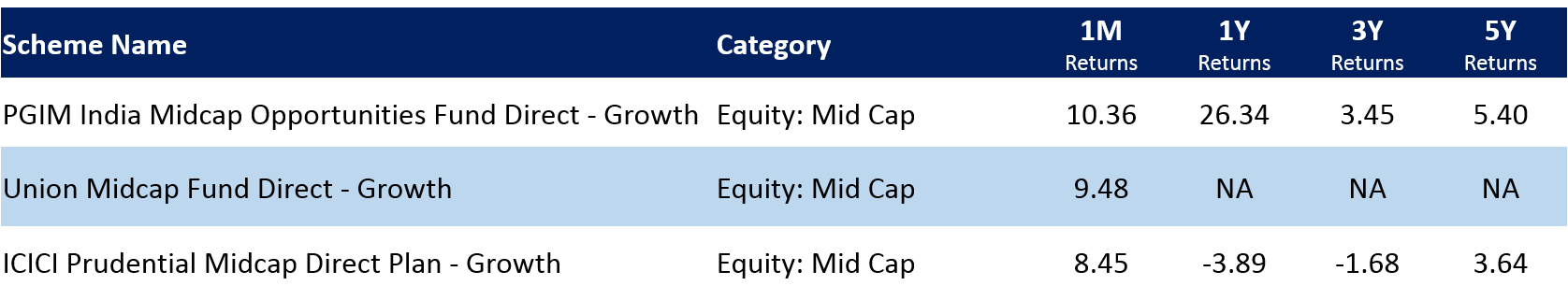

Best performing mid cap funds in July, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

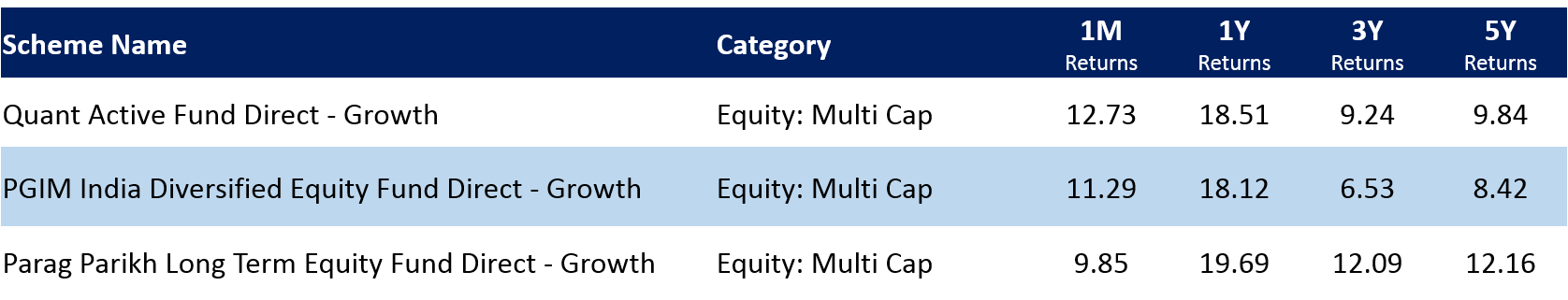

Best performing multi cap funds in July, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

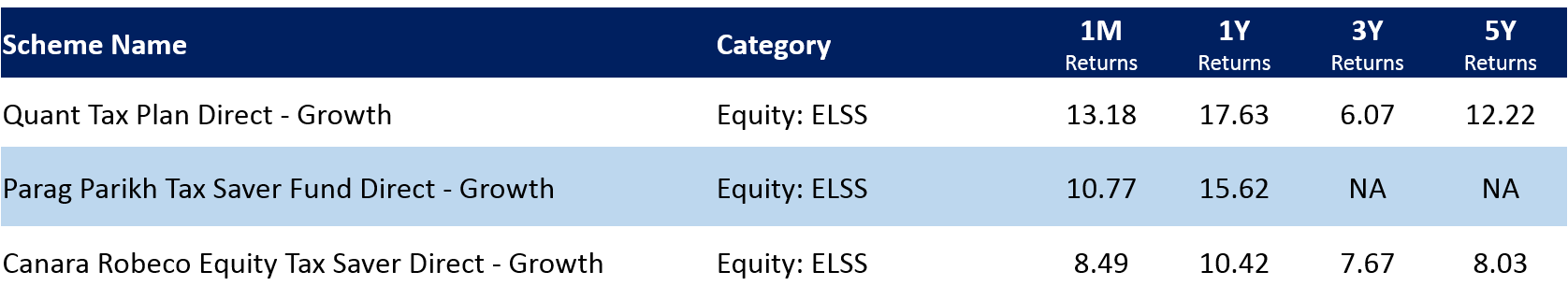

Best performing ELSS tax saver funds in July, 2020:

Note: All the returns are in %age terms. 1 month returns are point-to-point. 1 year, 3 year, 5 year returns are annualized.

What you should be doing?

Equity as an asset class is volatile over the short term but has the potential to generate wealth over the long term. So as an investor you should focus on consistency of returns rather than short term trends before picking a mutual fund. Given the inherent volatility of equities, it is advisable that you stick to SIP route. This will ensure that you invest in a disciplined manner and that you benefit from rupee cost averaging.

Finally, investment decisions should take into account your investment objective, investment horizon and risk profile. Investment Packs, created by Paytm Money, takes care of all of these in a simple way for you.