Contents

The COVID-19 pandemic is one of the worst crisis to have hit the global landscape in recent times. Markets fell drastically at first but have recovered most of the losses as lockdown restrictions started to ease. But as is with any crisis, some sectors outperform even in these challenging times. This is pretty evident from the last 3 month performance of Pharma, Energy & Technology sector funds, which rallied much more than their peers and the broader market.

The huge rally in these sectoral funds might tempt you to buy into these funds, but is that a good proposition? Through this article we want to explain the nature of sectoral and thematic funds and tell you if it makes sense for you to invest in them.

Sectoral & Thematic Funds

Sectoral funds are equity mutual funds that invest predominantly i.e. more than 80% of the assets in a particular sector (as per SEBI regulations). For example: Banking, Pharma, Technology etc. Similarly thematic funds invest predominantly into a particular theme. For example: Consumption, Energy, MNC etc.

As sectoral funds invest in a particular sector this makes their scope very narrow. Hence they are susceptible to high concentration risk compared to a diversified equity fund which invests across multiple sectors. The investment scope for thematic funds is relatively broader. Depending on the theme, they can invest in more than one sector but it is still restrictive vis-à-vis a diversified equity fund (Eg: Largecap). For example, an MNC theme fund can invest across multiple sectors such as Healthcare, FMCG, Financials and so on within the broad MNC theme.

Nature of Performance

In order to understand the risks involved in these funds better, we need to first understand how the sectors and themes play out in the short and the long run. Sectoral funds like banking, pharma etc. tend to be volatile in the short term. For example, Pharma would react strongly to any news flow on US FDA action while Banking would move sharply based on RBI rate cuts, NPA addition/ reduction etc. As these factors change dynamically, so does the performance of the sectors.

Thematic funds like consumption, MNC etc. on the other hand tend to be relatively stable than sectoral funds and tend to play out over a longer duration. Performance of a theme generally arises out of policy changes, technological disruption, consumer preferences etc. which tend to be less volatile than the factors affecting sectors. Also some sub sectors of a theme might perform better than others thus diversifying the overall performance to an extent.

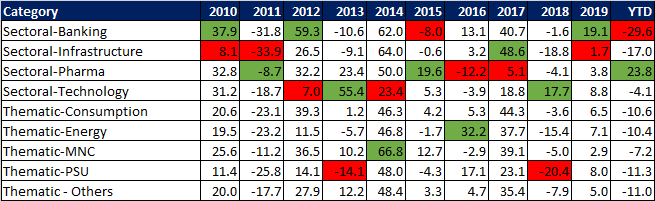

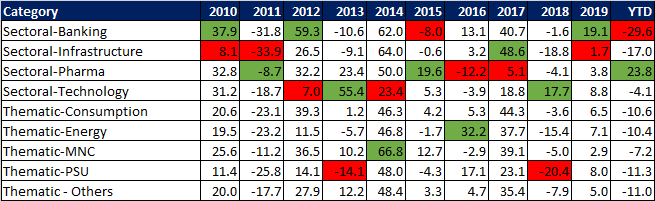

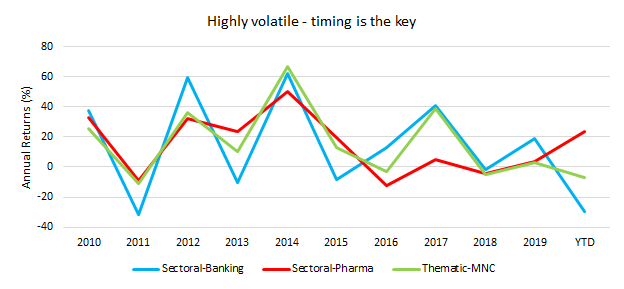

The following table shows the performance of various sectoral & thematic fund categories over the last 10 calendar years.

Note: Returns are in %. Returns are for the respective calendar years. YTD stands for Year to Date (NAV as on 19th June 2020)

As is evident from the table above, the winners tend to differ every year (as highlighted in green). Let’s focus on the performance of Sectoral – Banking to understand the volatility in these funds. On an average the funds have given decent positive returns every alternate year. High volatility is what makes these funds an extremely risky proposition.

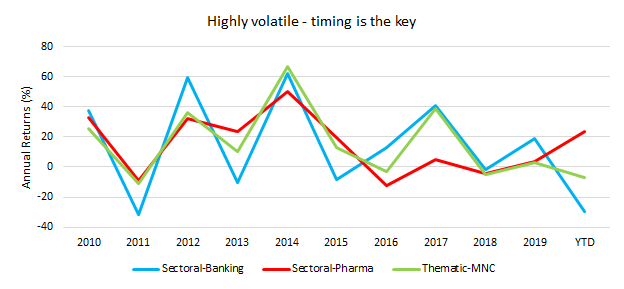

Note: YTD stands for Year to Date (NAV as on 19th June 2020)

The above graph also makes it clear that both sectoral and thematic funds tend to be very volatile & inconsistent. Some funds tend to perform well in alternate years while some others see a long period of underperformance followed by sudden outperformance.

Timing is of great essence

The most important thing while investing in sectoral and thematic funds is getting the timing right. An incorrect entry timing can result in huge capital loss. Even if you get the time of entry correct, a bad exit can significantly wipe out your accrued gains. Timing becomes even tougher due to the interim volatility. You might enter into a sectoral fund but it might underperform for a significant period of time before the rally starts (like Pharma funds in above graph). As we have emphasized in many articles, timing the markets correctly is almost impossible. This makes investment into sectoral and thematic funds a very risky affair.

Who can invest?

If you are a novice or a first time investor, you would neither be aware of the intricacies of sector(s) nor have a deep understanding of why/when a sector may outperform or underperform. Sectoral and Thematic funds are very risky and you may end up burning your hand in the process. What you should do is stick to your asset allocation and use only diversified equity funds for the equity part of your asset allocation.

You can take a look at Investment Packs. These are ready made and research backed solutions offered by Paytm Money. This will help you invest in the appropriate funds as per an asset allocation that is best suited for you.

Savvy and experienced investors should also limit their investments in these funds to a maximum of 10-15% of their overall equity allocation.

So it is advisable not to get enticed by the recent outperformance of a few sectoral funds. The majority of the outperformance might have already passed leaving little or no room for further outperformance.