All you need to know about Bharat Bond FoF3 min read

What is Bharat Bond FoF?

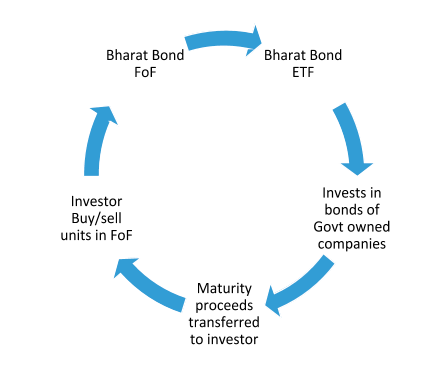

Bharat bond is a one-of-its-kind investment option created by Edelweiss Asset Management Company (AMC) and marks the emergence of a new class of investments in India. Bharat bond Fund of Funds (FoF) is essentially an open-ended mutual fund with a target (defined) maturity structure of 3 years and 10 years that invest in Bharat bond ETFs of respective maturities. The ETFs, in turn, aim to replicate the constituents of its underlying index comprising of bonds of CPSEs (Central Public Sector Enterprises), PFIs (Public Finance Institutions) and PSUs (Public Sector Undertakings) created by NSE.

The target maturity structure ensures that investors make relatively stable returns if they hold their investments until maturity. Thus, it brings together the best of both worlds i.e. a fixed maturity plan (FMP) and a passive fund. The underlying index, in this case, will be Nifty Bharat Bond Index which will comprise of AAA bonds of public sector companies with 3 and 10 years maturity. The index will be rebalanced quarterly by NSE and downgrades, if any in the constituents, will be taken out of the index during rebalancing.

Salient features of Bharat Bond FoF:

- Relatively Stable returns: You will incur minimum volatility in returns if you hold your investments till maturity of either 3 years or 10 years

- High Safety: As it invests in AAA bonds of government-owned companies, the chances of default are negligible

- High Liquidity: The scheme comes with no lock-in period and you can buy/sell units as per your convenience. For liquidity management purposes, 5% of the portfolio will be invested in government securities and repos implying, AMC will ensure liquidity at all times

- Lower tax incidence: You stand to earn minimal capital gains upon maturity. You will get 4 and 11 indexation benefits if you hold your investments for 3 and 10 years respectively

- Very low cost: The scheme has an expense of mere 0.0015%, which translates to a cost of mere Rs. 3/- for an investment of Rs. 2 lakh in a year.

- Transparency: The index is created and maintained by a third party i.e. NSE in this case. Also, you can track the index constituents and the yield to maturity of the portfolio on a daily basis from the website bharatbond.in

- Low fund manager intervention: This is a passive fund which tracks Nifty Bharat Bond Index ensuring it will be free from any active fund manager bias

Other details:

The Bharat Bond FoF will be available for investments in two series currently:

- Bharat Bond FoF April 2023: Around 3 years of maturity tracking Nifty Bharat Bond Index-2023

- Bharat Bond FoF April 2030: Around 10 years of maturity tracking Nifty Bharat Bond Index-2030

NFO Dates: The New Fund Offer (NFO) period is from 13th December 2019 to 20th December 2019

Minimum Investment: The minimum investment amount during the NFO period will be Rs. 1000 and in multiples of Rs. 1000 thereof

Allotment date: If you invest in the NFO period then the allotment of units will happen on 27th December 2019

Exit Load: There is an exit load provision of 0.10% if the units are redeemed within 30 days from the date of allotment

How to Invest & Where to Invest: Login to your Paytm Money app. Get your KYC verified in minutes if you aren’t already. Go to the ‘Invest’ section of the app and click on ‘New Fund Offers’ where you can view the fund open for subscription.

Also read our article on Why should I invest in Bharat Bond FoF ?