Why should I invest in Bharat Bond FoF?3 min read

Why should I invest in Bharat Bond FoF?

Bharat Bond is the new buzzword in newspapers and business channels these days. People are saying it’s a good product for retail investors. How should I view it?

You can perceive Bharat Bond FoF akin to a Fixed Deposit (FD) product which offers anytime liquidity and higher post-tax return if investments are held till maturity of 3 or 10 years. If the investments are held for more than 30 days from the date of allotment then unlike an FD, you won’t even be penalised for pre-mature withdrawals.

Is it true that the product will generate guaranteed returns?

The returns generated by Bharat Bond FoF are not guaranteed. But the returns can be relatively stable if you invest during the NFO period and hold your investments till the maturity of either 3 years or 10 years. There might be interest rate volatility leading to NAV fluctuation in the interim, but if held till maturity, you will accrue stable returns.

But what about the safety and liquidity of this product amidst the ongoing credit crisis?

The fund invests in AAA bonds of government-owned companies which have almost negligible default risk. So it is a very safe product from a credit risk point of view. Also, as you would be dealing with the Asset Management Company directly by investing in a FoF, the AMC will ensure liquidity at all times.

Can I not invest in a regular Banking & PSU (BPSU) debt fund instead of investing in this FoF?

You sure can, but a normal BPSU fund is mandated to invest only 80% in banking and PSU bonds. It can invest the rest 20% in any paper as per the fund managers’ view. Furthermore, the underlying investments need not be in AAA bonds only. Most BPSU bonds also don’t run a roll down strategy, implying the NAV of the fund will fluctuate due to interest rate risk.

The expense of the FoF is a mere 0.0015% which is much lower than a BPSU debt fund and also the constituents and the index YTM (yield to maturity) will be daily updated on bharatbond.in, making it extremely transparent.

Now that makes sense. Are there any additional benefits to investing in Bharat Bond FoF?

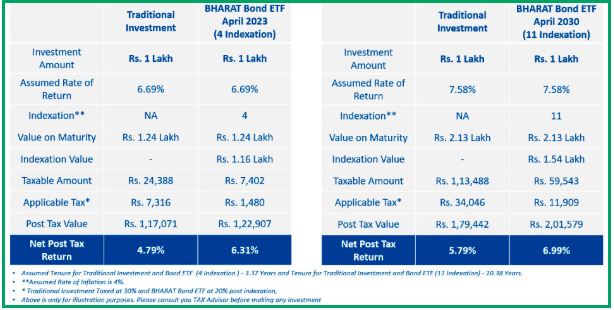

Well, it will have similar taxation benefit as a normal debt fund. So, you will get the benefit of 4 and 11 indexations if invested in 3 and 10-year maturity series, respectively. This implies minimal capital gains for you in comparison to traditional investments where interest earned is added to your income slab and taxed accordingly. Also, being a passive fund, it will ensure no active fund manager bias creeps in.

Can you give us an idea of the kind of returns we stand to make if we invest in this product?

An indicative return chart is shown below to give you a fair idea of the returns you can make if invested in this product. Also, a comparison is made with traditional savings instruments to give you a wholesome idea.

Thus, you can earn up to 6.31% CAGR if you invest in the Bharat Bond FoF April 2023 which has around 3 years maturity and up to 6.99% if you invest in the Bharat Bond FoF April 2030 which has around 10 years maturity.

That was indeed helpful. So, how much should I invest in Bharat Bond FoF?

It is advisable to invest only that much amount which you can freely park for 3 or 10 years without compromising on your needs. Remember, you can exit anytime you need the funds, but to generate stable returns, you have to invest until maturity.

How should I go about my investments?

Login to your Paytm Money app. Get your KYC verified in minutes if it’s not verified already. Go to the ‘Invest’ section of the app and click on ‘New Fund Offers’ where you can view the fund open for subscription. Click on the Invest button and choose the amount you wish to invest. Now proceed and make your payment. Investment done!!!