All About Corporate Actions In Paytm Money4 min read

What Are Corporate Actions?

A corporate action is an event carried out by a publicly traded company that materially impacts its stakeholders. These events are generally approved by the company’s board of directors. When a company issues a corporate action, it is initiating a process that directly affects the securities issued by that company.

Corporate actions can be either mandatory or voluntary. Mandatory corporate actions are applied to the investments by default, while voluntary corporate actions require an investor’s response to be applied.

Stock splits and bonus are examples of mandatory corporate actions; optional dividends and rights issues are examples of voluntary corporate actions. These may be either monetary e.g. dividend, or non-monetary e.g. bonus, rights, or stock splits.

Some common terms used in the context of Corporate Actions:

- Declaration Date: This is the date on which the board of directors announces to shareholders and the market as a whole that the company stock will undergo a particular Corporate Action

- Ex-Date: This is the date on which security trades without the benefit of Corporate Action. An investor buying security on or after the ex-date is not eligible for the Corporate Action by the Company.

- Record-Date: This is the date on which the company looks at its records to see who are the shareholders of the company entitled for the Corporate Action. An investor holding shares on record date will be eligible for the Corporate Action on that share.

Eligibility For Corporate Action:

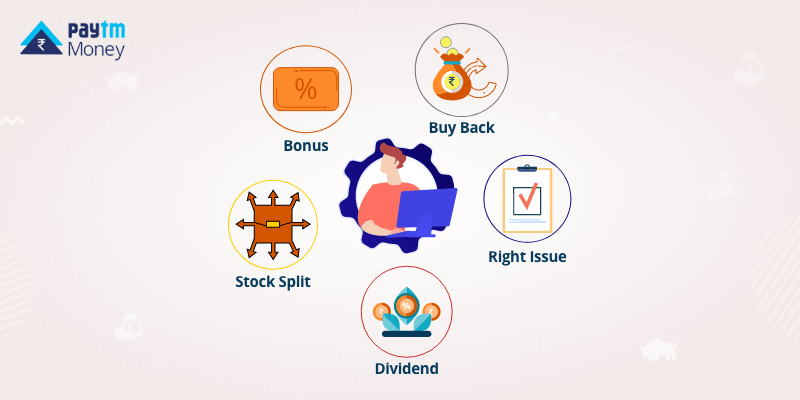

The different types of corporate actions are:

-

Dividend

Simply defined, Dividend is the portion of profit of a company, distributed to its shareholders. Typically, dividends are cash payments made on a per-share basis to investors. For instance, if a company pays a dividend of Rs 2 per share, an investor with 10 shares would receive Rs. 20 in cash.

-

Stock Split

A company increases the number of shares that are outstanding by issuing more shares to existing shareholders. For example, in a 1:2 stock split, every shareholder holding one share is given an additional share. In such a case, the face value of the share is reduced (in this case by half).

The stock price is also affected by a stock split. After a split, the stock price of the company reduces since the number of outstanding shares increases, however the market capitalization remains the same.

-

Bonus

A bonus share is a free share of stock given to current shareholders in a company, based upon the number of shares that the shareholder already owns.

While the issue of bonus shares increases the total number of shares issued and owned, it does not change the market capitalization of the company. For example, if the Bonus ratio is 1:2, it means that you will be given a bonus of 1 new stock for every 2 stocks you own of the same company. The average price will come down, adjusted to the total investment.

-

Merger

The combining of two or more companies is called a merger. In this case, stockholders of one company are offered securities in the acquiring company in exchange for the surrender of their securities.

-

Demerger

Demergers are situations in which divisions or subsidiaries of parent companies are hived off into independent corporations. Generally, the parent company maintains some degree of financial interest in the newly formed corporation, although that interest may not be enough to maintain control of the new corporate entity.

-

Consolidation

A company would issue a consolidation (reverse stock split) to increase the share price because they feel it would be more marketable at a higher price.

The nominal value of each share is adjusted to maintain total market value as before the consolidation. The new shares are issued free of all charges to shareholders. On the effective date of the consolidation, the price per share is adjusted to take into account the reduced number of shares in issue.

-

Right Issue

When a company wants to raise capital, issue of fresh shares to the existing shareholders is one option available to the company. In such an issue, existing shareholders have the right to buy a specified number of new shares of the company at a specified price within a specified time. Usually this price is below the market price.

The idea is to reward existing shareholders with an investment opportunity, which is perceived to be attractive. This is a voluntary corporate action, which means a stockholder can choose not to exercise their right.

-

Buy Back

Offer by the issuing company to existing shareholders to repurchase the company’s own shares or other securities convertible into shares is called Buyback. This results in a reduction in the number of outstanding shares.

So, if you are a stockholder for a company that has announced a Corporate Action, look out for the impact of the corporate action on your holdings. We have an easier way out for you; we have added a tag for Corporate Action in company pages, holdings and watchlist. Now, you can view upfront which stocks and ETFs will have corporate action.

Also Read- Paytm Money Annual Report: How the young indian millennial invests