Decoding The 6-lakh Cr National Monetization Plan2 min read

On 23rd August 2021, the central government launched a mammoth Rs. 6 lakh crore plan of asset monetization over the next 4 years.

Before we get into the details of this, let’s get the basics right.

Asset monetization is the process of earning revenue through an asset! We bet you can loosely connect the dots. But hold that thought, let’s just dive into the scheme now.

What Is National Monetization Pipeline (NMP)

Simply put, the government would be inviting private sector players to come in and monetize brownfield projects.

And what are these brownfield projects?

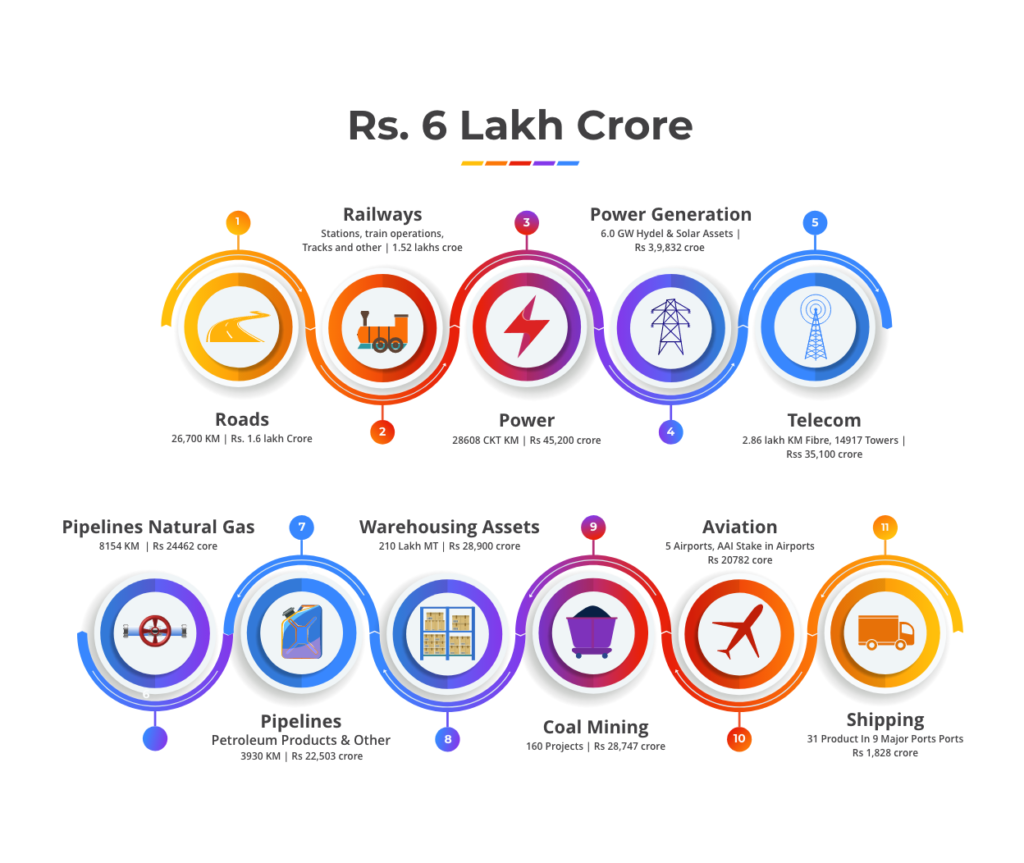

These will be projects primarily across roads, railways and power sector as well as telecom, mining, aviation, ports, natural gas and petroleum product pipelines, warehouses and stadiums.

And no, the government isn’t selling these assets! It is merely transferring rights to monetize these projects.

Outsourcing of a kind, if we may.

What Is The Role Of The Private Sector?

Private players will be responsible for operating, maintaining and ensuring that these projects are being monetized to their optimum potential.

The private sector would come into these projects through models such as Infrastructure Investment Trust (InvITs), Public-Private Partnerships (PPPs) or Toll-operate-transfer (TOT).

What Is The Purpose of NMP?

Private participation will help monetize the projects better and ensure that the funds generated are ploughed back into the infrastructure sector of India!

“The objective is that instead of government providing money through budgetary resources for infrastructure creation, existing infrastructure is better managed through that private sector and that will be used for more and more infrastructure creation,” said Kant.

Efficiency at it’s best, wouldn’t you say?

Which Assets Comprise The Rs. 6 Lakh Crore?

Here are assets which will be considered to be monetized more efficiently.

Source – Bloomberg Quint

Source – Bloomberg Quint

Disclaimer – This content is purely for informational purpose and in no way advice or a recommendation.

Also Read- Revised Transaction Charges in Bank Nifty Index