Are you evaluating your SIP investments correctly?3 min read

Contents

In an earlier blog post, we defined what ‘long term’ means while investing in midcap and small cap mutual funds. In this post, we will bring out the subtle differences between lump sum and SIP investing which you need to keep in mind while doing SIPs. This aspect becomes all the more important if your investments through SIP mode have been underperforming over the past few years, Ex: SIP in small cap mutual funds.

Understanding SIP investment period

SIP investing is different from lump sum investing with respect to how we view the invested time horizon. Let us take an example to understand it better.

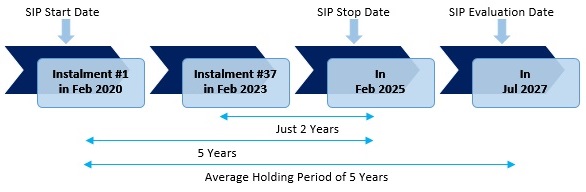

Suppose you have a sum of INR 60,000 to invest in Feb 2020. You can choose to invest it in one go as a lump sum today or do a monthly SIP of INR 1,000 spread over 5 years till Feb 2025. On completion of 5 years when you evaluate your investment in Feb 2025, you need to be careful. In case of the lump sum investment, the entire amount will remain invested for a period of 5 years. Whereas, in case of the SIP, only the first instalment done in Feb 2020 stays invested for 5 years. All other instalments will remain invested for shorter tenures. Your investment in Feb 2023 will stay invested for only 2 years and your last instalment in Jan 2025 will complete merely a month! So, average holding period for your portfolio would be 2.5 years and not 5 years (as might be perceived). This can be seen in the illustration below.

Stretching the timelines in SIPs

A minimum holding period of 5 years is classified as long term in the case of mid and small cap mutual funds. But as we saw previously, this was the case for lump sum investing. Ideally, you should give some more time to your SIP investments so that the average holding period meets the intended time horizon.

This means in the case of SIP, you should extend your holding period by 2.5 years so that your average holding period is 5 years as shown in the illustration above. This will ensure that your investments get the benefit of rupee-cost averaging while creating wealth over the invested horizon.

Case of Small cap funds

A lot of investors who invested in small cap funds through SIP mode in the last 3 years must be seeing their portfolios in negative now. So, would it not make sense to switch the investments to a good large cap scheme which has delivered good returns in the recent past? The answer is NO!

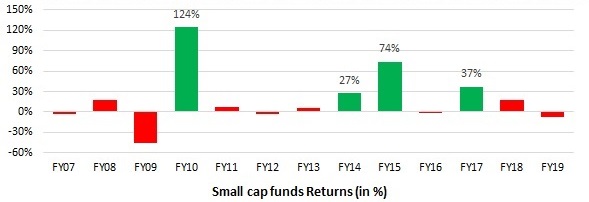

Small caps in general are one of the most volatile categories to invest in. They might underperform a few years in a row, but the sudden outperformance in the following year more than compensates the losses incurred in the preceding years. The following graph shows the yearly performance of small cap funds since FY 2007.

As is evident from the graph, 3 years of underperformance since FY07 was followed by a huge outperformance in FY10. The same trend can be seen to repeat around FY15 thus reinforcing our point. Also, small cap valuations have corrected a lot recently. Hence the downside is limited and a turnaround may be round the corner.

You would have definitely come across this often used disclaimer while evaluating mutual fund performance, “Past performance is not indicative of future returns.” So just because large cap funds performed well in the recent past does not mean they will continue to outperform other categories in the future as well.

Thus it may be a good idea to continue your SIPs in small cap funds and not redeem them midway unless you are in urgent need of funds.

Finally, as an investor you should stick to your asset/sub asset allocation and build your portfolio accordingly. Don’t shift your investments to other categories of funds just because they have given better returns recently. Only when you stick to your asset allocation, you can achieve your financial goals.