Thinking about International Equity Mutual Funds?5 min read

International Equity Funds and Index funds have been the buzz word recently in the mutual fund domain. In one of our previous posts, we looked closely at index funds. In this post, we would help you understand International Equity Funds better. These funds became popular over the past year due to US equity markets performing well compared to Indian markets, particularly large caps.

What is an International Equity Fund?

A mutual fund which predominantly invests (greater than 80% of its assets) in foreign countries’ equity or equity related instruments is classified as an International Equity Fund. As per SEBI re-categorization norms, these funds come under the Sectoral/Thematic category.

These funds operate in two ways. One, having fund manager in India who takes a call on the international company’s stocks and makes investments, for example: ICICI Prudential US Bluechip Equity Fund, Aditya BSL International Equity Fund — Plan A etc. Two, they operate as a Fund of Fund (FoF), which means they put your invested amount completely into another international fund and do not make investments into stocks themselves, for example: Franklin India Feeder-Franklin US Opportunities Fund, DSP US Flexible Equity Fund etc.

Most of the international equity funds offered by AMCs in India are large cap oriented and invest into US equities. While there are a few funds that invest in other geographies as well, for example Franklin Asian Equity Fund, Edelweiss Europe Dynamic Equity Offshore Fund, HSBC Brazil Fund, etc.

Investors might be attracted to the high returns that these funds have given over the short term. However, they need to aware that these returns are accompanied with high volatility as well.

So, should you invest in an International Equity Fund? To answer this question, a proper understanding of the pros and cons of International Equity Funds and how they stack up against Indian Large Cap Funds is necessary.

Key points to know before investing in International Equity Funds

Taxation:

Unlike Indian Large Cap Funds, capital gains on International Equity Funds attract debt taxation. This implies that for a holding period of less than 3 years, capital gains will be taxed as per your tax slab (can be as high as 30% plus surcharge and cess). If the holding period is more than 3 years, then the tax rate would be 20% with the benefit of indexation. Whereas in an Indian Large Cap Fund, long term capital gains (over 1 year) are tax-free up to INR 1 lakh per year, and beyond that are taxed at 10% plus surcharge and cess.

Expense Ratios:

Most of the International Equity Funds, being FoFs, charge their normal expenses as well as the expense of the underlying international scheme in which they are investing. This may result in expenses being higher than the standalone funds. So, you need to keep an eye on the total expenses while investing in these funds.

Currency hedging:

As most of the investments into International Equity Funds are hedged as per the prevailing exchange rates, so you might get only partial benefit of rupee depreciation in your returns.

Higher Settlement Period:

International Equity Funds have a higher settlement period of up to 5 days as compared to 3 days for Indian Large Cap Funds. This implies that it might take as long as 5 business days to get your money back from the time your redemption request was placed.

Requires more broad-based understanding and monitoring:

As an Indian citizen, you may keep track of the domestic market performance through newspapers or other sources. However, you might not be tracking international markets regularly. Besides, an additional layer of complexity relates to finding out the underlying equity investments in FoFs. Also their performance is dependent on a lot of factors such as economic cycle, government policies, global factors, you need a well-informed advisor to look after your portfolio or be an expert yourself.

But investing in them has some benefits too, such as.

Diversification:

Investing in international funds helps in diversifying your portfolio geographically. Different countries go through different cycles given the conditions in their domestic markets. Data suggests that most of the international funds have low correlation with Indian markets. So, an international exposure may help reduce the volatility in your portfolio.

Invest in top companies:

International funds will provide you an opportunity to invest in top companies of the world like Apple, Amazon, and Alphabet etc. These companies are market leaders in their respective sectors and you may gain from their competitive advantages.

How have International Funds performed over the long term?

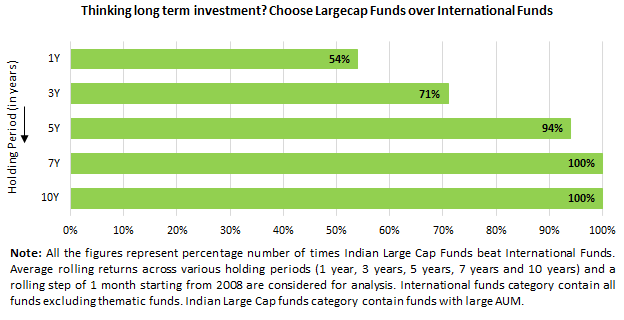

Let’s take a look at historical returns of International Equity Funds in comparison with Indian Large Cap Funds.

We analyzed and compared monthly rolling returns of the two categories across various holding periods. If you would have invested in Indian Large Cap Funds for a period of one year, there would have been a 54% chance that your fund would have outperformed International Equity Funds. If you would have invested for 5 years or more (long term), there is a close to 100% chance that returns from Indian Large Cap Funds would have been more than that of International Equity Funds.

Thus, the chance of outperformance increases with the holding period if we look at historical performance.

Our View

We believe Indian markets have the ability to outperform developed markets for the foreseeable future. Hence, we feel that there is limited need for international fund exposure in a retail investor’s portfolio. However, HNIs with a big portfolio can invest some portion into international funds to achieve geographical diversification. But they understand the risks involved and constantly monitor these investments.

We hope we have answered your earlier question of whether you should invest in international funds. Be aware of the highlighted points if you are planning to invest in an international fund.

Explore Indian Large Cap Funds and International Equity Funds offered by various AMCs on Paytm Money app! For users who always wanted to invest in Mutual Funds but don’t know how to get started, we suggest them to explore Investment Packs on Paytm Money app which are designed to take care of your investment needs based on your risk profile & make this investment choice simpler for you!