Is the extra 2% really worth it in Debt funds?5 min read

Contents

The first thing that probably catches your attention when you look at an investment product is the returns that it can generate. All of us look to maximize the returns on our investments and this is where things can go wrong for us if we lose sight of the risk involved. In reality, risk and returns go hand in hand.

This becomes a bigger problem when you invest in a product thinking it to be ‘safe’ but the underlying risk starts playing out. This has been the case with debt mutual funds over the past year and half.

What different products are expected to do?

Debt or fixed income products are a key component of any asset allocation as discussed in our previous article. In general, debt products take on lesser risk and are expected to provide lower but stable returns compared to equity products that are more volatile (risky) but are expected to provide long term wealth creation.

Hence both equity and debt are important in any investor’s asset allocation as per your risk profile. The goal is to use debt products for capital preservation and equity for wealth creation.

What has been happening in debt funds?

As discussed previously about risk analysis of debt funds, they carry interest rate risk and credit risk. Over the past year and half, credit risk or default risk has been playing out regularly.

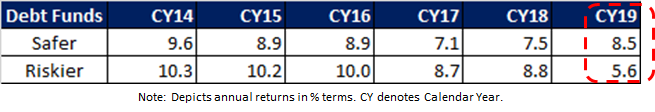

A debt mutual fund can take on higher credit risk by lending money to companies which have a lower credit rating i.e. the chance of them not returning the borrowed money is higher. To compensate for this higher risk, the borrower pays a higher interest, which boosts the returns generated by the fund. This can be seen from the below table comparing annual returns of two debt funds. Safer fund takes on lesser credit risk compared to the riskier fund

As long as the borrower keeps paying interest as well as principal, these funds can generate around 1-2 % higher returns than funds that take on lesser credit risk. As it is with any investment product, the risk eventually starts catching up. You can see how it has affected returns in CY19 (highlighted in red). In debt mutual funds, it started with the default by IL&FS group in late 2018 followed by a series of other credit events.

The unique nature of credit risk!

A credit event or default is essentially binary i.e. 0 or 1 event. This means that if a company that the mutual fund has lent to/ invested in defaults, the fund neither gets interest payment nor the principal lent out. In effect, this investment is ‘written down’ to reflect this loss of capital. The recovery, if any, tends to be a long drawn out process.

For an investor, this comes out as a sharp single day drop in NAV. This happened once again this month, when several mutual funds wrote down their exposure to Vodafone Idea Limited.

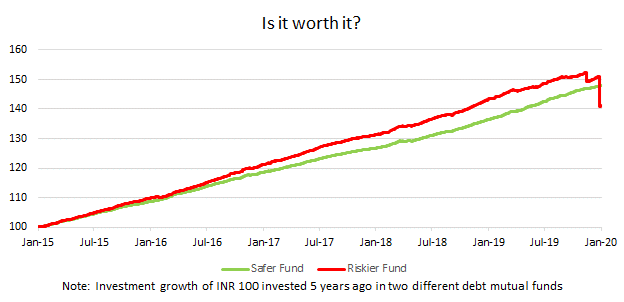

Keep in mind that many of the funds that take more risk actually generate only 1-2% higher returns than their category peers. But is the risk really worth it? Consider two debt funds, one takes on more credit risk (red line) and the other takes on lesser credit risk (green line).

As can be seen from the graph, the riskier fund (red line) keeps generating marginally higher returns on a regular basis but all this can be wiped out by a single credit event. The safer fund (green line) does generate lower returns but has a lesser chance of suffering from credit events.

Our take on approaching debt funds

The way we look at things is that investors should go for equity oriented products for long term wealth creation/ capital appreciation and invest in debt oriented products for capital preservation. Once we are clear on this, returns naturally take a back seat while safety and liquidity come to the fore while selecting the appropriate debt mutual funds.

SEBI defines 16 categories within debt mutual fund space. Not all categories of debt funds are really relevant for a retail investor as some categories are inherently risky. This is especially true given many investors seek to use debt funds as an alternative to bank FDs. It is best to stay in safe funds.

Paytm Money has picked out the relevant categories and created a curated list of funds that will help you make the right choice – giving more importance to safety and liquidity and not just returns. You can find them under the Investment Ideas section titled “Better than Savings Account”, “Better than Fixed Deposit” and “High Quality Debt Funds”

Is it worth losing your sleep over this?

Debt funds are meant to provide stability to your portfolio thanks to their stable return profile. Even during equity market downturns, the debt funds in your portfolio should cushion the price correction you experience. Basically, they ensure that you enjoy a peaceful and good night’s sleep!

Going after that extra 2% returns in debt funds while taking on disproportionately higher amount of risk can very well cause you to worry and lose your night’s sleep when a sharp NAV drop happens in your fund. After a credit event, you may land up with returns lower than FD or even a saving bank account interest rate.

So, before investing in debt funds, do think about “Is the extra 2% really worth it”?!