Don’t panic and redeem your investments!5 min read

Contents

The recent episode of winding up of 6 credit oriented debt mutual fund schemes of Franklin Templeton Asset Management Company (AMC) has created confusion and doubt among investors leading to huge redemption from mutual fund schemes across AMCs. Through this article we will address your concerns on how to go about your mutual fund investments amidst these tough times.

Franklin Templeton Case

The 6 schemes of Franklin AMC that were wound up had material direct exposure to credit segment i.e. high yielding and lower credit quality securities. As investors turned more and more risk averse amid the COVID-19 crisis, the credit segment witnessed severe illiquidity. This made it extremely difficult for the AMC to manage the unprecedented level of redemption they faced post the outbreak, compelling them to wind up these schemes. Continuation of these schemes would have resulted in huge value destruction for the investors. Hence the decision was made to protect the interests of all existing investors. You can read our previous blog for a detailed understanding of what exactly happened in Franklin AMC.

A key takeaway for you is that the winding up decision affects only the 6 credit oriented debt schemes of Franklin AMC and not its equity schemes . Equity, hybrid and debt schemes of other AMCs are not at all impacted by this decision. So make sure that you don’t give in to panic just because of this and rush to redeem your mutual fund investments.

Let us go through each asset class- Equity and Debt to make sure you approach them right and you make informed decisions.

Equity: Importance of remaining invested

COVID-19 pandemic is not the first crisis that the equity market is going through. Over the last 15 years equities have witnessed major global and domestic events like 2008 financial crisis, Fed tapering, demonetisation, introduction of GST, Union Budgets and general elections. Equity as an asset class is volatile in the short term. Naturally, it has witnessed a sharp correction during many of these events, but has bounced back strongly to generate long term wealth.

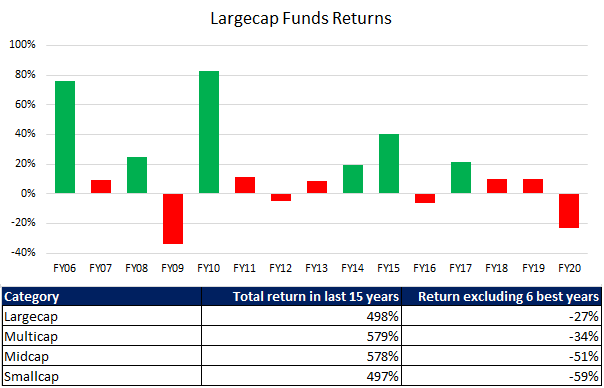

Note: FY stands for ‘financial year’. Returns shown are in absolute terms.

The above graph shows the returns generated by large cap funds over the last 15 financial years. A closer look shows that, the funds generated high returns (>=20%) only in 6 out of these 15 years. If you had remained invested for these 15 years then you would have earned a whopping 498% absolute returns i.e. your investment would have become 6 times! But if you had failed to remain invested in the markets in 6 of these best years then you would have made -27% returns which means you would have ended up losing money! Similarly, as shown in the table, if you were not invested in small cap schemes in 6 of the best years then you would have earned -59%!

Thus, huge returns in equity are earned in merely a few years of your overall investment horizon. You might be seeing your equity portfolios in the red currently, but do keep in mind that these are only notional losses. As the markets recover, so will your portfolios. But if you redeem your investments now, then you would make your losses permanent. As timing the markets is almost impossible, the next best thing you can do is to simply remain invested. Given the extent of correction in equities, you can also consider adding some investments to equity in a staggered manner while sticking to your risk profile based asset allocation.

Debt: Prioritize safety over returns

Debt funds have faced a lot of credit defaults in the recent past. Be it the ILFS crisis, NBFC crisis, ADAG group of companies default etc. majority of the debt schemes which had a focus on high quality were not affected by these episodes and steered clear in spite of the challenging market conditions during these times.

We believe that debt should always be looked at from a capital preservation perspective rather than wealth generation. As highlighted in our earlier blog, to generate extra 1-2% return compared to its peers, a debt fund may be taking on higher credit risk.

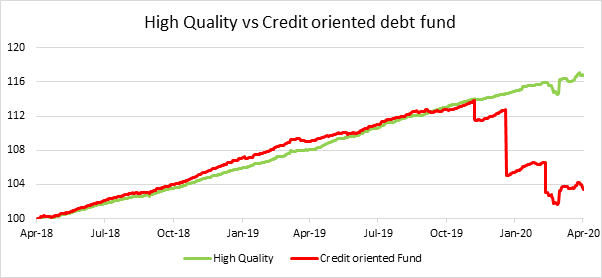

Note: The graph shows investment growth of INR 100 invested in the two funds.

The above graph represents the investment growth of a high quality debt fund (Safer Fund – Green) relative to a credit oriented fund (Riskier Fund – Red) over the last 2 years. As is evident, the credit oriented fund generates higher returns initially, but as defaults start to happen, it erodes away almost 2 years of returns in a matter of few months. Investment in the safer debt fund ensures steady returns over the investment horizon and most importantly your peace of mind.

So if your debt portfolio is primarily parked in high quality debt funds (credit rating of AAA/A1+/AA+/Sovereign/Cash) then there is no need to panic. You should continue holding onto these investments. If you have investments in funds that take on higher credit risks then consult your financial advisors immediately. Depending on the portfolio quality (high concentration of illiquid assets or below AA- rated assets) and redemption pressure, if any, that the fund is facing, your advisor would be in a good position to give you an exit call. If you are in urgent need of funds then redeem your debt investments first. If you want to make any fresh investments in debt then follow your risk profile based asset allocation and stick to funds that maintain a high quality portfolio. Read more on our blog to understand how to pick the right debt fund.

Conclusion

RBI has been pro-active in ensuring adequate liquidity in the system and providing financial stability to the markets. SEBI regulations allow a mutual fund scheme to borrow up to 20% of their assets to meet redemption needs. Many MFs have informed AMFI that they have no outstanding borrowing as of March end. RBI has also provided an INR 50,000 cr special liquidity window to help MFs tide over any redemption pressure.

So, remain invested in equities and do fresh investments if any in a staggered manner. If you have any urgent need of funds then redeem from your debt portfolio (be it FD or debt fund). Continue to stay invested in high quality debt funds and park surplus, if any, in these funds. Consult your financial advisor to know if you need to exit investments in credit oriented debt schemes.