Contents

The debt market in India has been going through a difficult phase ever since the IL&FS default in Sept’2018. Since then, many debt mutual funds have seen sharp and permanent NAV drops due to defaults by a number of entities they had lent to. This has clearly made investors aware of credit risk that is present in debt funds.

Credit Risk funds

Credit risk is basically the chance that the money lent out by the mutual fund is not paid back by the borrower. There is a sub-category of debt funds called Credit Risk funds. As the name suggests, these funds lend out money to entities/ firms that are considered to have a higher chance of default i.e. higher credit risk (lower credit rating such as AA- or A+). For taking on higher risk, they charge a higher rate of interest from the borrowers. This can enable credit risk funds to generate higher returns compared to funds that lend out only to safer entities/ firms. But as we had discussed previously, the risk of default tends to catch up sooner rather than later and can wipe out years of returns in one stroke!

What were the triggers?

Given investor experience since IL&FS, Credit Risk funds as a category had been witnessing outflows for over a year. What was a trickle, became a flood after Franklin AMC decided to wind up six of their credit oriented debt funds with effect from 23rd April, 2020. This unprecedented step was taken citing severe illiquidity in debt market, especially in the one dealing with lower credit quality papers.

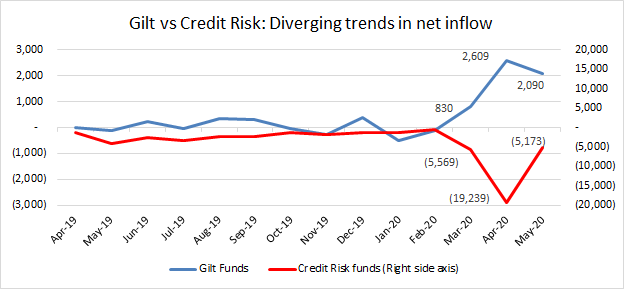

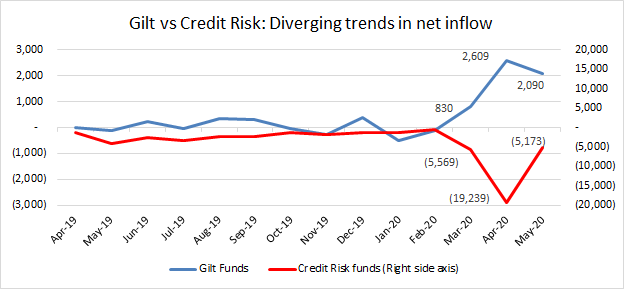

Note: Numbers are in INR Crores. Gilt here refers to Gilt and Gilt with 10 year constant duration categories. Data as per AMFI

The above graph clearly suggests that investors are pulling out of credit risk funds and moving into the perceived safety of Gilt funds. What also probably influenced investors was the risk-off sentiment brought in by Covid-19 crisis which had caused equity markets to correct sharply across the world. Gilt funds looked like a safe alternative and one that could give good returns.

Are Gilt funds really safe?

SEBI regulations mandate that Gilt funds need to invest at least 80% of their portfolio in government securities or Gsecs. In practice, most gilt funds invest 100% in Gsecs.

Coming back to the question, are gilt funds safe? The answer is both Yes and No!

Yes because Gilt funds, by definition, lend out to the Central Government and State Governments – the chances of either of them ever defaulting is negligible or nil! So these funds carry little or no credit risk, making them safe when seen from the perspective of credit risk alone. This means that the chances of you losing your invested money due to defaults is almost zero!

No because Gilt funds carry considerable interest rate or duration risk. This makes Gilt funds volatile on a daily basis. Hence they wouldn’t be suitable as a short term investment option. The volatility will get smoothed out if you can hold them for longer time horizon. So if you are looking at Gilt funds, investing with at least 5 year horizon would be beneficial.

Interest rate risk

Debt funds aren’t associated with credit risk alone but also carry interest rate risk or duration risk. This means your investments can fluctuate with changes in interest rate in the market. Interest rates and bond prices are inversely related. Let us say that RBI has cut rates, which has been the case over the past few months. This will cause the price of bonds traded in the market (Yes, just like stocks, bonds too are traded!) to go up. So a falling interest rate leads to rising bond prices and vice-versa.

Not all bonds are affected equally by changes in interest rate. All else being equal, a bond which matures in 1 year is affected less as compared to a bond which matures in 10 years by changes in interest rate. The longer the maturity, greater is the interest rate risk involved.

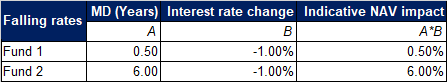

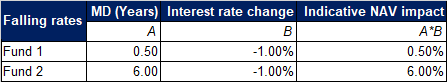

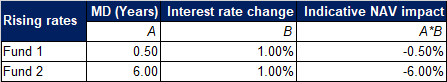

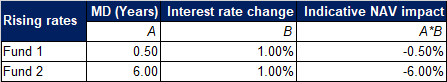

This relationship is technically captured by a parameter called Modified Duration (MD). A higher MD will lead to greater change in price for the same interest rate change and vice-versa.

Scenario 1: Falling interest rates will lead to gains – Higher MD means higher gains

Scenario 2: Rising interest rates will lead to losses – Higher MD means higher losses

So clearly, you would need to be aware of the interest rate risk in your investment. Higher the MD, greater would be the volatility experienced.

Volatility in Gilt funds

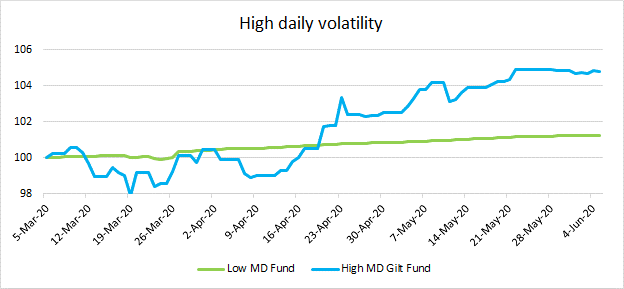

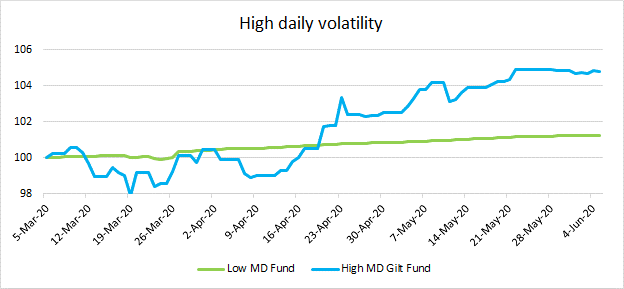

Most Gilt funds tend to maintain a longer MD. This has enabled them to deliver excellent returns when interest rates are falling. Gilt funds have generated over 8% and 13% in the last 6 months and 1 Year respectively.

Note: Graph depicts growth of INR 100. Liquid fund is considered for Low MD Fund and Gilt fund is considered for High MD Gilt Fund. Both funds belong to same AMC.

The flip side is clear from the above graph. These funds are exposed to considerable volatility on a daily basis. The higher MD makes them susceptible to even small changes in interest rates. Additionally, there is the risk of poor or even negative returns if interest rates start rising.

What should be your approach?

Getting the return expectation right is the key in most investments and is certainly true for Gilt funds. Simply because they generated higher returns in the recent past doesn’t mean they will continue to do so in the future. As we have seen, the higher returns have come due to the fall in interest rates. Unless interest rates continue to fall, one can’t expect such high returns.

Just like timing the market is difficult in equities, timing the interest rate cycles correctly is equally difficult. So attempting to generate high short term returns through Gilt funds would be difficult. Also, you have to be prepared to face the daily volatility that comes with Gilt funds and not expect a smooth and steady investment journey.

We would recommend that you invest in these funds with at least a 5 year investment horizon. Given the short term volatility, you can consider the SIP route to build up your investment position in Gilt funds. We would also advise that the maximum allocation to Gilt funds be 20% of your debt investments.

Bulk of your debt investments i.e. the core portfolio can be in categories that limit both credit and interest rate risk. To help you out here, Paytm Money has created a filtered list of funds under “Better than Fixed Deposit” and “High Quality Debt Funds”. You can find them under the Investment Ideas section on Paytm Money App!