Home First Finance IPO Details – Date, Price & Overview5 min read

Indian equity markets were in full swing in 2020 with bumper IPOs hitting the markets, especially in the second half of the year. In 2020 markets witnessed average listing gains, i.e., the opening stock price being higher than the allotment price, of 35.6%, which were the best returns in a decade.

The buoyancy of IPO listings has continued into 2021. After Indian Railway Finance Corporation and Indigo Paints, Homefirst Finance is the third IPO to be launched this year.

Contents

All about Home First Finance

Established in 2010, the Home First Finance provides home loans to first-time homebuyers in the low- to middle-income segments. The company’s target audience could be the salaried class who work in small firms or self-employed individuals running small businesses.

It was founded by former Mphasis Chairman Jaithirth Rao and Bank of Baroda’s MD and CEO PS Jayakumar, who are stalwarts in their field. Taking the mantle of its founders forward, HFFC has amalgamated technology with affordable housing. It provides an end-to-end digital onboarding process, the ease of which makes it popular among customers.

Due to its solid premise, as of 30 September 2020, HFFC has managed to establish a solid presence with a network of 70 branches spanning over 60 districts in 11 states and a union territory in India. Its most noteworthy presence, however, is in the urbanized regions of Gujarat, Maharashtra, Karnataka and Tamil Nadu.

In the last two financial years, i.e., the financial year 2018 to 2020, HFFC’s gross loan assets have grown at a CAGR of 63.4%, i.e., from Rs. 1,355 crore as of 31 March 2018 to Rs. 3730 crore as of 30 September 2020. This substantial rise in business could be because they strategically expanded to such areas that have quite a bit of demand for housing finance. For instance, the 11 states and a union territory in which it has a presence accounted for around 79% of the affordable housing finance market in India during 2019.

What’s more, the company’s popularity with credit rating agencies is of note. CARE Ratings has upgraded HFFC’s rating from ‘CARE A-‘ as of 31 March 2017 to ‘CARE A+’ as of 30 September 2020. ICRA Ltd has given it an A+ (stable) rating.

HFFC IPO Listing Details

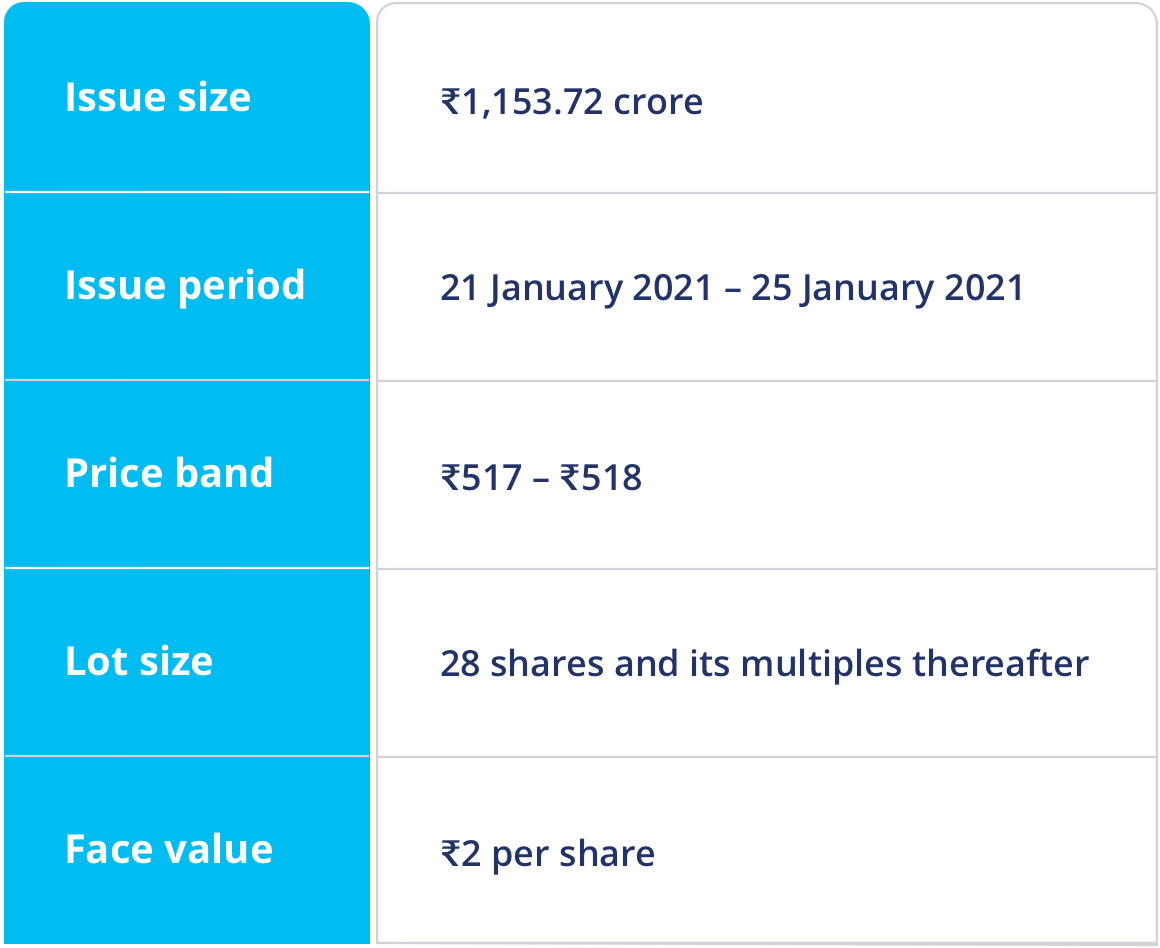

The Housing First Finance’s IPO of Rs. 1,153.72 crore is offering a fresh issue of Rs. 265 crore with a face value of Rs. 2 per share. The company’s issue opens on 21 January 2021, Thursday and closes on 25 January 2021, Monday. Further, HFFC is offering the shares in the price range of Rs. 517 to Rs. 518 with a minimum lot size of 28 shares.

The public issue also comprises an offer for sale of Rs. 888.72 crore by existing shareholders who will be offloading a part of their shares.

With respect to the allocation of the shares, 50% of the issue has been reserved for Qualified Institutional Buyers (QIB), 35% for retail investors (RII) and 15% for non-institutional investors (NII).

The equity shares are all set to be listed on the BSE and NSE and trading will begin on 3 February 2021.

Axis Capital, Credit Suisse Securities, ICICI Securities and Kotak Mahindra Capital are the book running lead managers for HFFC’s issue. KFIN Technologies Pvt. Ltd. is the registrar.

Why HFFC decided to go public?

The private lender aims to utilize the net proceeds from the IPO to augment its capital base for any capital requirements that may arise in the future for the growth of its business and assets. Of course, getting listed on the stock exchange does wonders for a company’s profile. So, HFFC hopes to capitalize on that and improve the visibility of its brand among existing and potential customers.

HFFC’s strengths and risks

Strengths

· HFFC is a technology-driven company that has the potential to handle growing operations in a capable and cost-effective manner.

· For HFFC, the “customers always come first.” Thus, they have a clear customer-centric commitment.

· With a population of ~139 crores, India could be touted as one of the largest housing markets. HFFC has deep penetration here.

· Their underwriting process is centralized and backed by data science.

· The company has a well-diversified and cost-effective financing profile.

· The company has an experienced management team and a qualified team of operational personnel and marquee investors.

Risks

· The availability of cost-effective funding sources is extremely important. Any disruption in these might impact business.

· The continuing impact of the COVID-19 pandemic could have an adverse effect on the business.

· Volatility in borrowing and lending rate could lead to the net interest income fluctuating.

· An inability to recover outstanding loans might affect the business negatively.

· The housing finance industry is highly competitive as it boasts of many big brands and players.

· Also, the Indian housing finance industry is heavily regulated. Any change in laws and regulations could have an unfavorable impact on HFFC’s business.

How to apply for an IPO through Paytm Money?

1. Log in to the Paytm Money app and complete your fully digital KYC for the stock, if not done already.

2. Once your details are verified and the Demat account is created, click on the IPO section on the home screen.

3. You will then be able to see a list of past and upcoming IPOs where you can apply for IPOs that are open for applications.

4. Next, you must add details for bidding such as quantity, amount, and so on.

5. After that, you have to enter your UPI id so that the funds for your highest bid are blocked. You will receive a mandate for the same on your UPI app.

6. Once you accept the mandate, your application will be successfully submitted.

7. Once the allotment happens, you will be notified about your allotment status.

Key Takeaways of the HFFC IPO