Lower interest rates: What should investors do?4 min read

Contents

The Cause

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on 27th March 2020, decided to cut the policy Repo Rate by 75 bps from 5.15% to 4.40%. It also reduced the Reverse Repo Rate from 4.90% to 4.00%. Last week, the Reverse Repo rate was further reduced to 3.75%. Put simply, RBI and other world central banks are attempting to make available ample supply of money to banks at cheaper rates of interest and through them to all other parts of the economy. This is one among many measures announced by the RBI to help the economy that is facing pressures of slowdown due the COVID-19 pandemic. It is aimed at bringing down the cost of borrowing in the economy.

The Effect

We deposit money in banks in the form of Recurring deposits (RD), fixed deposits (FD) and Savings bank account. Banks use this money to lend out to others in the form of loans. For cost of borrowing to come down, the rate of interest the banks charge for loans will have to come down. As a consequence, the rate of interest that banks can pay us on our deposits will also reduce. Hence, the bigger banks now offer 2.75%-3.50% interest on SB account compared to 4% earlier. FD rates at SBI have come down by up to 50 bps (100 bps =1%) and the 1 year FD now pays 5.70% interest.

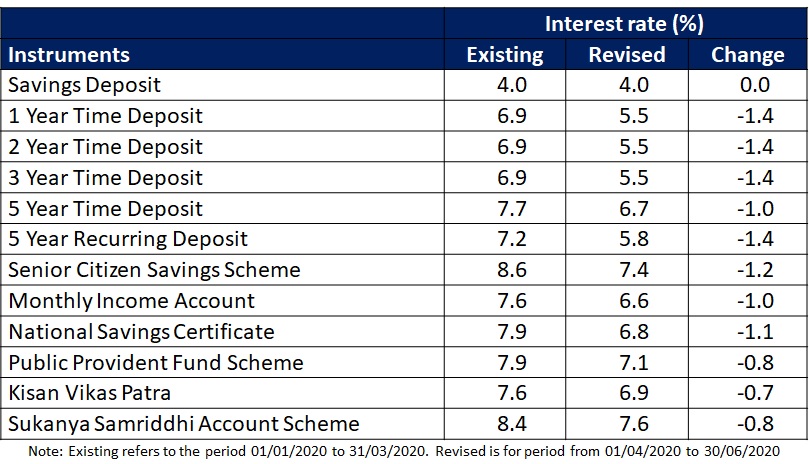

The government has also reduced the interest rates of small savings schemes between 70 to 140 bps for the April-June 2020 period. For example, the interest rate of Public Provident Fund (PPF) has been cut by 80 bps to 7.10% while the 5 year National Savings Certificate (NSC) has been cut by 110 bps to 6.8%. You can take a look at the complete list of small savings instruments below:

What should you do?

Over the past month, both equity and debt markets have undergone a lot of volatility and uncertainty. It is difficult to predict as to how long this period will last. Your response as an investor should be on two levels.

Firstly, it is important that you stick to your asset allocation i.e. how much you invest in equities vs. debt. This means that you do not shift your debt investments into equity and vice-versa just by looking at the interest rates. This will ensure that your investments are aligned with your risk profile and will help you tide over this period of uncertainty and volatility. Read more on importance of maintaining asset allocation.

Secondly, this will be a good time to take a relook at your debt portion of the portfolio and set the expectations from the same correctly.

Debt or Fixed Income Portfolio

Debt should be used for capital preservation and providing stability to your portfolio. Once this expectation is set right, the focus shifts from returns only to safety and liquidity. Hence while looking at debt products, be it FD or debt mutual funds, it is better to prioritize safety over returns.

Let us look at a few examples. You may not be happy that your usual Bank FD is now giving you a lower interest of say 6%. You may be tempted to shift it to somewhere else where the FD rates are higher at say 7.5%. Amongst debt mutual funds there would be funds that maintain a high quality portfolio offering 6-8% returns. On the other hand, there would be funds that offer 10-12% returns but may be taking on higher credit risk in their portfolios.

The possibility of higher returns (than peers) in fixed income products like FD or debt funds, are likely to come at the cost of taking on higher risk. You may end up taking on disproportionately higher risk when you try to earn that extra 1-2% return on fixed income products. Hence lower interest rates in one product should not be a reason to switch between products. It is far more prudent for you to avoid this. Keep in mind that with these investments, return of capital is more important than return on capital! Read why it is wrong to try and chase the extra 1-2% return.

Action points for you

- Stick to your asset allocation as per your risk profile

- Continue with PPF and other small savings schemes if you want assured returns

- Spread out the FDs across 2 or 3 larger banks as you should prioritize safety over returns

- Do not put all your money in any FD simply because it offers a higher interest rates

- Debt funds don’t offer assured returns; ensure that the funds you pick have a high quality portfolio

It is advisable to get your portfolio reviewed by a financial advisor to make sure that you are not taking on risks that you’re not aware of or more than what you can stomach. Paytm Money provides you with a filtered list of debt funds under different categories under the Investment Ideas section. You can check out “Better than Savings Account”, “Better than Fixed Deposit” and “High Quality Debt Funds” to get an indicative list of debt funds that you can choose from for different time horizons.