Asset allocation will help you tide over market volatility5 min read

Contents

Are you tempted to check how your investments are doing on a daily/weekly basis? Do you get bothered or worried when your portfolio is in the red or shows a sharp dip in value? Does this stress you out so much that you would rather take a loss and exit your investments than holding on to them for a longer time period? If some of your answers are a ‘Yes’, then you are probably not going about investing in the correct way!

3 step process of investing

Investing is essentially a three step process – Risk Assessment, Asset Allocation and Security Selection. Picking and investing in funds simply based on historical returns isn’t the right approach. Most investors tend to assume that if a fund has done well over the past 1 or 2 years, it will keep continuing to do so. Chasing returns is never a good idea and does not help you reach your financial goals!

Financial goals, be it wealth creation or capital preservation, can be achieved only if you stay the course and remain invested in the market. This is easier said than done! Markets are volatile in nature and is prone to sharp ups and downs on a routine basis. To make sure you can stay calm during the volatility, you need to follow the three step investing process. This will ensure that you take only the risk that you can sustain for a long period. We had discussed how the asset allocation based on investor risk profile is crucial to achieve this.

A Moderate investor

Equity can give short term losses but has significant long term wealth creation potential. Debt generates lower returns over the long term but is a lot more stable than equity. Let us say that the Risk Profile Questionnaire tells you that you are a ‘Moderate’ risk taking investor. Simply it means you would prefer a consistent growth pattern with few fluctuations in your investment. Hence you are better off splitting your money evenly between Debt and Equity asset classes. So your possible asset allocation can be 50:50 towards Equity and Debt.

A genuine doubt you may have now is that if you are a long term investor and equity has long term wealth creation potential, why not be 100% invested in equity? What is the need for asset allocation? You might even have zeroed in on a couple of equity mutual funds that have given stellar returns over the past couple of year to invest in. Let us see why this is not a good idea for you!

All Equity vs Asset Allocation

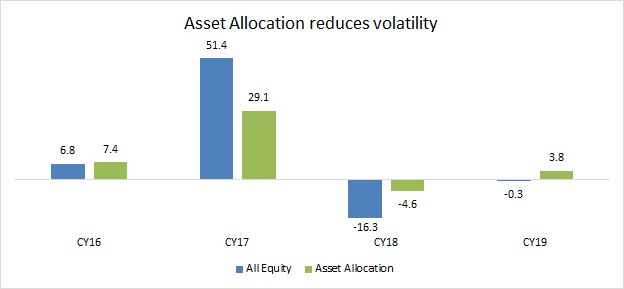

Small cap equity mutual funds gave a whopping 79% returns on an average in CY14. This was followed by 11% in CY15. Seeing the good performance in the previous two years, investors could have decided to put their money in small cap funds. As you can see from the below graph (blue bar), the returns in CY16 and CY17 were excellent! But ask yourself this, if you had an all-equity portfolio, could you have stomached a sharp 16.3% drop in your investment that occurred in CY18? A Moderate investor may have panicked and exited his investments. This goes against long term investing that is needed to achieve financial goals.

Note: Returns are in %. CY is Calendar year. All Equity is average returns of smallcap mutual funds. Asset Allocation is 50:50 combination of All Equity and average returns of money market mutual funds. Only Direct plan is considered.

On the other hand, if you had stuck to your asset allocation in line with your risk profile (Green bar), you would have made lesser returns in CY17 but the drawdown in CY18 would have been much lesser at 4.6%! This would have helped you ride through the volatility and remain invested for the long term.

Do keep in mind that this is only an example. It is impossible to know beforehand when the sharp corrections can happen. It could very well be the case that your investments see a sharp correction immediately after you invested. You would be able to benefit from the potential upside in the years after the correction only if you are able to take that volatility and not exit your investments during such periods.

Smoother investor journey

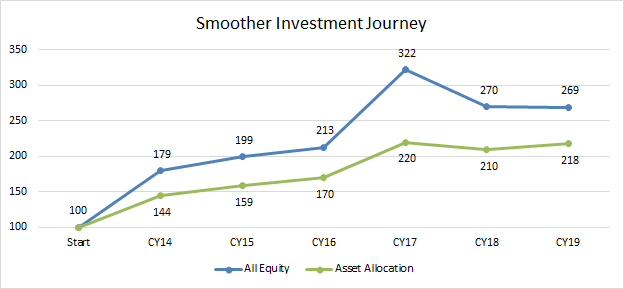

Asset allocation basically ensures that you have a smoother investment journey. The volatility will be in line with your risk profile.

Note: Returns are in %. CY is Calendar year. All Equity is average returns of smallcap mutual funds. Asset Allocation is 50:50 combination of All Equity and average returns of money market mutual funds. Only Direct plan is considered. Amounts in INR

The above graph clearly shows how asset allocation can ensure less volatility and hence less stress. This will make sure that you would remain invested through the ups and downs in the market and help you reach your financial goals.

What should you do?

Make sure that you follow the three step investing process. Having an asset allocation in line with your risk profile will help you stay invested and reach your financial goals. If this seems too time consuming and tedious, you can explore ‘Investment Packs’ on Paytm Money that takes care of all three steps and gives you a ready-made solution. Read our earlier blog to know how investment packs help in long term investing.