A Deep Dive Into Portfolio Rebalancing6 min read

In investing, a “buy and forget” approach could do more harm than good to your financial wellbeing –– particularly, when the portfolio consists of market-linked investment instruments viz. stocks and mutual funds.

Investing is a dynamic activity and a portfolio review is an indispensable part of it.

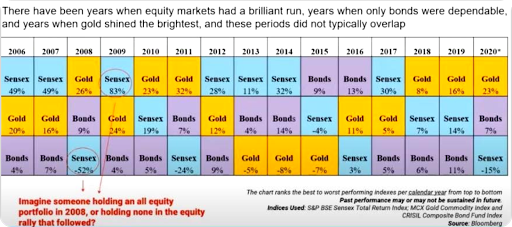

Not all asset classes move in the same direction always. In the past, there have been years when equity markets had a brilliant run; when generally only bonds were considered for diversification, and years when gold shone the brightest (like in the last one-and-a-half year). So, the returns from every asset class could be dissimilar, and maintaining the asset allocation mix best suited for you is important.

Image: Growth of Various Assets Classes Over The Years

Given the uncertainty in the world today, safeguarding your financial health and paying attention to your investment portfolio is essential. Otherwise, you may not necessarily create wealth effectively and fulfill the envisioned financial goals.

Yes, in all probability you may have invested in the good quality stocks, mutual funds, and other investment avenues. But over time, some of the investments may not be performing.

Short-term underperformance (less than a year), due to market turbulence or when contrarian calls are freshly taken, can be ignored. However, when stocks and mutual fund schemes in the portfolio continue to be persistent underperformers for long periods, then surely it requires your attention, followed by a prudent investment action.

Besides, over the years it is also likely that…

- Your financial circumstances may have changed (for various reasons)

- Inflation has inched-up at a much greater pace than expected

- Outlook towards money has changed

- Risk profile has been altered

- The risk-return expectations have changed

- Investment objectives today are different

- You wish to adopt a change in investment style

- And it may not be too long before the envisioned financial goals befall

The aforesaid factors, too, warrant a portfolio review and rebalancing.

Portfolio rebalancing refers to adjusting the asset allocation of your investment portfolio taking into consideration the facets discussed above. While the objective of a portfolio review is to take a course correction and rejig the portfolio constituents, whereby you hold among the best and suitably ones within each asset class (equity, debt, and gold) that can help to achieve your financial goals.

The decision to Buy/Hold/Sell the investment instruments in the portfolio should not be done arbitrarily but based on a rational, scientific, and unbiased approach with thorough research and analysis.

So typically, while reviewing the Equity portfolio, assess the following:

- The total allocation to stocks in the portfolio; check if it is in congruence with your risk profile, broader investment objective, financial goals, and the time horizon to achieve the envisioned goals.

- The number of mutual funds held in the portfolio; take care not to over-crowd the portfolio.

- The proportion of top-10 equity-oriented mutual fund schemes in the overall equity portfolio.

- The fundamental attributes of the equity-oriented mutual fund scheme.

- Exposure to market capitalization segments – large-cap, mid-cap, and small-cap — to weigh if the portfolio is inclined to one segment, or is well-diversified across capitalizations.

- Category -wise and sector-wise exposure.

Likewise, while reviewing the Debt Mutual Fund, the following should be evaluated:

- Whether the total allocation to debt holdings justifies your risk profile, investment objective, goals you wish to address, and the time horizon.

- The total number of debt mutual funds: corporate fixed deposits; bonds; debentures; type of debt mutual funds; bank fixed deposits, etc.

- The fundamental attributes of the debt securities held in the portfolio (Who is the issuer; yield; the rate of interest; the investment plans/options; the tenure/Maturity/Lock-in Period; premature withdrawals, etc.).

- Whether the debt securities held are appropriate in the current interest rate cycle

- The issuer-wise exposure, whereby the debt portfolio is fairly diversified.

- The credit rating-wise exposure, so that you avoid taking unduly high credit risk.

- The maturity-profile-wise exposure, for it to be in-line with your liquidity needs and financial goals.

Based on the above, plus paying heed to the asset allocation and overall performance of the portfolio, investment actions need to be taken.

By the same token, when hard-earned money is invested in mutual funds although you leave it to Asset Management Company and professional fund managers, a mutual fund portfolio review is pivotal as well for your financial wellbeing.

Also, do note after the norms for Categorisation & Rationalisation of Mutual Fund Schemes by the capital market regulator in October 2017, fundamental attributes of many mutual fund schemes changed. Given this, it might be the case that you could be holding a mutual fund scheme/s in the portfolio that may not match with your initial investment objective, risk-return expectations set when you had first invested, and therefore now warrants a comprehensive mutual fund portfolio review.

Here’s how to review the mutual fund portfolio…

- Check the asset wise allocation between equity-oriented, debt-oriented, and hybrid funds and assess if it is in sync with your risk profile, broader investment objective, financial goals, and time to achieve the envisioned financial goals.

- Within the categories (equity, debt, and hybrid) look at exposure to sub-categories viz. Large-cap Fund, Large & Mid-cap Fund, Mid-cap, Small-cap Fund, Multi-cap Fund, value style, dividend yield, Liquid Fund, Overnight Fund, Ultra Short Duration Fund, Short Duration, Medium Duration, Long Duration, Dynamic Bond Fund, Gilt Fund, Banking & PSU Fund, Conservative Hybrid Fund, Aggressive Hybrid Fund, Multi-Asset Allocation Fund, Solution-oriented Funds, Gold Funds, etc.

- Assess the fund house or AMC-wise exposure. Keep in mind, holding schemes of large AMCs does not necessarily make robust, safe, or well-rewarding.

- Weigh the sector-wise and company-wise allocation to recognize the portfolio characteristics and the possible reasons for underperformance or outperformance, as the case may be.

- Study the quantitative aspects such as returns, risk ratios, risk-adjusted returns, performance across market cycles, expense ratio, exit load, the AUM of the fund, etc.

- Pay attention to the qualitative factors viz. the portfolio characteristics; the credential of the fund manager (and his team); funds-to-fund manager ratio (or to simply put the number of schemes managed by every fund manager); the proportion of total equity AUM of the fund house actually performing well (to check if the fund house is managing the assets prudently or is just in the race to garner more AUM); and the investment process & system at the fund house among a host of others.

- Conduct a risk analysis of the entire mutual fund portfolio based on the above and take timely actions i.e. Buy, Hold, or Sell. And in case of ‘Sell’ calls or switches, even assess the exit load and taxation impact.

If you take timely actions, your portfolio can be well-aligned to accomplish the envisioned financial goals.

But just as you would avoid self-medication and consult a doctor when it comes to your medical health, it might do best to approach a Financial Advisor, who can comprehensively review your mutual fund portfolio.

An unhealthy portfolio not just stops you from fulfilling your financial goals, but also weakens your financial future.

Remember, the adage: A stitch in time saves nine.

Review and rebalance your investment portfolio today!

Happy Investing!

Author: Mr. Chirag Mehta – Senior Fund Manager, Alternative Investments, Quantum Mutual Funds

Ranked as the 4th best Fund Manager by Citywire in 2017; Mr. Mehta specializes in the field of alternative Investment Strategies and holds more than 15 years of experience in managing commodities.