Smart Investing Masterclass: Top-up Your Regular Income With Passive Investing2 min read

Think of those fond memories when your first ever salary or income got credited to your bank account. But that first flush of overwhelming happiness soon withered away as and when your necessities were met, and over time you searched for means to accommodate your luxuries.

In that case, who doesn’t want a quick brush of side income? Creating active income streams from passive fund investments is your way forward. Earn some extra money by sitting at the comfort of your home. Yet the thought of losing out money and the risk angle must be bothering you. Don’t worry! We got you covered.

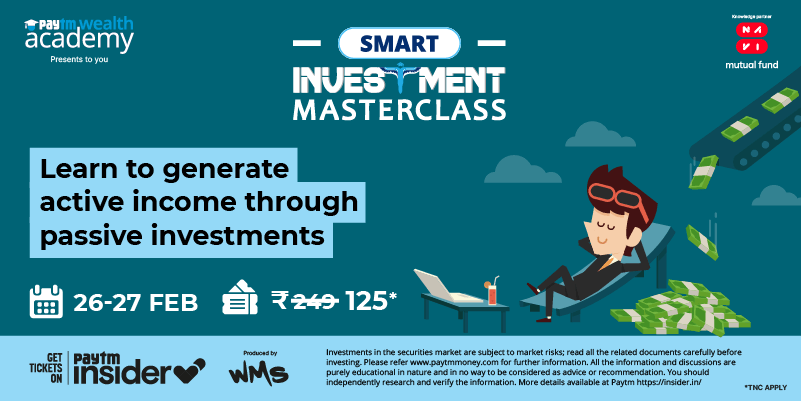

Paytm Wealth Academy is bringing to you a Smart Investing masterclass to teach you some optimum ways to invest with good returns. It deals with Passive Investments, to be held this 26th and 27th February.

So what’s in store for you:

- The need for the passive funds and a comparative analysis between active and passive funds.

- Now that you know about its need, it’s imperative to pick some funds which will add value to your portfolio. Our speakers will highlight the pros and cons of equity, international equity, commodity, debt funds.

- But picking the favoured option isn’t enough. You need to weigh your options with respect to the risks, costs incurred, and performance of the benchmark index. The masterclass will teach you to avert risks through diversified asset allocation. Basically it will teach you how to invest in passive funds actively and in active funds passively!!

- Day 2 of the masterclass will be more of a personalized take on both passive and active fund planning. It will figure out the best fund for you based on your goal, minimum investment amount, time period, age and risk appetite through the SIP and lump sum method.

Did you know that returns from passive funds can match the performance of the benchmark like Nifty 50, Nifty Bank index based on its investment objective? We bring you a case showing how much Nifty 50 brought back returns to someone who invested passively for a period of 10 years. See it for yourself:

Passive income streams can help you achieve your goals like financing children’s education, hopping on a world tour, increasing assets and more. This might also help you with your post-retirement plans.

With the Covid-19 pandemic wreaking havoc on the country’s economy and the common man’s finances, passive income or passive investing is surely going to ease out your budgetary concerns.

So what are you waiting for? Your one-step guidance on passive investing is here.

Go grab your tickets for this Smart Investing Masterclass; but not passively, rather actively!!